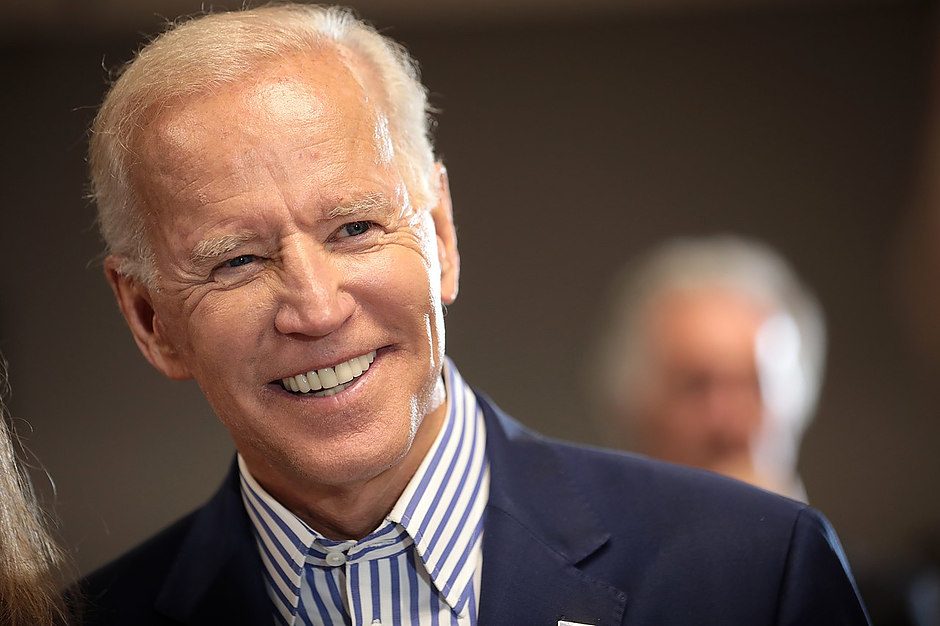

Biden out, bull run in? Here’s what analysts think

United States President Joe Biden shocked the markets when he ended his reelection bid on Sunday, July 22.

Some analysts suggested that the president’s withdrawal from the election race could benefit Bitcoin (BTC $67,288) and other crypto assets in the coming months, while others cautioned that investors should temper their excitement for now.

The price of Bitcoin immediately dipped as much as 2.8% following the announcement, touching the $65,800 mark, but it quickly regained over 3.6% by the time of publication, according to TradingView data.

The price of Bitcoin slumped and then rallied sharply following Biden’s announcement. Source: TradingView

Describing Biden’s sudden move as a “win for crypto assets,” eToro market analyst Josh Gilbert told Cointelegraph that Trump’s heightened chances of reelection represent a “huge boost for the asset class:”

The longer that we see Trump staying ahead in the election odds, the more crypto assets will price in his victory.

“It’s difficult to envision Kamala Harris or another Democrat candidate overturning Trump’s lead in the polls with just three months left in this election race, but a lot can happen in that time frame, so nothing is off the cards,” he explained.

Trump has recently made Bitcoin and cryptocurrencies a key part of his election campaign, declaring on June 14 that he would bring an end to the Biden administration’s “war on crypto” if elected president.

10x Research founder Markus Thielen suggested that a crypto-friendly Trump could announce that he would make Bitcoin a strategic reserve asset for the US government at the upcoming Bitcoin 2024 conference in Nashville, Tennessee.

In a July 21 report, Thielen wrote that the US government holds just 212,800 BTC worth around $15 billion, while it holds around $600 billion in gold reserves. If the government doubled its Bitcoin holdings, it would be “nearly equivalent” to the price impact of net inflows into spot Bitcoin exchange-traded funds (ETFs) year-to-date.

Looking forward, Gilbert said he expects to see the price of Bitcoin drive higher, citing the upcoming launch of spot Ether (ETH $3,483) ETFs in the US as one of the main catalysts for growth across the market.

Don’t get too excited about a Trump win yet

However, some analysts say the recent Biden development may not lead to an immediate surge for crypto.

Swyftx analyst Pav Hundal warned that while Biden’s withdrawal could boost Trump’s chances, it would be difficult to directly link this and the current bounce in price action in the broader crypto market.

“Learning from the Bitcoin ETF experience, we could see a temporary stalling of prices before the uptrend continues,” he said.

This recent surge might be attributed to early Ethereum ETF speculation, and it’s important for investors to stay cautious and not get overly excited in the short term.

Similarly, Gary Black, managing partner at The Future Fund, warned his 433,000 followers on X that a Trump presidential victory was far from a done deal.

“Those who think Trump/Vance will win by a landslide are getting ahead of themselves,” Black said in a July 22 post to X:

Source: Gary Black

“The American public doesn’t trust Trump after the events of Jan 6th. I was no fan of Biden or Kamala but Dems could still nominate Newsom, Michelle Obama, or another leading Dem to be their Presidential candidate.”

“It’s too early to have such high conviction about a second Trump Presidency.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.