Binance Coin, EOS, and Chainlink prepare for explosive rally while Bitcoin stalls

- Altcoins remain in a state of limbo while Bitcoin consolidates within a narrow trading range.

- Binance Coin, EOS, and Chainlink have yet to recover from the recent retracement in the cryptocurrency market.

When paired against Bitcoin it is evident that most altcoins have shown some signs of weakness lately. However, the bulls could be looking to push prices higher as the behemoth cryptocurrency sleeps.

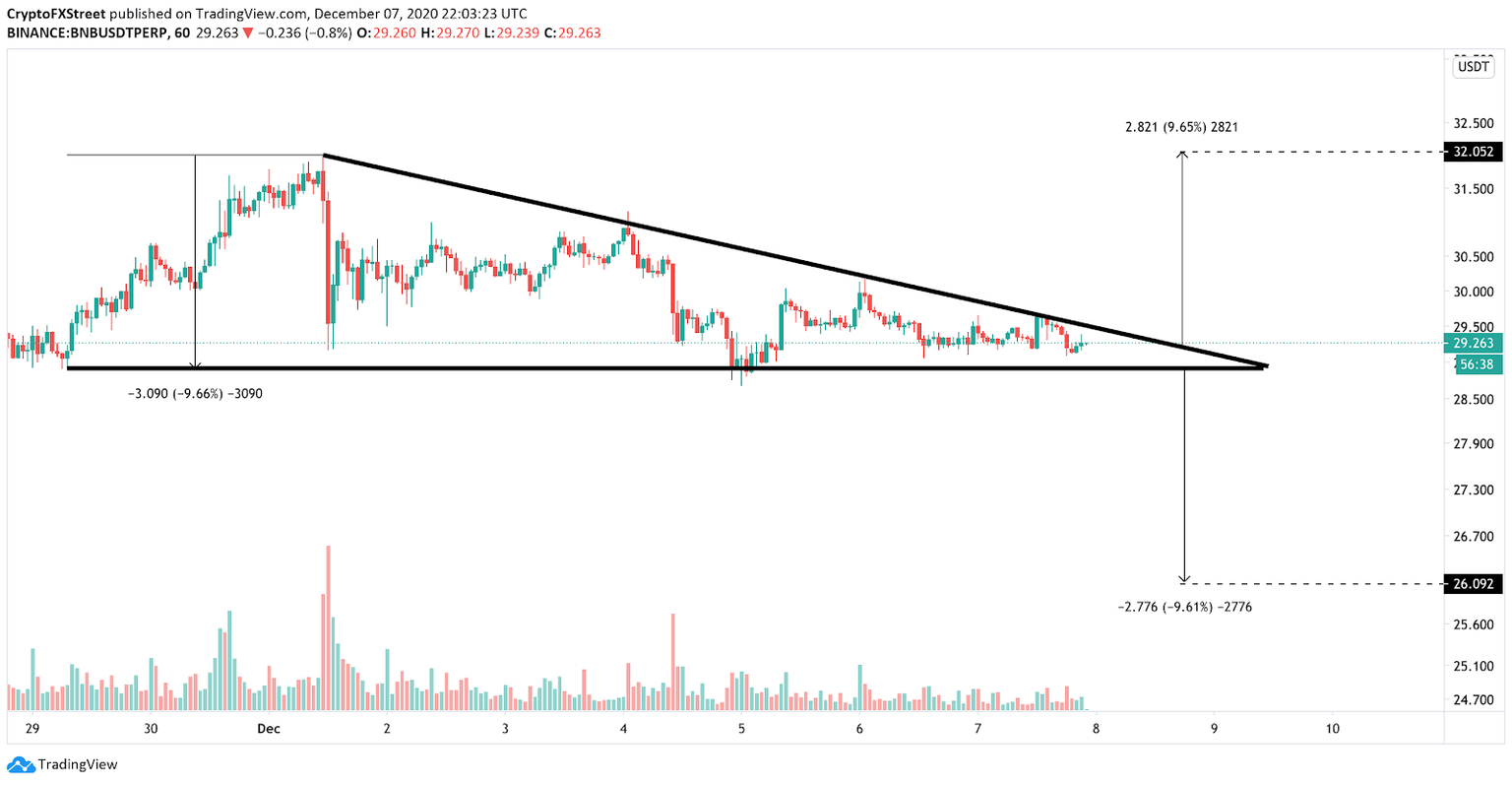

Binance Coin price primed to advance further

The $29 zone has remained a strong psychological support level for Binance Coin after its last thrust from $22 on September 22. The most recent price action saw the BNB drop by more than 10% from a high of $32 to a low of $28.6.

BNB/USDT hourly chart

Absent any decent increase in volume and buy pressure, the formation of a descending triangle on the 1-hour chart suggests that a breakout is underway.

Moving past the triangle’s hypotenuse at $29.5 could see Binance Coin price rise to $32 while an hourly candlestick close below $29 might trigger a correction to $26.

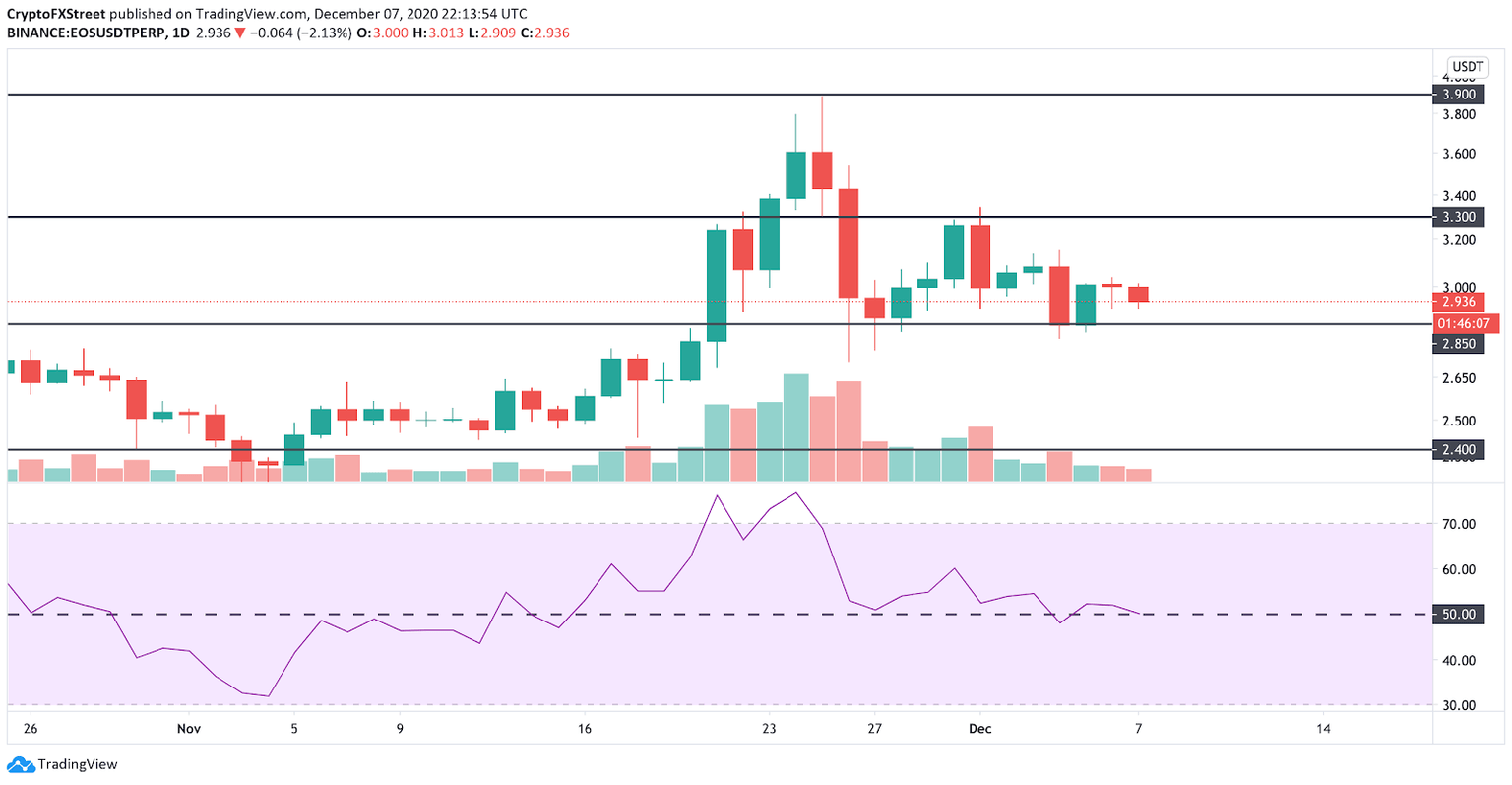

EOS price prepares for another interlude

After returning 6% of the gains from late November, EOS price has managed to hold above the $2.85 support level while volume dissipates. Now, it appears that the smart contracts token may be in for a brief period of consolidation. The RSI sits around the 50 mark, showing some reluctance in making any significant upward or downward movement.

EOS/USDT Daily chart

Some of the key price levels to watch ahead of EOS are the $2.85 support and the $3.3 resistance. A daily candlestick close above or below this price range will determine where this cryptocurrency is headed next.

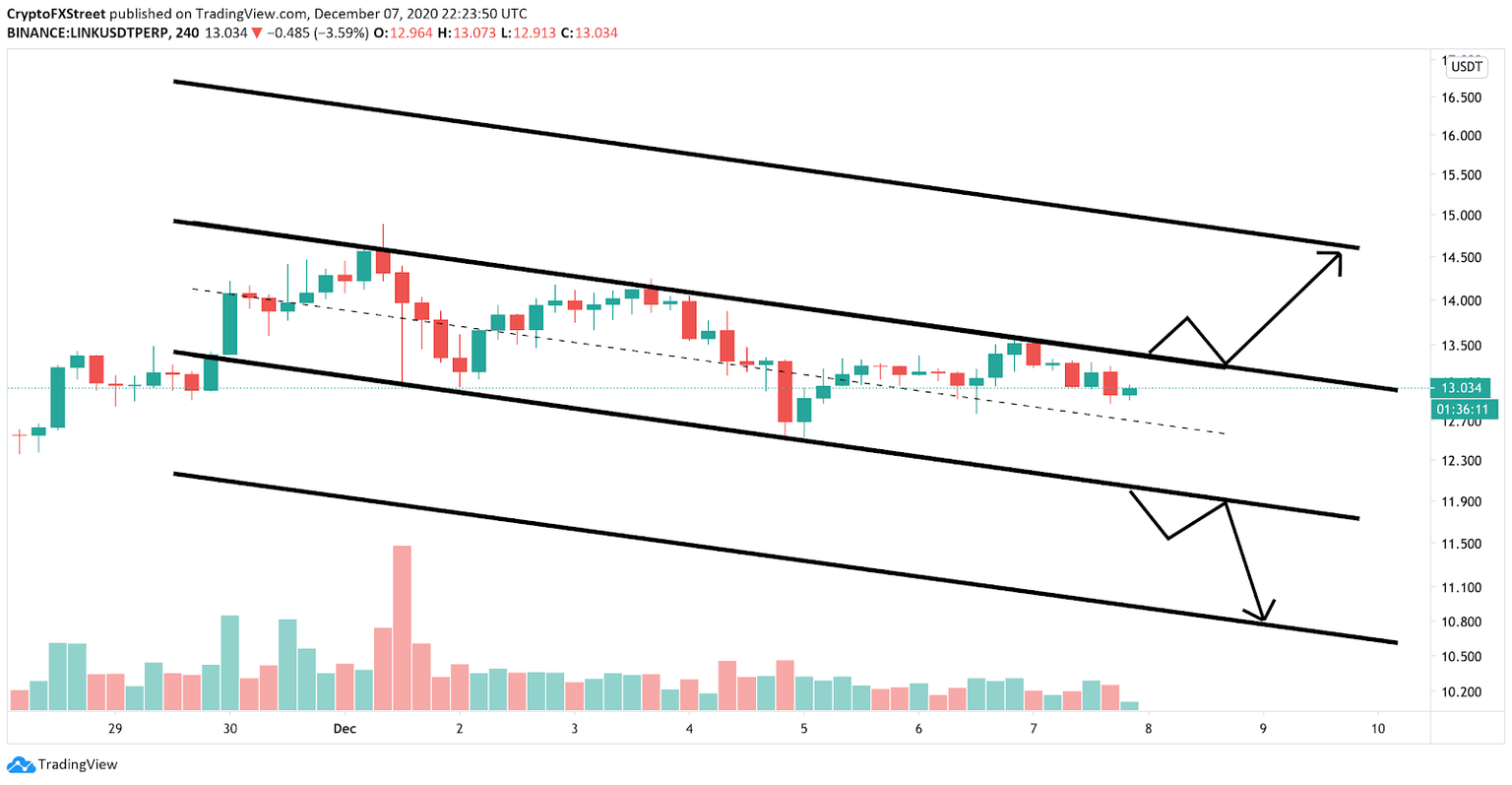

Chainlink price may retrace before it breaks out to $15

Chainlink price appears to be contained within a descending parallel channel since late November. Since then, each time the decentralized oracles token rises to the channel’s upper boundary, it gets rejected and drops to the lower edge. From this point, LINK tends to bounce back to resistance.

The recent retest of the overhead resistance suggests that Chainlink may drop to the channel’s lower boundary at $12. If this support level holds, LINK could rebound to $13.2 and potentially break out of this consolidation pattern, aiming for $15.

LINK/USDT 4-hour chart

However, if the $12 support level fails to hold, Chainlink might suffer further losses. Slicing through this hurdle will likely see LINK plunge to $10.5. Thus, it is imperative to pay attention to the $12 support as well as the $13.5 resistance level.

Author

FXStreet Team

FXStreet