Binance Coin price could shed more than 10% if this trend continues

- Binance Coin price seems to be stuck, producing lower highs since August 10.

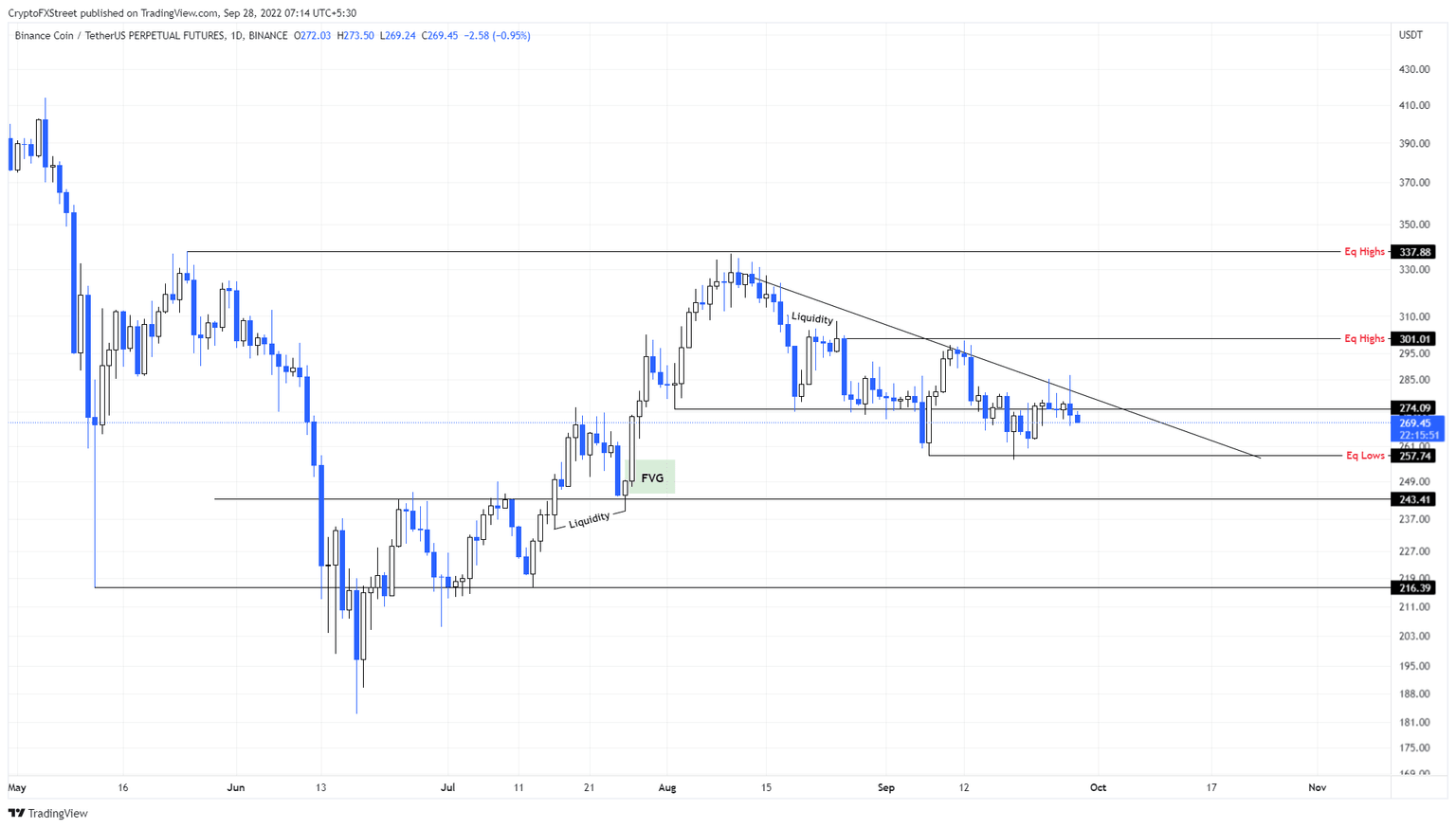

- The recent development has led to a descending triangle formation that forecasts a 13% crash to $224.

- A daily candlestick close above $301 will invalidate the bearish thesis for BNB.

Binance Coin price has been on a downtrend for quite some time and has intensified after the recent sell-off in Bitcoin price. Investors need to pay close attention to the BNB’s moves over the last three weeks, which revealed a bearish setup.

Binance Coin price has one chance to avoid another selloff

Binance Coin price has produced four lower highs since August 10 and the swing lows of these moves have managed to produce roughly equal lows at $241 and $257. When trend lines are drawn connecting the last two lower lows and equal highs, it reveals a descending triangle in formation.

Another retest of the equal lows at $257 will confirm this setup that forecasts a 13% downswing, determined by adding the distance between the widest part of the triangle to the breakout point at $257. The theoretical forecasting method reveals a target of $224.

While this target seems a little far-fetched, investors can expect a 10% drop from the current position at $269 to the $243 support level. Only a breakdown of this level will indicate a further continuation of the downtrend for Binance Coin price.

Therefore, investors need to pay close attention to Binance Coin price’s reaction at $257 to understand where the altcoin will head next.

BNB/USDT 1-day chart

On the other hand, if Binance Coin price absorbs the incoming selling pressure and overcomes it with a surge in bullish momentum, things could change for the better. If BNB produces a daily candlestick close above $301, it will invalidate the bearish thesis by producing a higher high and shift the narrative favoring the bulls.

However, after this move, buyers need to maintain this momentum to propel Binance Coin price to $337.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence Binance Coin price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.