ATOM price suggests bears are still in control for these reasons

- Cosmos price lost 20% of market value this month and has since recovered by 16%.

- Together the Relative Strength Index and Volume Profile Indicator suggest the bear is still in control of the ATOM price.

- Invalidation of the bearish thesis is a breach above $11.14.

Cosmos price (ATOM) is producing a countertrend rally after suffering a steep decline throughout the month. If market conditions persist, ATOM could wipe out newly established bullish positions. Key levels have been defined to gauge ATOM’s next potential move.

Cosmos price points lower

Cosmos price has declined by 40% since the start of November. During the downswings, the bulls have struggled to retaliate for more than a day or so before the bears initiate another attack. On November 21, the ATOM price fell to a new monthly low at $8.72. Following the decline, the bulls have produced a 16% countertrend spike. Despite the optimistic gesture, the technicals suggest the bears will continue to flex their reign.

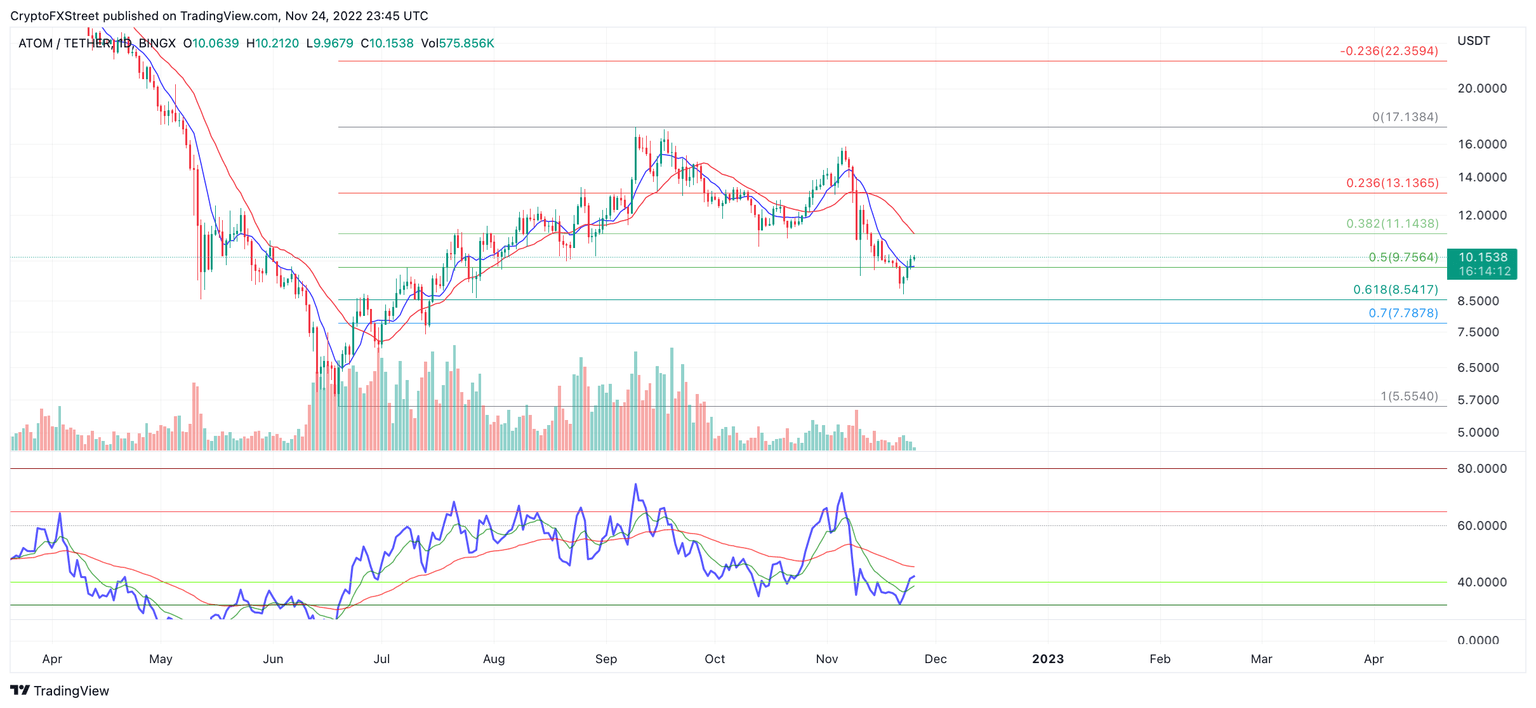

ATOM price currently auctions at $10.16. A Fibonacci retracement tool surrounding the summer low at $5.55 into the September high at $17.13 shows the recent bottom as a few cents shy of the 61.8% Fib level. The bullish hammer on the daily chart likely enticed bulls to enter the market.

ATOM/USDT 1-Day Chart

Still, Volume Profile Indicator remains sparse during the uptrend retaliation. Additionally, the Relative Strength Index printed a new low, unlike Ethereum and Bitcoin, which produced bullish divergences during the November 21 selloff.

When combined, there are enough reasons to suggest ATOM has lower targets to breach. The next key areas of interest are the 61.8% Fib level at $8.54 and potentially the liquidity below $7.70. Invalidation of the bearish outlook lies above the 21-day simple moving average at $11.14. If the bulls hurdle the barrier, an additional uptrend hike targeting the $13 liquidity zone will stand a fair chance of occurring. Such a move would result in a 33% increase from the current Cosmos price

In the following video, our analysts dive deep into the price action of Bitcoin, analyzing key market interest levels. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.