Avalanche price nears $20 breakout as China tariffs spark crypto market recovery

- AVAX holds $18 support as China retaliates with tariffs in response to U.S. trade policy escalation.

- Crypto markets stabilize as investors seek alternatives amid rising geopolitical tensions and equity market uncertainty.

- Avalanche price consolidates within tight range, signaling potential breakout if macro pressure drives capital into crypto.

Avalanche (AVAX) traded within a narrow 2% range between $18 and $20 this week, signaling stability as markets digest geopolitical volatility.

Avalanche holds firm as U.S.–China trade tensions ignite risk-off sentiment

Avalanche (AVAX) price remained resilient around the $19 level on Friday, continuing a three-day consolidation phase amid escalating global trade tensions. The U.S. initiated a new round of tariffs earlier this week, triggering a wave of sell-offs across global equity markets. AVAX briefly dipped to $17.60 on Thursday, marking its lowest price point of the week.

However, Friday brought signs of stabilization. China responded to Washington’s tariff package by announcing its own retaliatory measures.

China’s retaliatory 34% tariff has sparked fears of prolonged trade hostilities, prompting investors to reassess risk allocations.

US stocks slid further on the news, while prominent assets such as Avalanche began to attract renewed interest.

Avalanche (AVAX) price analysis

Trading volumes on AVAX’s 24-hour chart ticked higher by Friday afternoon, reflecting growing activity around the consolidation zone.

Market participants are increasingly positioning digital assets as hedges against macroeconomic and geopolitical uncertainty.

As fears mount over how the trade war may affect the global earnings outlook, the crypto sector’s relative insulation from traditional trade flows has drawn attention.

Historically, capital rotation into cryptocurrencies accelerates during periods of weakening investor confidence in equities and fiat-linked assets.

Avalanche’s steady support around the $18–$19 range suggests traders may be positioning for a breakout in the coming days, should risk-off sentiment deepen

AVAX price forecast: $20 breakout ahead if BTC recovery continues

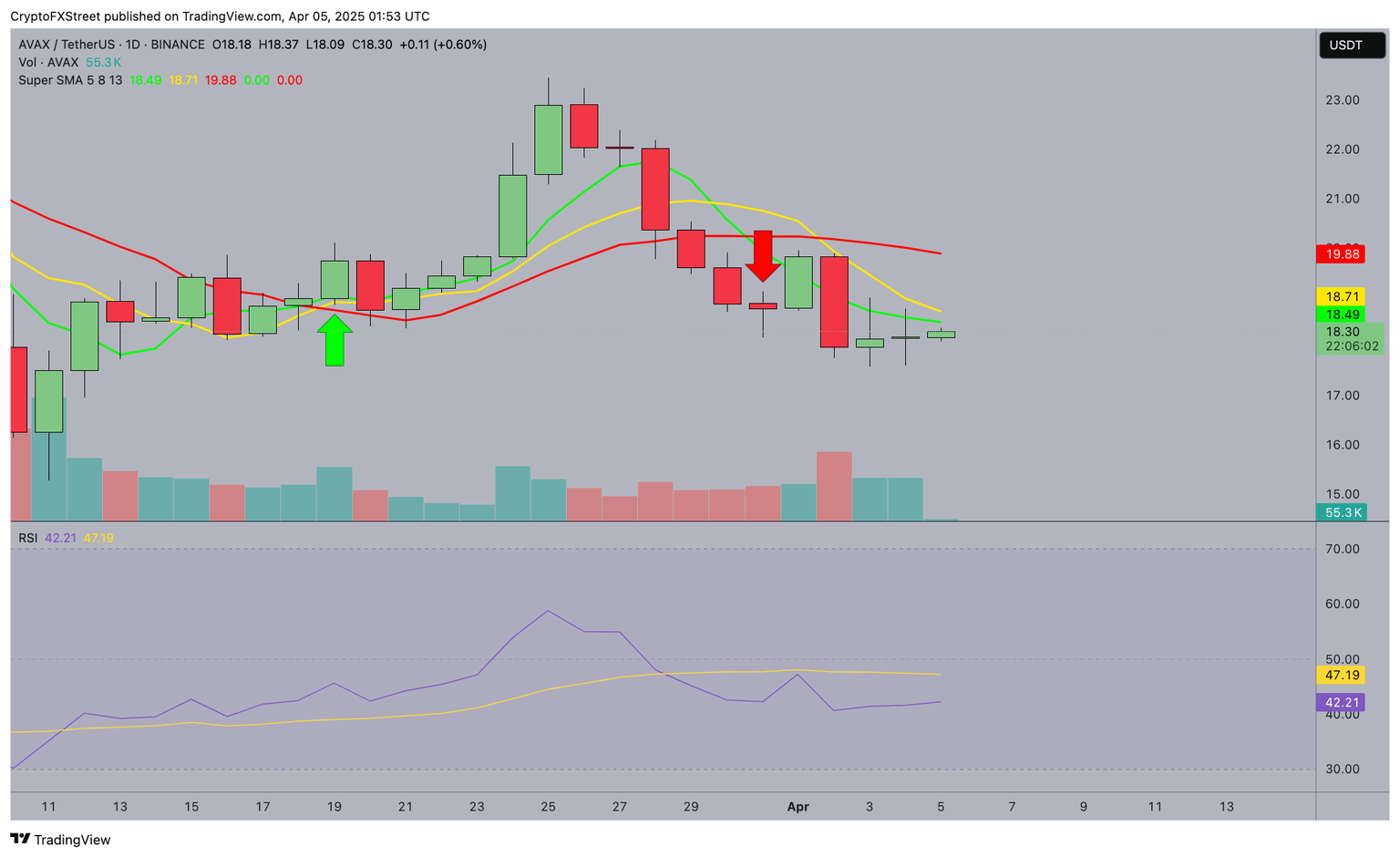

Avalanche (AVAX) price remains in a consolidation phase near $18.50 as technical indicators suggest a cautious bullish setup, signaling a potential breakout toward $20.

AVAX price has been stabilizing near key support, showing resilience after a recent decline from the $22 peak.

The Super SMA indicator suggests mixed sentiment, with the yellow and green lines trending downward while the red SMA at $19.88 acts as a significant resistance level.

The price is currently trading below all three moving averages, indicating a bearish short-term outlook. However, the narrowing gap between the moving averages suggests that downward momentum may be fading.

AVAX price forecast

The Relative Strength Index (RSI) hovers around 42.15, indicating that AVAX is in neutral-to-oversold territory. If buying pressure increases, the RSI could reclaim the 50 level, strengthening the bullish case.

Meanwhile, the volume indicator shows a decline in trading activity, suggesting that selling pressure is subsiding.

If volume picks up on an upward move, AVAX could challenge the $19.88 resistance and potentially retest the $20 psychological level.

A rejection at current levels could send AVAX toward $17.50, but if bulls maintain control, an upward breakout remains on the table, contingent on broader market sentiment.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.