Binance Coin recovers from bull trap as BNB readies to breakout

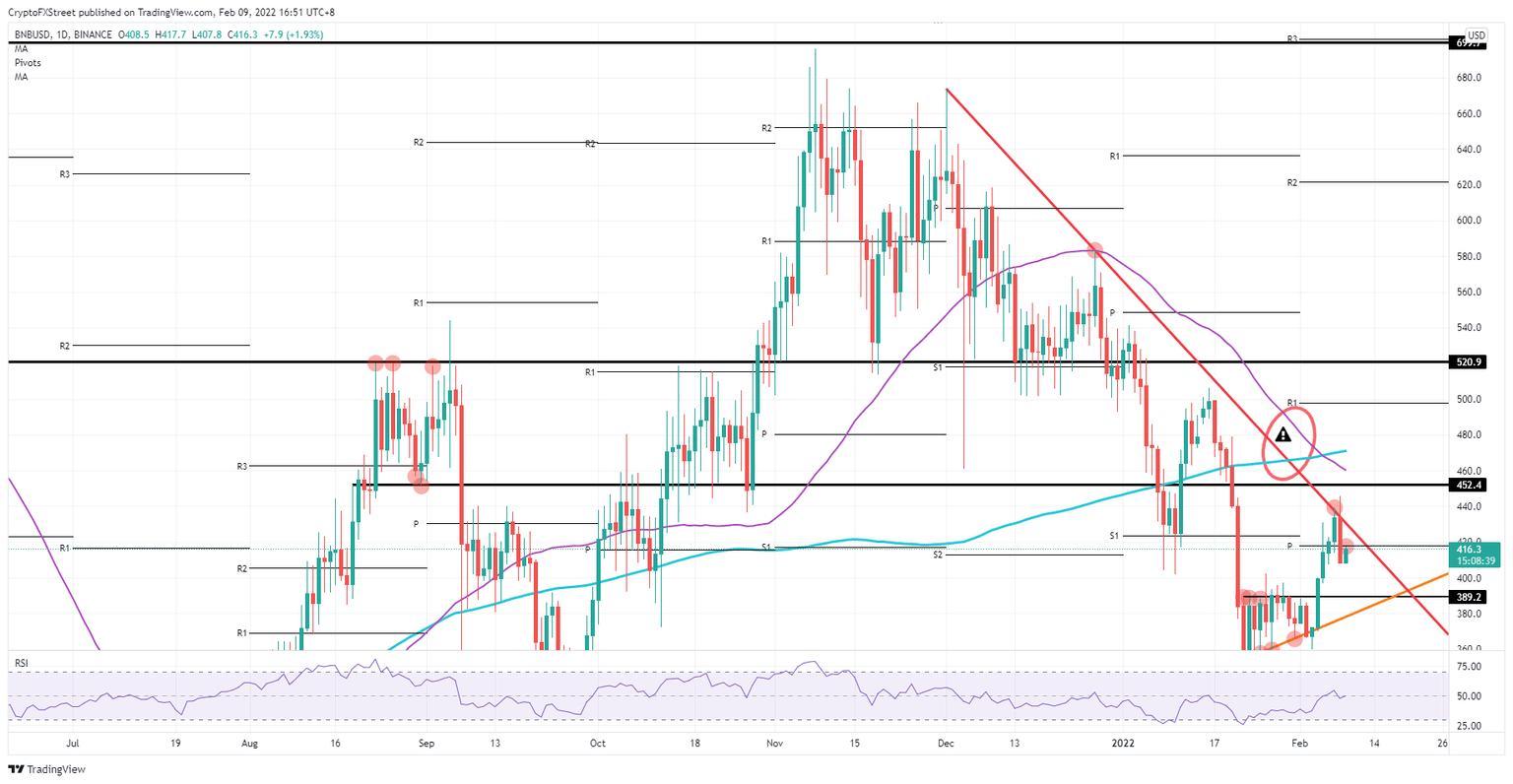

- Binance Coin was set to break its downtrend since December, but price action has faded, and bears sprang a bull trap.

- BNB sees bulls climbing out of the ditch after a positive open across the board in ASIA PAC and European indices.

- BNB could hit $452 by the end of this week, bringing some 10% gains to portfolios.

Binance Coin (BNB) price action hurt quite a lot of bulls yesterday, after bears jumped on the break above the red descending trendline and, in the process, pulled BNB price to the downside, hitting bulls with a loss. Bulls had to cave in and take the loss but are back today as favourable tailwinds from equity markets are spilling over into cryptocurrencies. Expect more upside to come as investors are now ultimately looking beyond the messages from several central banks last week, and taking advantage of upside opportunities, with BNB price action set to hit $452 by the end of this week.

When BNB hits $452, bulls have reached a 10% gain, and the downtrend is dead and buried

Binance Coin looked very bullish yesterday as the price shot through the red descending trend line dictating price action since December. With that break, more bulls jumped in eagerly for a long position thinking this could be the prelude of a rally up towards new all-time highs. But bears pushed back, making it a false break and trapping bulls in the process, who then got squeezed out of their positions at the break of $434.70. With a 6% loss on the books intraday, the Relative Strength Index had to halt its uptrend and saw a short bearish knee-jerk reaction.

BNB price action is getting some help this morning from global indices as both the ASIA PAC and the European sessions are printing green numbers on all major stock indexes, and several hedge trades are starting to unwind. This has created a positive bullish sentiment that is creating tailwinds for several asset classes in global markets, among them cryptocurrencies. Critical for today is that BNB price action can break above the monthly pivot around $420 and possibly break the red descending trend line with a daily close above it again, to set the scene for $452 later this week.

BNB/USD daily chart

After the firm rejection on the false break, a possible rejection by the monthly pivot at $420 could be next. That would mean that the red descending trend line is just still too tough to break, and with the death cross – from the 55-day Simple Moving Average (SMA) trading below the 200-day SMA – we have two very bearish indicators capping any upside potential. Expect a search for support towards $389 with the short-term support level and the orange ascending trend line as underpinning elements keeping BNB price action from falling further.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.