Avalanche Price Forecast: Grayscale files SEC registration for Avalanche Trust

- Avalanche price holds above key support at $22.53, with potential for a rebound if support holds.

- Grayscale Investments has submitted an SEC S-1 registration statement to launch the Grayscale Avalanche Trust.

- On-chain data show rising Total Value Locked and daily transactions, supporting the case for a recovery in AVAX.

Avalanche (AVAX) price hovers above its key level at $22.53 at the time of writing on Tuesday, after falling over 9% the previous day. Market participants digest Grayscale Investments’ move to file an S-1 registration with the US Securities and Exchange Commission (SEC) for the launch of the Grayscale Avalanche Trust on Monday. Strengthening on-chain metrics, such as rising Total Value Locked (TVL) and daily transactions, hint at growing network activity that could support a potential recovery in AVAX.

Grayscale files for Avalanche Trust

Crypto asset manager Grayscale filed for an SEC S-1 registration statement on Monday to launch the Grayscale Avalanche Trust (AVAX), aiming to list it on Nasdaq. The trust seeks to track the price performance of AVAX, with Coinbase Custody serving as the custodian and Coinbase, Inc. acting as the prime broker.

While the announcement underscores a bullish long-term outlook for AVAX, it failed to spark an immediate price rally on Monday. However, filings by large investment firms like Grayscale are generally positive as they enhance legitimacy, improve liquidity, and provide traditional investors with easier access to Avalanche without directly holding the token.

Avalanche’s on-chain data show bullish signs

According to Artemis Terminal data, Avalanche’s TVL increased to a yearly high of $2 billion on Saturday. This increase in TVL indicates growing activity and interest within Avalanche’s ecosystem, suggesting that more users are depositing or utilizing assets within AVAX-based protocols.

%20(1)-1756179356623-1756179356636.jpeg&w=1536&q=95)

Avalanche TVL chart. Source: Artemis Terminal

Additionally, its daily transactions also reached a year-to-date (YTD) high of $2 million on Saturday, indicating a surge in traders’ interest and liquidity in the AVAX chain.

-1756179377610-1756179377611.jpeg&w=1536&q=95)

Avalanche daily transactions chart. Source: Artemis Terminal

Avalanche Price Forecast: AVAX hovers around key support

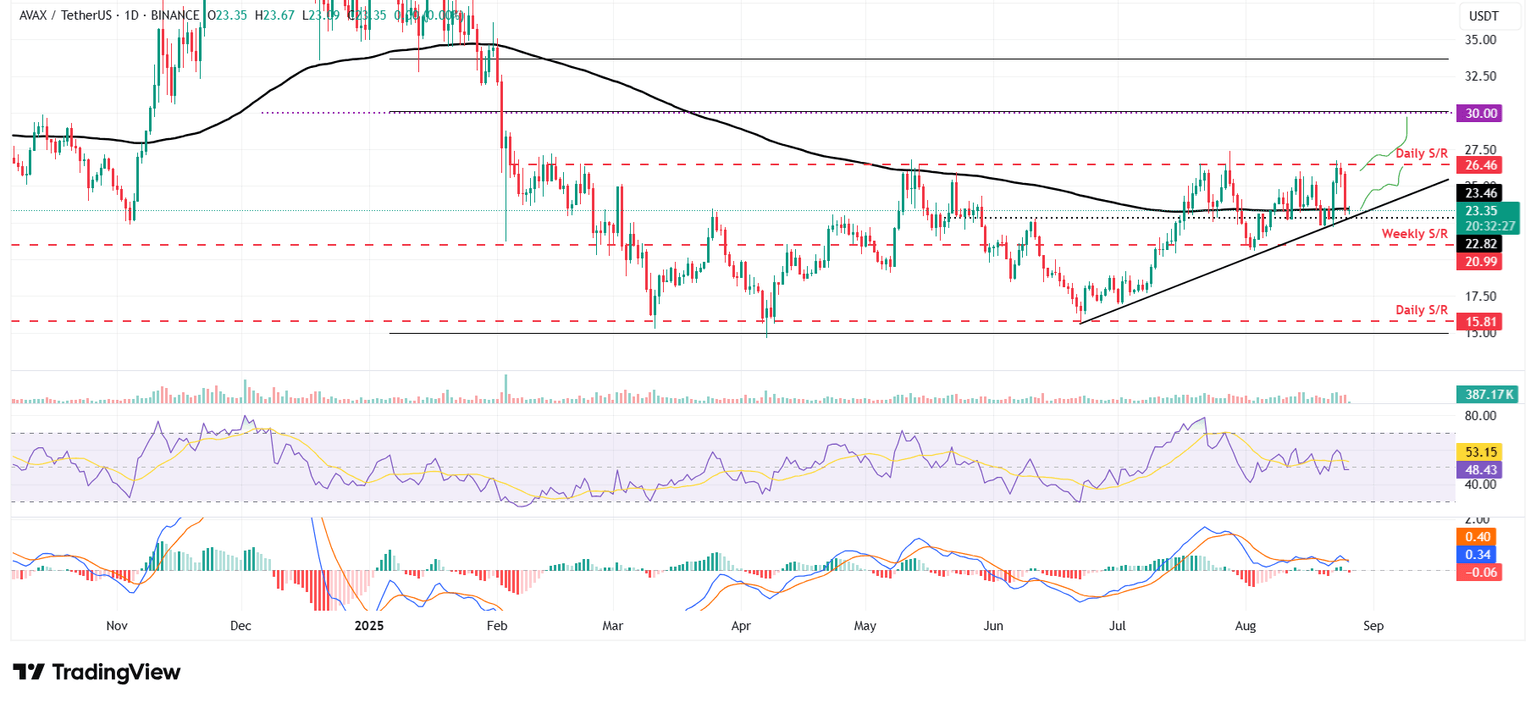

Avalanche price faced a rejection from its daily resistance level at $26.46 on Sunday and declined by over 9% the next day. At the time of writing on Tuesday, it hovers at around $23.35.

If AVAX finds support around its daily level at $22.82 and recovers, it could extend the recovery toward its next daily resistance at $26.46.

The Relative Strength Index (RSI) on the daily chart slipped below its neutral level of 50, indicating bearish momentum. For the recovery rally to be sustained, the RSI must move above its neutral level.

AVAX/USDT daily chart

However, if AVAX closes below its daily level at $22.82 on a daily basis, it could extend the decline toward its weekly support at $20.99.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.