Binance Coin Price Forecast: BNB price rebounds above $600 as crypto market activity spikes

- Binance Coin price rose above the $600 level on Monday, as the frenzied market reaction to the US trade war sparked demand.

- Aggregate trading volume across the crypto markets crossed $451 billion on the day, spurring demand for exchange tokens.

- BNB technical indicators signal further upside potential if bulls hold out for a close above $600.

Binance Coin (BNB) price rebound 8% to reclaim $600 on Monday, as market frenzy sparks demand for exchange tokens.

BNB price rebounds above $600 as crypto market frenzy sparks demand for exchange tokens

Binance Coin (BNB) has staged an impressive rally, breaching the $600 level on Monday amid heightened volatility across the cryptocurrency markets.

This surge comes against the backdrop of a frenzied global market reaction to the ongoing US trade war, which has driven investors to seek refuge in digital assets.

As traditional markets grapple with uncertainty, the crypto space has seen a notable influx of capital, pushing aggregate trading volumes to over $451 billion within 24 hours.

BNB’s performance stands out as it capitalizes on the growing demand for exchange tokens, essential for facilitating transactions on platforms like Binance.

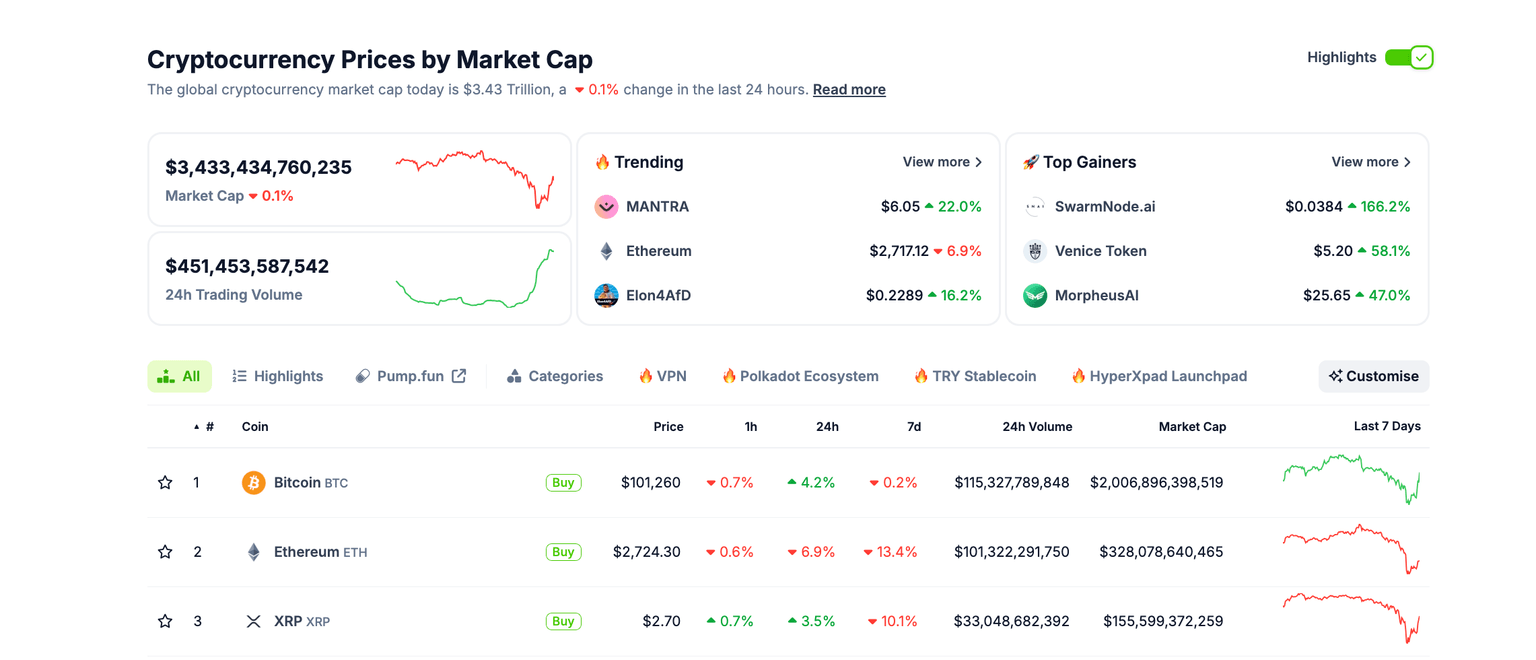

The broader market snapshot from CoinGecko reveals mixed trends: while Bitcoin and Ethereum have shown slight retracements, with BTC trading around $101,260 and ETH at $2,724.30, BNB has managed to defy the downtrend, posting solid gains.

Crypto Market Performance, Feb 3, 2025 | Coingecko

With BNB price registering a 8.3% gain, Bitcoin price experienced a minor 0.7% drop over the past hour but remained up 4.2% over 24 hours. Meanwhile, Ethereum faced a 6.9% decline on the day.

BNB’s utility within the Binance ecosystem, such as staking yield and transaction fee discounts emphasizes its appeal amid volatile market phases. This explains why it outperformed BTC and ETH on the day.

BNB Price forecast: Rebound above $620 could validate bullish dominance

The latest 12-hour candlestick chart for Binance Coin (BNB) against Tether (USDT) showcases significant price action. BNB recently rebounded from a low near $500, marking an impressive recovery after a sharp decline that saw the price drop by approximately 15.66% over five bars (2 days and 12 hours) with a trading volume of 1.77 million. This correction was followed by a strong bullish green candle, signaling an 8.63% recovery as the price surged to $616.15, supported by a volume of 353.43K.

BNB price Forecast | BNBUSDT

The Donchian Channel (DC) highlights critical support and resistance levels, with the lower boundary around $500 and the upper boundary near $690.82. BNB is currently trading above the midline ($595.41), indicating a potential shift towards bullish dominance. The Relative Strength Index (RSI) sits at 37.70, recovering from oversold conditions, while the RSI moving average at 41.41 suggests a bullish divergence that could support further price increases.

If BNB maintains its momentum above $600, a breakout past the $620 resistance level could validate a bullish trend, targeting the $650-$690 range. However, failure to hold above $600 might trigger a retest of the $580 support zone. The current technical setup favors the bulls, provided market conditions remain supportive and trading volumes continue to rise.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.