Binance Elliott Wave technical analysis [Video]

![Binance Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/Ondo-finance_Neutral_XtraLarge.png)

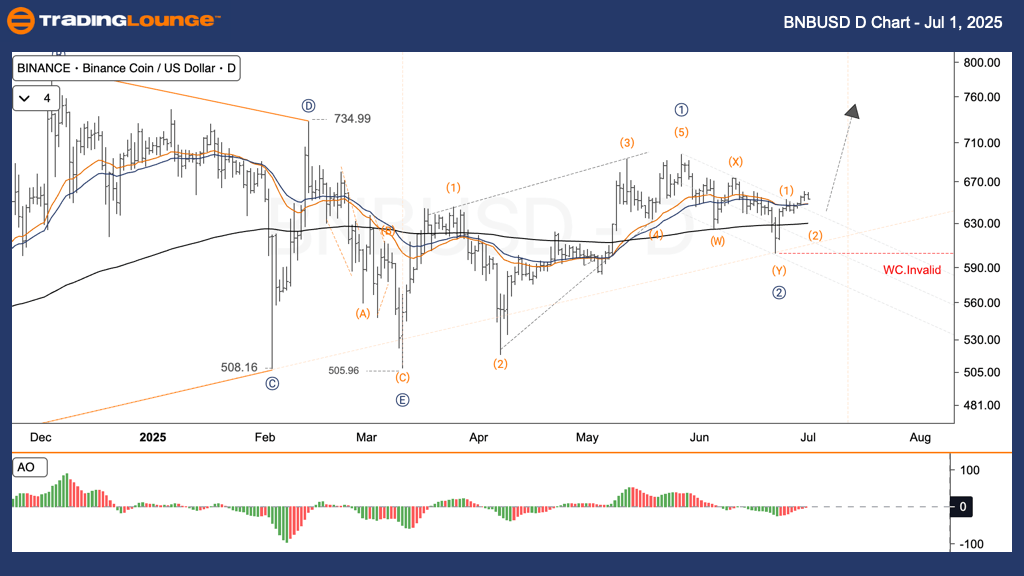

BNB/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave 2.

Direction next higher degrees: Wave IV of Impulse.

Wave cancel invalid Level: $597.

BNB/USD trading strategy – Daily chart

Binance Coin (BNBUSD) is presenting a potential bullish reversal following a correction phase, likely marking the completion of wave ② near the Fibonacci retracement zone of 50% - 61.8%. This price area now hints at the start of a medium- to long-term advance into wave ③.

Trading strategies

-

Strategy:

-

For short-term traders (swing trade)

-

Watch for a price reversal near $633 to initiate a Long Position.

-

-

Risk management:

-

If the price dips below $597, the wave count becomes invalid and should be reviewed immediately.

-

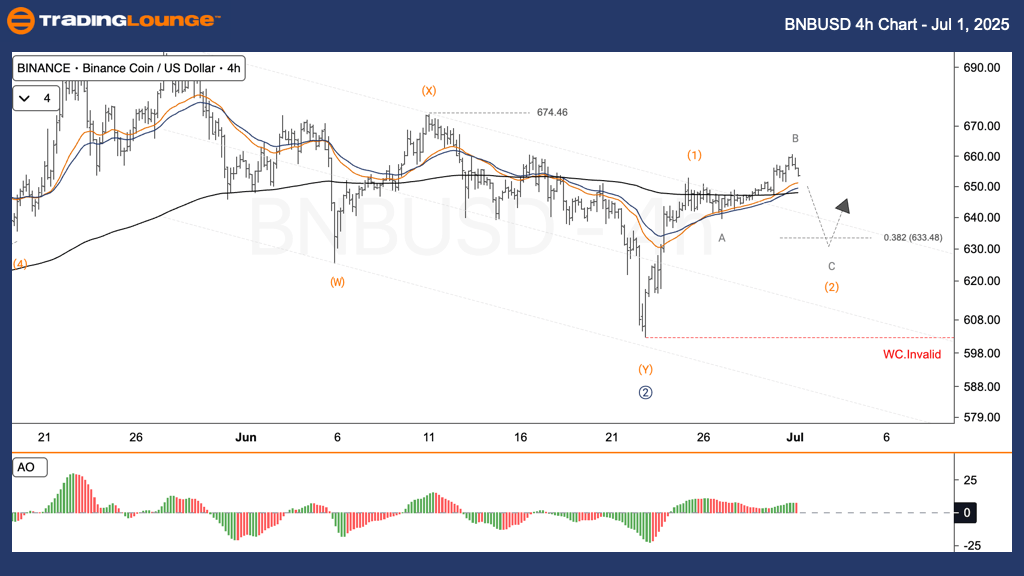

BNB/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave 2.

Direction next higher degrees: Wave IV of Impulse.

Wave cancel invalid Level: $597.

BNB/USD trading strategy – Four-hour chart

The BNBUSD market structure suggests a probable end to wave ② within the Fibonacci 50% - 61.8% retracement area. The price action signals the beginning of wave ③, indicating a possible trend reversal in the medium term.

Trading strategies

-

Strategy:

-

For short-term traders (Swing trade)

-

A reversal near $633 offers a good opportunity to open a Long Position.

-

-

Risk management:

-

If the price breaks below $597, reassess the Elliott Wave count immediately.

-

Binance (BNB/USD) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.