AI tokens add $17 billion in 24 hours as Nvidia market cap hits $1 trillion

- Nvidia market capitalization touched $1 trillion before NVDA declined to $401.

- Nvidia became the fifth company in the US to achieve this milestone after Apple, Microsoft, Amazon and Alphabet.

- AI crypto tokens, including The Graph and Ocean Protocol, rose significantly, with the latter noting a 12% rally.

The Nvidia stock, NVDA, and Artificial Intelligence (AI) hype continue to power gains across the Traditional Finance (TradFi) and the Crypto market. With the US-based company hitting a major milestone over the last 24 hours, AI tokens also enjoyed the ensuing bullishness.

Nvidia nears the big leagues

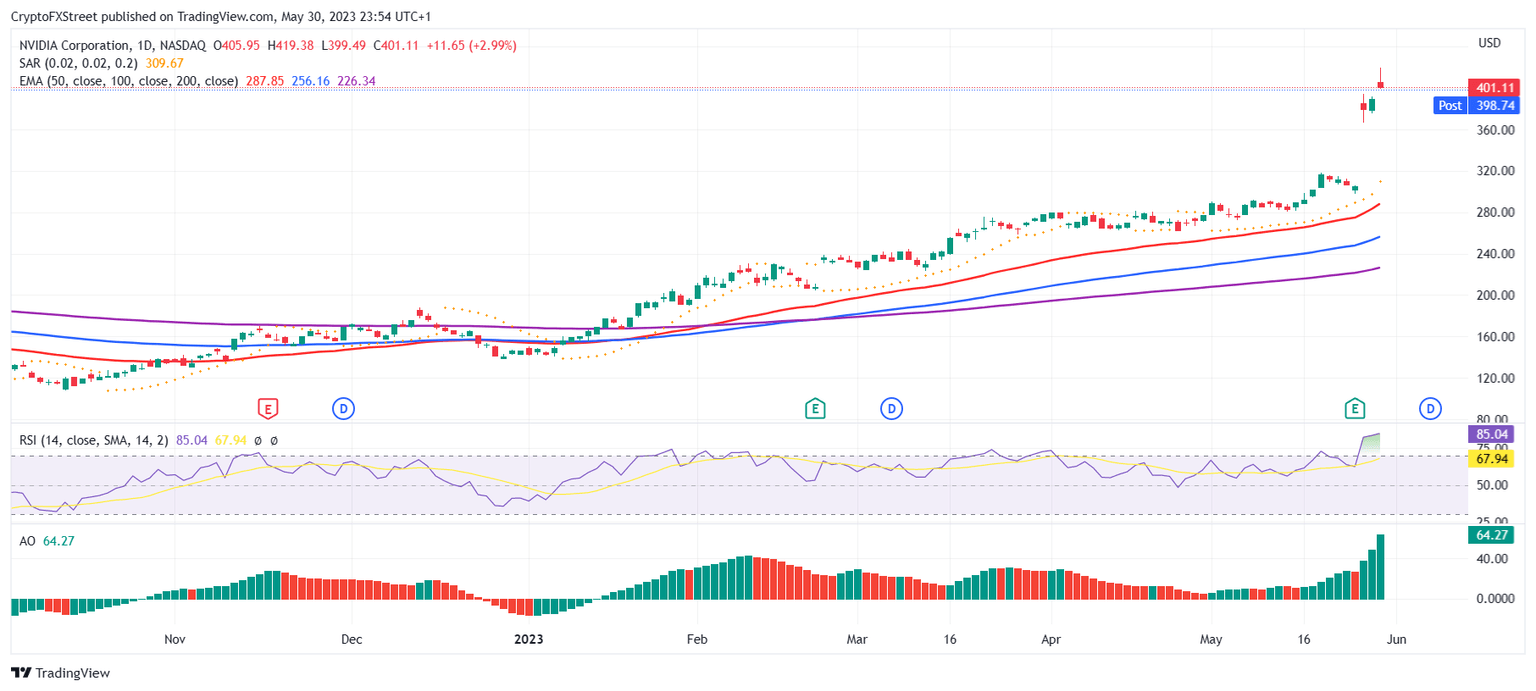

Nvidia’s stock NVDA is still continuing its rise nearly a week after the historic rally observed on May 25. The company’s share price soared by more than 4% during the intra-day trading hours on May 30, which resulted in the market capitalization of Nvidia crossing the $1 trillion mark.

This rally was short-lived, however, as the stock came back down to close at a 3% increase at $401 from the highs of $419 and was still losing value in the after-hours, falling to $398 at the time of writing.

NVDA 1-day chart

For a brief moment, Nvidia became only the fifth publicly traded company in the United States to hit the trillion dollar market cap, following Apple, Microsoft, Amazon and Google’s parent company - Alphabet.

The main reason behind this phenomenal rally was the response to its positive financial reports and ongoing AI hype over the last couple of days. This led to the 24% increase on May 25, subsequently impacting the crypto market as the bullishness was not just limited to the TradFi market.

The cross-market effects of Nvidia’s achievement could still be seen on May 30 when AI tokens observed a rally following the news of NVDA’s $1 trillion market cap.

AI Crypto tokens taste the NVDA hype

AI crypto tokens’ market capitalization added nearly $17 billion in the last 24 hours as their market cap rose by 3.19%. While the rest of the crypto market is still either posting red candlesticks on the chart or refraining from marking any gains, AI tokens noted rallies.

AI coins, including The Graph (GRT), Render token (RNDR), SingularityNET (AGIX), Ocean Protocol (OCEAN), etc. Among the top AI tokens, OCEAN stood out with a nearly 12% rally in the past 24 hours to hit the monthly high of $0.3881.

OCEAN/USDT 1-day chart

The Graph also rose to trade at $0.132 but is attempting to breach through not just one but three key barriers in the form of the 50-, 100-, and 200-day Exponential Moving Averages (EMA). Once the token manages to flip them into support floors, a further rally is likely.

GRT/USDT 1-day chart

However, these tokens’ dependence on external triggers and AI hype is slightly concerning as well since bubbles burst and hypes go away. Thus, AI crypto tokens are also vulnerable to a decline unless Nvidia manages to join the trillion-dollar market cap club definitively.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.