AVAX briefly recovers but Avalance remains at risk of another 30% correction

- AVAX price has been under some heavy selling pressure.

- Bulls attempt a relief rally, but the near-term structure looks weak.

- A deeper correction is likely before a new upswing can occur.

AVAX price has dropped as much as 31% from the all-time high it established on November 21st. Since then, it has recovered over 25% of that loss until it faced renewed selling pressure against some key Ichimoku levels.

AVAX price to continue lower, correction likely not finished

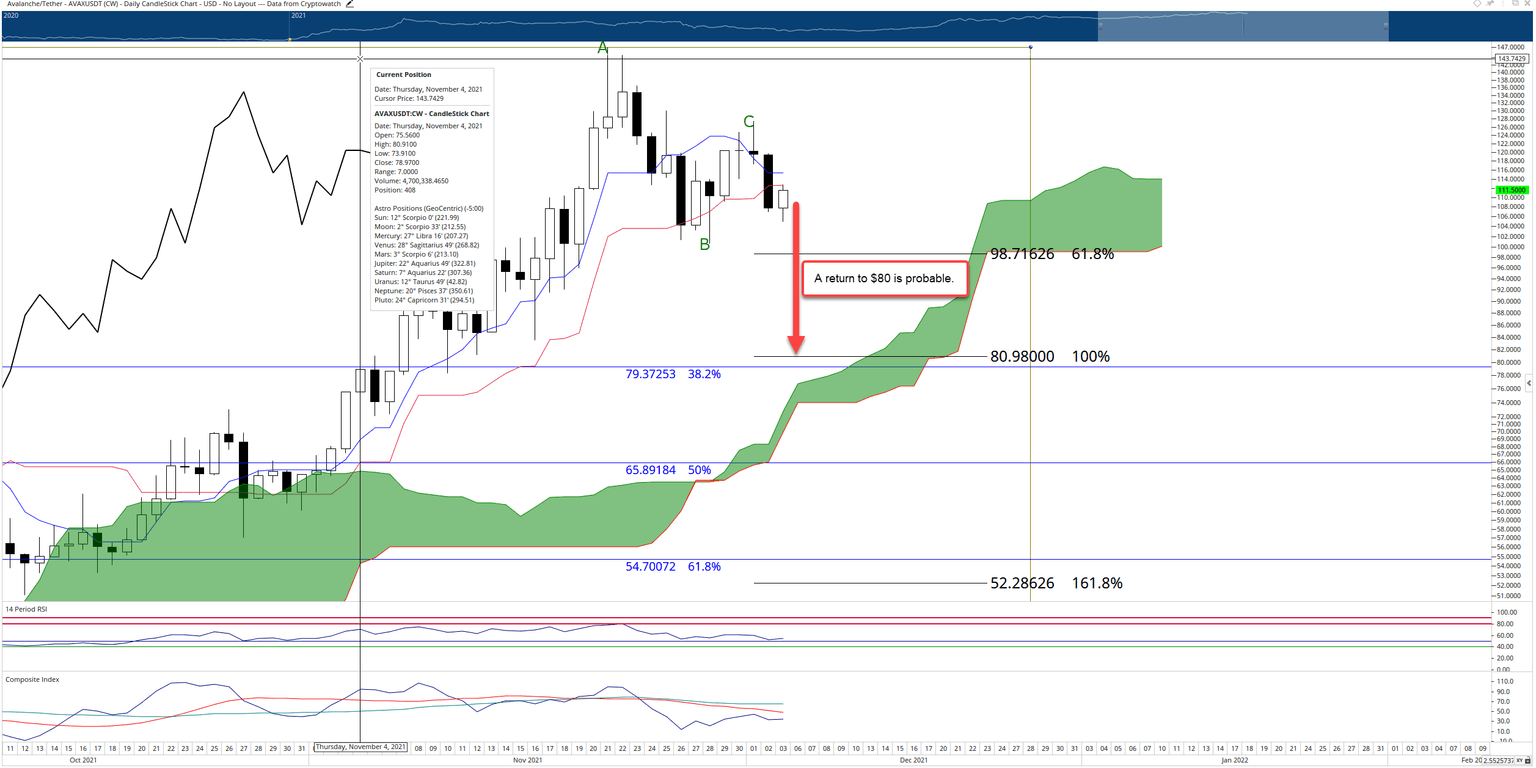

AVAX price showed some early signs that the selloff it experienced between November 21st and November 26th was finished. However, as AVAX approached the Tenkan-Sen and Kijun-Sen, sellers came in and continued to pressure AVAX further south, culminating with a 10% drop on Thursday’s candlestick with a close below the Tenkan-Sen and Kijun-Sen.

The Friday trading session has yielded some buying, but the bulls are currently struggling against the Kijun-Sen and Tenkan-sen, again, at the $113 price level. Moreover, the current swing setup indicates that bulls will have an exceedingly tricky time pushing higher.

The likely target area that AVAX price will move to is the $80 value area. The 38.2% Fibonacci retracement, 100% Fibonacci expansion, and Senkou Span A share the $80 value area. However, bulls should be cautious of how thin the 2021 Volume Profile is at $80.

AVAX/USDT Daily Ichimoku Chart

Because cryptocurrencies have a typical mean reversion move between 40% and 60%, a retracement to the 50% Fibonacci retracement at $65 is undoubtedly a high probability move as well. A major high volume node in the Volume Profile adds to the $65 price level as support for AVAX price.

But a significant corrective move is by no means a certainty. AVAX is still in an obvious bull market. A close above the $135 value area would likely invalidate any near-term corrective move expectations.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.