Binance Coin Price Prediction: BNB could revisit $243 as bulls disappear

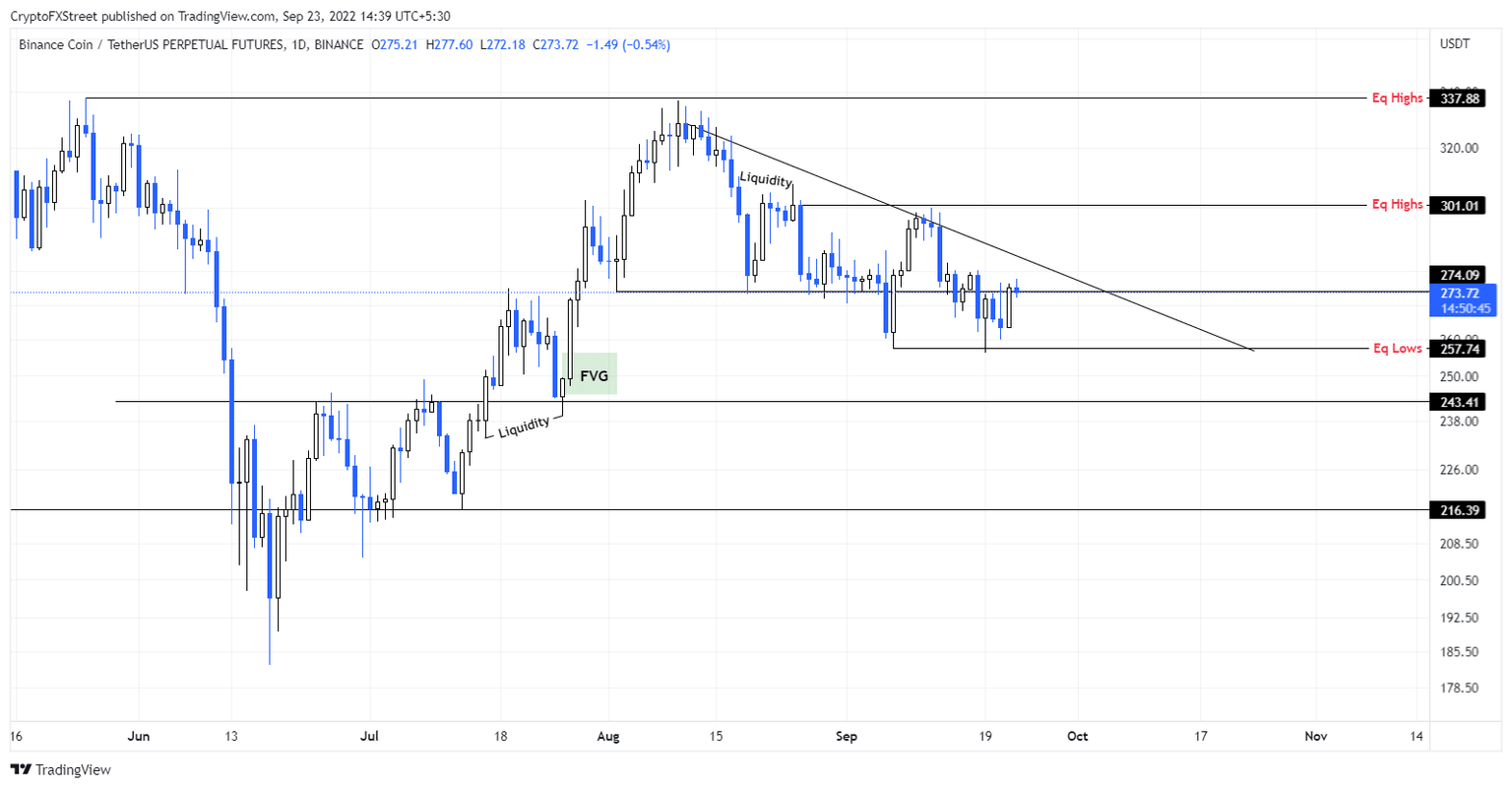

- Binance Coin price shows a lack of buying pressure resulting in rejection at the $274 resistance level.

- A continuation of this development could see BNB drop to $243 or lower in the coming days.

- If bulls push the altcoin above $274 and break past the declining trend line, it will invalidate the bearish outlook.

Binance Coin price reveals a lapse in bullish momentum that has extended the altcoin’s struggle with an immediate hurdle. Owing to this bias, BNB could see a further drop in its market value as sellers seize control.

Binance Coin price faces a decisive moment

Binance Coin price failed to move past the $274 support level after grappling with it for roughly a week. This development denotes weakness, indicating buyers are unwilling to step in in adequate numbers to drive price through this level.

Hence, investors can expect BNB to drop lower and sweep below the equal lows formed at $257. A breakdown of this level with a failed recovery will send Binance Coin price to fill the inefficiency, aka Fair Value Gap (FVG), extending from $256 to $245.

There is a good chance that sidelined buyers could step in at this level and buy BNB at a discount. However, market makers might try to hunt the liquidity by sweeping below the July 17 and July 26 swing lows at $233 and $239, respectively.

In total, this move would constitute a 10% to 15% loss, depending on where Binance Coin price forms a base.

BNB/USDT 1-day chart

Regardless of Binance Coin price’s bearish outlook, if the Bitcoin price triggers a run-up, it could result in a swift recovery above the $274 support level. This development would kick-start a recovery rally.

However, buyers need to push Binance Coin price above the declining trend line connecting the swing highs since August 10. This move will invalidate the bearish thesis and signal a break in structure favoring the bulls.

In such a case, the Binance Coin price could attempt a sweep of the equal highs at $301.

Note:

The video attached below actually talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence Binance Coin price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.