AVAX price expected to recover recent 20% losses as investors lean into accumulation

- AVAX price noted a 5% increase over the last 24 hours following the 20% drop on April 26.

- Retail wallets have increased in the last month. However, large wallet holders continued to dump in April.

- The network is noting a surge in short-term holders which could be alarming for the price as this cohort's balance is susceptible to selling at all times.

AVAX price, although it has not made any notable growth in the last few days, might be on the way to making a quick recovery thanks to its investor's bullishness. Supporting the same, not only did their presence on the network increase, but their accumulation is also on the rise.

Furthermore, USD Coin (USDC) issuer Circle announced that it would be implementing stablecoin transfers between Ethereum and Avalanche. Through the use of USDC, users can conduct seamless transactions across the two platforms, which in return would enhance liquidity and interoperability in the DeFi ecosystem.

AVAX price poised for recovery

AVAX price is currently trading at $17.77 after facing a near 20% crash in the span of three days on April 19.

AVAX/USD 1-day chart

This, however, seemed to have no effect on the cryptocurrency or its holders because the network was scheduled to witness one of the most important upgrades - Cortina on April 25.

Read more about the Coritna upgrade’s impact here - Avalanche Cortina upgrade might be the Hail Mary AVAX needs

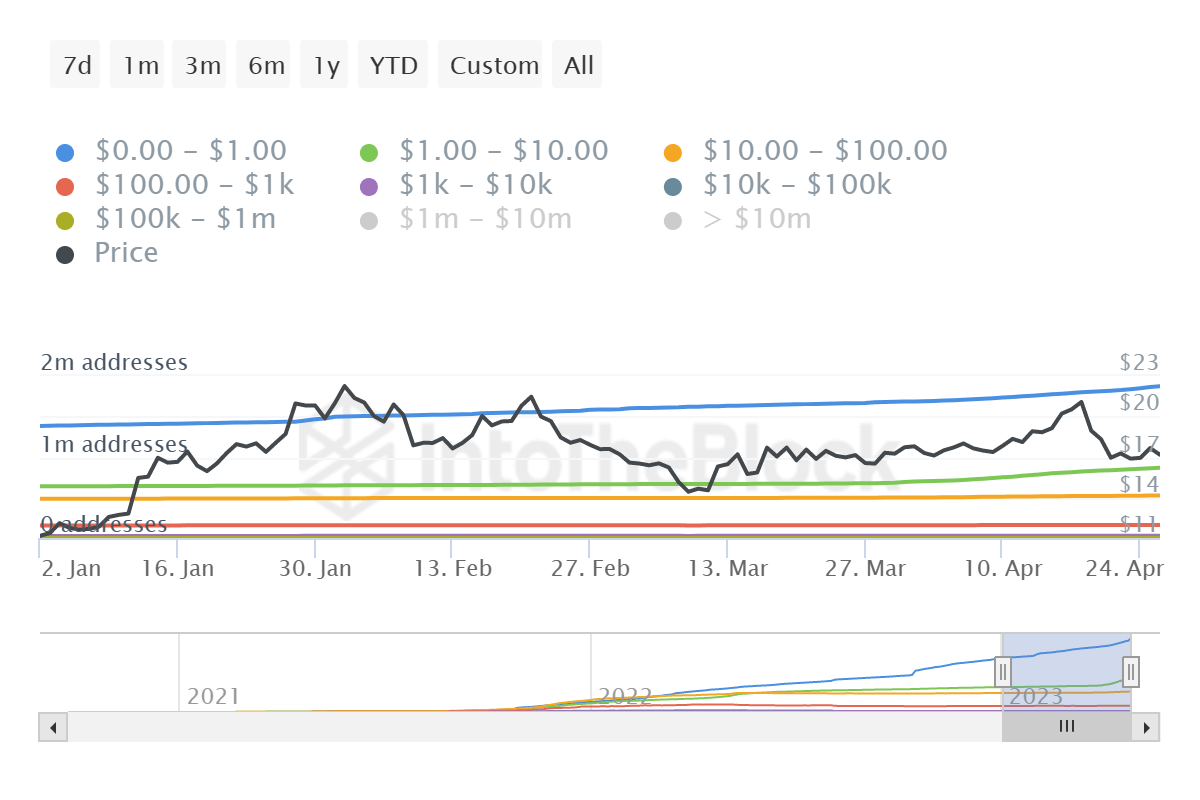

Ahead of its arrival, not only did the investors’ presence increase, but so did their bullishness. Over the last month, retail addresses have registered a significant spike across different groups of addresses based on their holding.

The most notable increase was observed among the small wallet holders, particularly the cohorts holding $1 to $100 worth of AVAX. Collectively over 230,000 new addresses were formed in the last month with the aforementioned balance.

Avalanche addresses by holding in USD

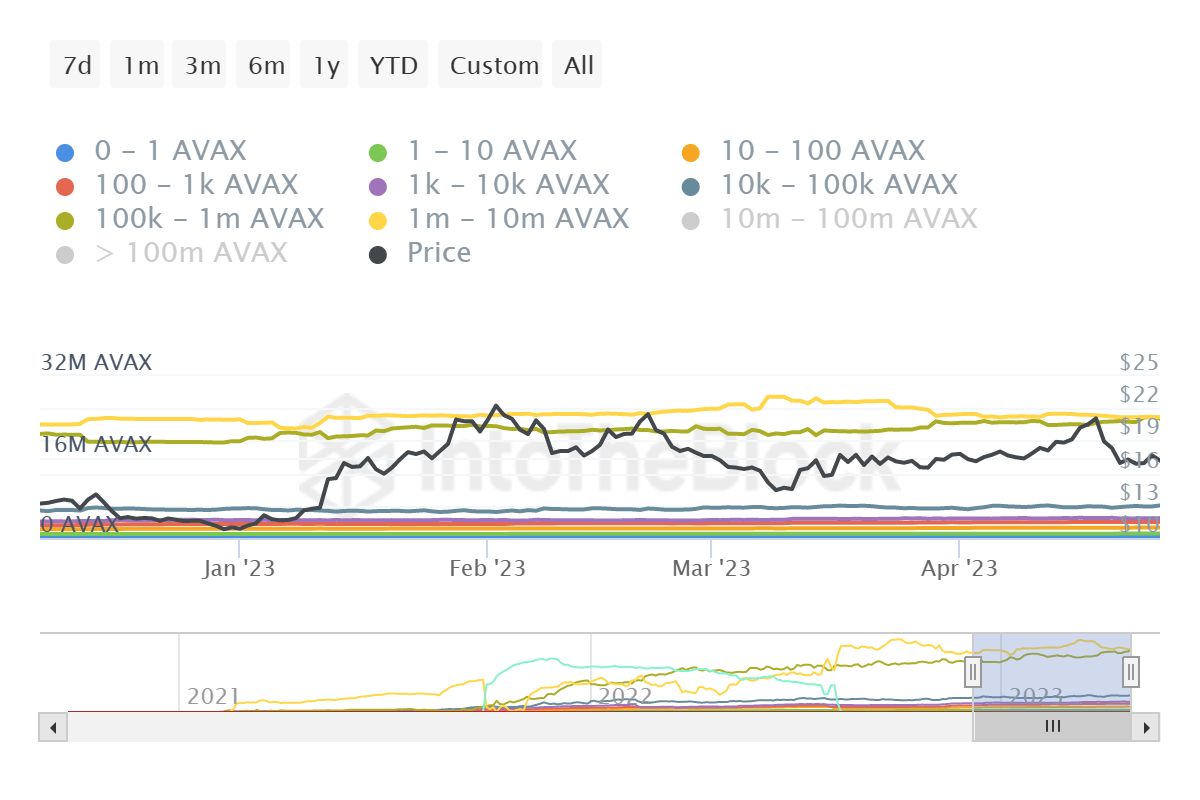

Surprisingly at the same time, some large wallet holders took the other route and decided to shed a chunk of their holdings. Addresses holding 1 million to 10 million AVAX noted a decline of 2 million AVAX worth $34 million. This was, however, picked up by whales immediately, who accrued a little over 3.1 million AVAX worth $51 million at the current prices.

Avalanche addresses by balance

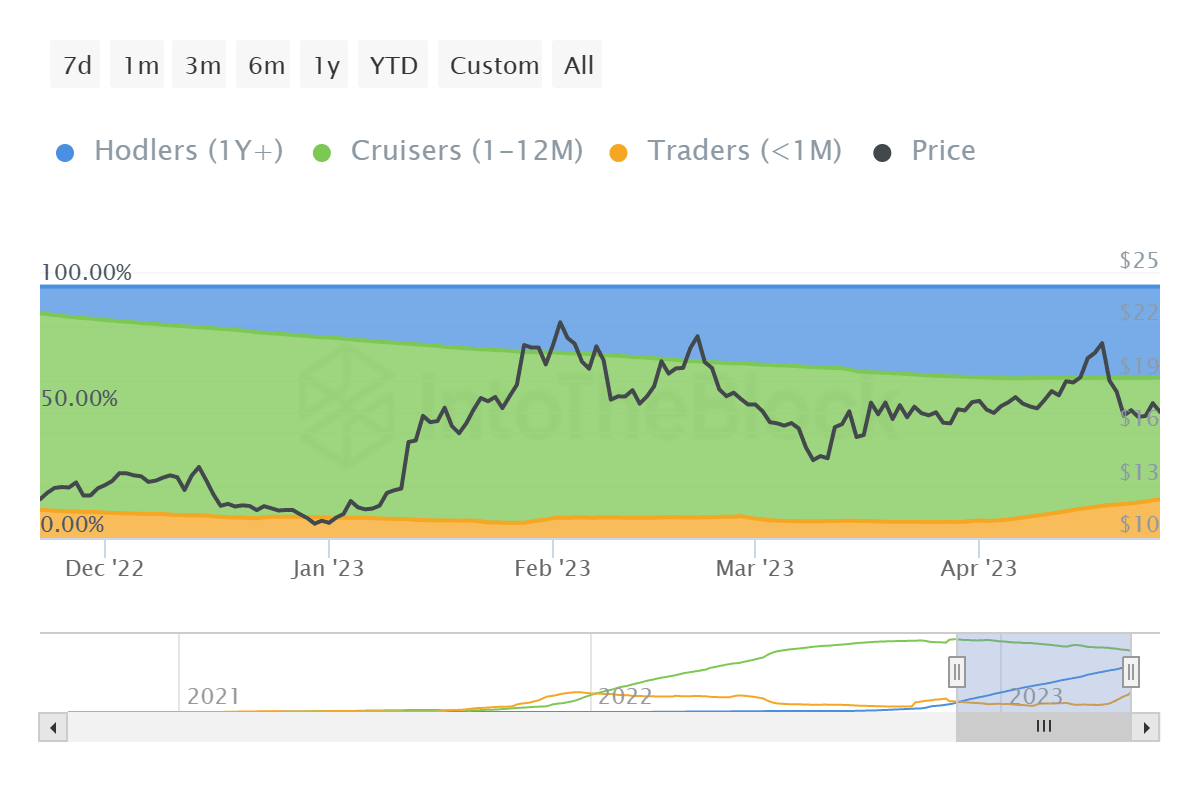

By the looks of it, a bullish scenario for AVAX price is most likely going forward. However, the majority of the investors currently are short-term holders (Traders) that have only been holding their supply for less than a month.

Avalanche addresses by time held

These addresses are more susceptible to panic and FOMO and could very easily sell their supply at any time, which could lead to a downswing in AVAX price.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.