Algorand Price Prediction: ALGO liftoff seems imminent despite broad-based market declines

- Algorand fell sharply from $0.26 but oversold conditions hint at a potential reversal.

- The cryptocurrency market was destabilized on Tuesday after Hong Kong's financial watchdog announced crypto exchange regulation.

Algorand has not found a formidable bottom since the highs traded at $0.76 in August. Investors appear to have accustomed themselves to the pain of shattering one support after another. However, the token has started showing signs of a significant reversal. On the other hand, bulls have held the ground at $0.23 despite the breakdown at $0.24.

Algorand impending reversal eyes $0.3

ALGO is trading at $0.23 at the time of writing, following a sharp drop from $0.26. Widespread losses on Tuesday affected the entire cryptocurrency market. They were triggered by the Securities and Futures Commission (SFC) news in Hong Kong, commencing regulation for cryptocurrency exchanges.

Bitcoin dropped under $13,500, which extended the breakdown from $14,000. Ethereum retested support at $370 while Ripple slipped beneath the tentative support at $0.23. A majority of the major crypto assets have recorded losses between 3% and 7% on the day.

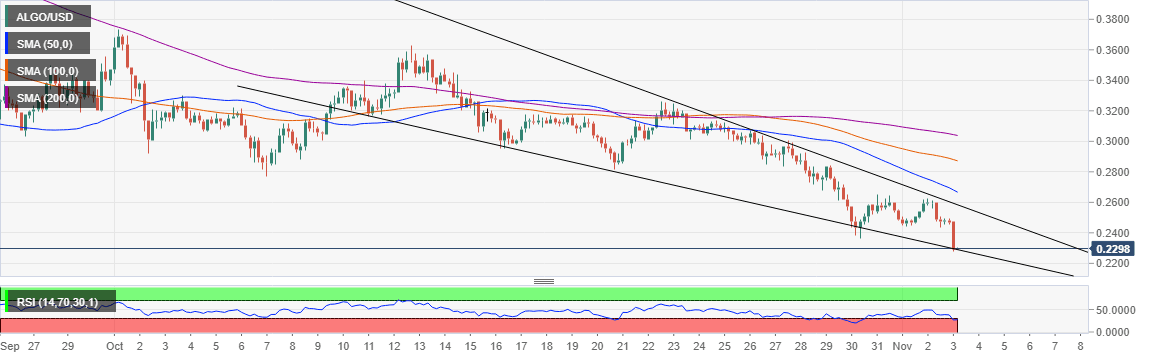

Algorand also corrected by over 11% in 24 hours, but the oversold conditions highlighted by the Relative Strength Index (RSI) hint at a potential reversal. Additionally, Algorand formed a descending wedge pattern on the 4-hour hour, which brings to light the possibility of recovery.

ALGO/USD 4-hour chart

The bulls need to hold above the lower trendline of the wedge pattern as well as $0.23. Stability at these levels would allow buyers to shift the focus to the resistance at $0.26. A breakout from the wedge might add credence to the bullish outlook, hence support a potential spike to $0.3.

A TD Sequential indicator buy signal in the form of a red nine candlestick recently presented on the daily chart. In other words, the above bullish narrative seems to have been validated. Therefore, traders should be aware and watch out for a confirmation of the impending breakout.

ALGO/USD daily chart

According to Santiment, a leading provider of on-chain metrics in the cryptocurrency market, ALGO's social mentions have declined significantly over the past few days. However, the low social volume presents opportunities for growth instead of spikes that usually culminate in price corrections. According to the chart below, a correlation seems to have been established between the price and the social volume.

Algorand social volume chart

Looking at the other side of the fence

The anticipated bullish outlook will be invalidated if Algorand extends the bearish leg farther down, perhaps under $0.20. Such a move is likely to call for more sell orders, in turn, forcing ALGO towards the primary support at $0.15. A fall under the wedge pattern may also trigger losses, adding weight to the bearish narrative.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637399776521947185.png&w=1536&q=95)

%20%5B07.46.58%2C%2003%20Nov%2C%202020%5D-637399776923093016.png&w=1536&q=95)