Bears positioned to take the lead as $930M in Bitcoin options expire Friday

Derivatives data for Bitcoin weekly options suggests bears may have the upper hand in tomorrow’s $930 million expiry

On May 21 at 8:00 AM UTC, $930 million worth of Bitcoin (BTC) weekly options will expire. As usual, the leader Deribit holds a 90% share, but the recent market drop might have given bears too much power.

While traders and analysts scramble to find a rationale for the 53% drop from the $64,900 all-time high, ExoAlpha CIO David Lifchitz perfectly described the recent market conditions when he said:

“This looks like the final flush-out after the last couple of months of an irrational bull run, shitcoin frenzy and other antics.”

The correction was so strong that even avid Bitcoin defenders flipped, including the global Chief Investment Officer of investment giant Guggenheim, who dubbed crypto markets as ‘tulipmania’.

Regardless of the reasons behind the price action, traders that held previously inexpensive rights to sell Bitcoin at $45,000 or $46,000 are now celebrating.

Don’t fall for what looks to be a 'balanced' situation

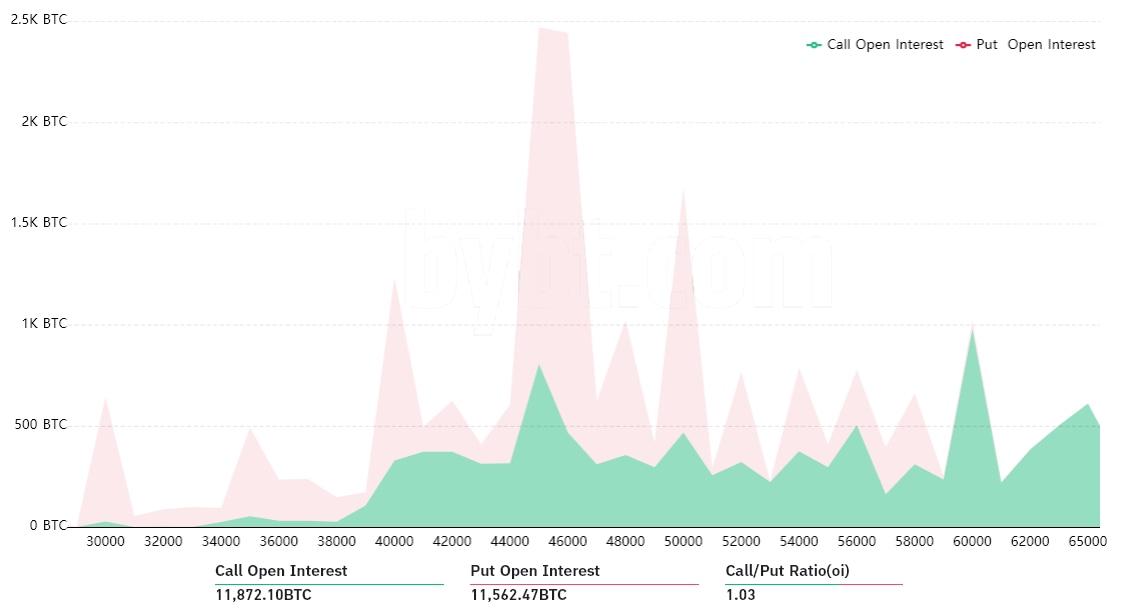

Although the current setup looks balanced between call (buy) options and the neutral-to-bearish put (sell) options, Bitcoin’s 30% drop has shifted the balance to favor bears over the past two weeks.

Out of the 11,872 call options, only 15% have been created using $44,000 and lower strikes. This means the remaining 85% became worthless, as there are less than 14 hours left for the weekly expiry. Therefore, the 1,850 neutral-to-bullish call options below $44,500 represent a $75 million open interest.

On the other hand, 88% of the put options have $36,000 or higher strikes. Those options allow its buyer to sell Bitcoin at a fixed price, so most commonly used on neutral-to-bearish strategies.

The bear's advantage is likely to spill off for next week

Unlike futures contracts, there is not much gain in rolling over a losing position to the following week. As we approach the expiry date, a right to acquire Bitcoin at $50,000 is effectively worthless right now. That’s the reason why bears’ current advantage will likely continue exerting pressure.

Overall, the put options at $36,000 and higher amount to $400 million in open interest. The $325 million difference favoring the more neutral-to-bearish options is a decent advantage as we approach Friday’s expiry.

However, it is important to highlight that monthly options usually handle most of the action, and May 28 will be no different with $1.95 billion open interest. While it seems premature to call it, bears will likely continue to pressure markets considering there are almost no call options at $38,000 or lower for next week.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.