ADA declines amid Charles Hoskinson's proposal to convert $100 million from Cardano treasury into stablecoins

- Cardano founder Charles Hoskinson suggested converting $100 million worth of ADA into stablecoins and Bitcoin.

- The capital reallocation strategy aims to boost Cardano's DeFi ecosystem.

- ADA declined by over 4% in the past 24 hours and is now eyeing $0.60 support after seeing a rejection at the upper boundary of a descending channel.

Cardano (ADA) declined 4% on Friday as Cardano founder Charles Hoskinson proposed converting $100 million worth of ADA into stablecoins and Bitcoin (BTC) to boost its ecosystem's stablecoin issuance.

ADA drops 4% amid Cardano treasury allocation proposal

Cardano co-founder Charles Hoskinson has suggested converting $100 million in ADA tokens into Bitcoin and stablecoins. In a YouTube video on Friday, Hoskinson discussed Cardano's low stablecoin issuance within its DeFi ecosystem.

"Cardano has a disproportionately low ratio of stablecoin issuance to our DeFi. It sits a little under 10%," Hoskinson said in the video recording on YouTube.

There is approximately $31 million worth of stablecoins on the Cardano network, compared to $273 million in its total value locked (TVL), according to DefiLlama data. Hoskinson also shared that the Cardano Foundation's treasury does not hold any yield-bearing instruments. This could be a significant problem for Cardano, particularly given high market volatility in the past few months, he stated.

Drawing examples from sovereign wealth funds of Norway and Abu Dhabi, Hoskinson suggested that the Cardano ecosystem needs to generate returns on its treasury, which can be re-invested into the network. He highlighted that the move could improve the visibility of Cardano-native stablecoins and ultimately pave the way for exchange listings.

However, critics argued that the token sale could cause ADA's price to fall further, with bearish sentiments already rising. Hoskinson addressed the criticism, emphasizing that $100 million would not harm the network.

The proposed fund conversion aims to raise Cardano's stablecoin issuance ratio to approximately 33% or 40%, compared to its current level of 10%. As part of the plan, between $25 million and $50 million could be allocated to Bitcoin in a bid to stimulate Bitcoin-centric DeFi activity and attract yield-seeking participants.

Hoskinson shared that he has written a 40-page document outlining the plan and circulated it among key team members who are currently reviewing it.

"We're going to look at it and then we're going to syndicate that with a lot of the DeFi applications in the Cardano ecosystem and have a discussion about its practical readiness," Hoskinson added.

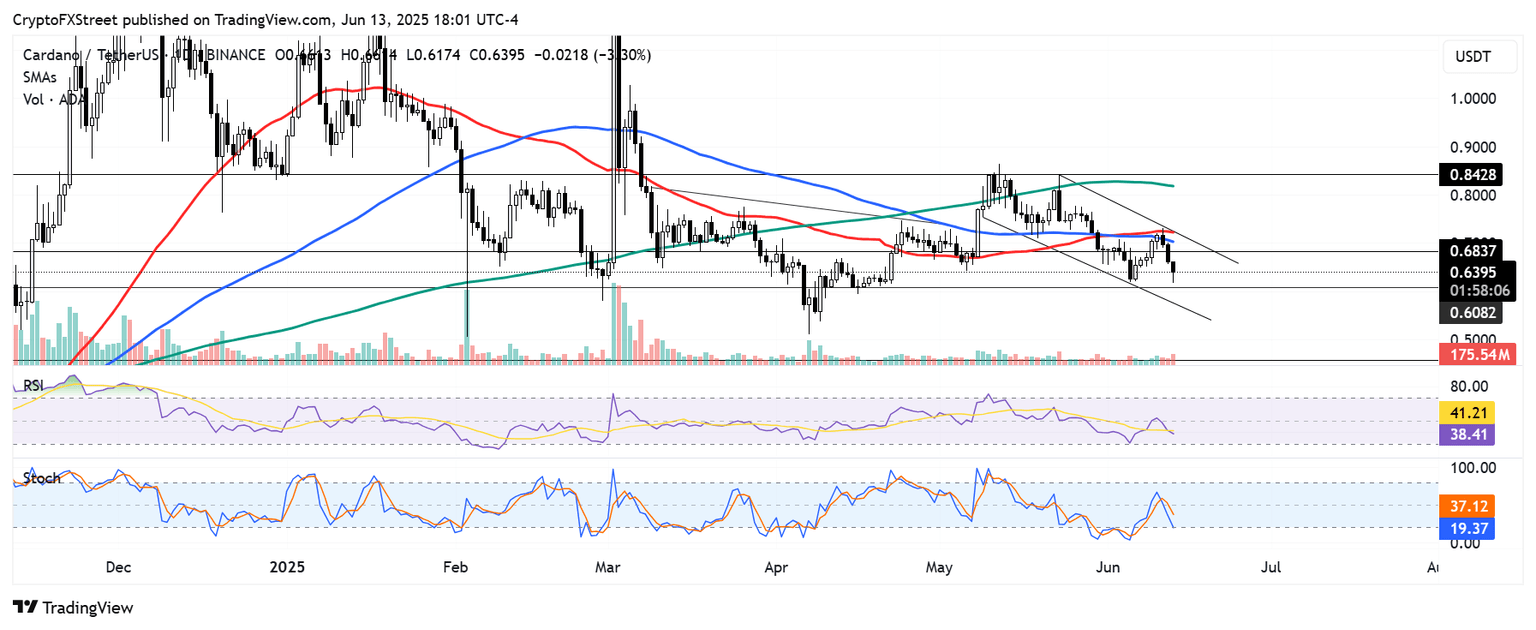

ADA eyes $0.60 support after seeing a rejection at descending channel upper boundary

ADA is down 4% following rising war tensions in the Middle East between Israel and Iran. The altcoin saw a rejection near the upper boundary of a key descending channel — strengthened by the confluence of the 100-day and 50-day Simple Moving Average (SMA).

ADA/USDT daily chart

On the downside, ADA could find support at $0.60. A further downward pressure could see it bounce off the channel's lower boundary if the $0.60 support fails. On the upside, it has to overcome the channel's upper boundary to stage a rally toward $0.84.

The Relative Strength Index (RSI) saw a rejection at its neutral level line and has declined below its moving average. Meanwhile, the Stochastic Oscillator (Stoch) is testing its oversold region line. A decline into the oversold region signals an accelerated bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi