Aave price targets $600 as key indicator flashes buy signals

- Aave price is on the verge of a significant breakout towards $600.

- A key indicator has presented two strong buy signals in favor of the digital asset.

- There are no significant barriers on the way up for Aave.

Aave has seen a notable 30% correction since its top at $581.66 on February 10. The digital asset now seems ready for a new leg up and a breakout above $450.

Aave is facing only one barrier before $600

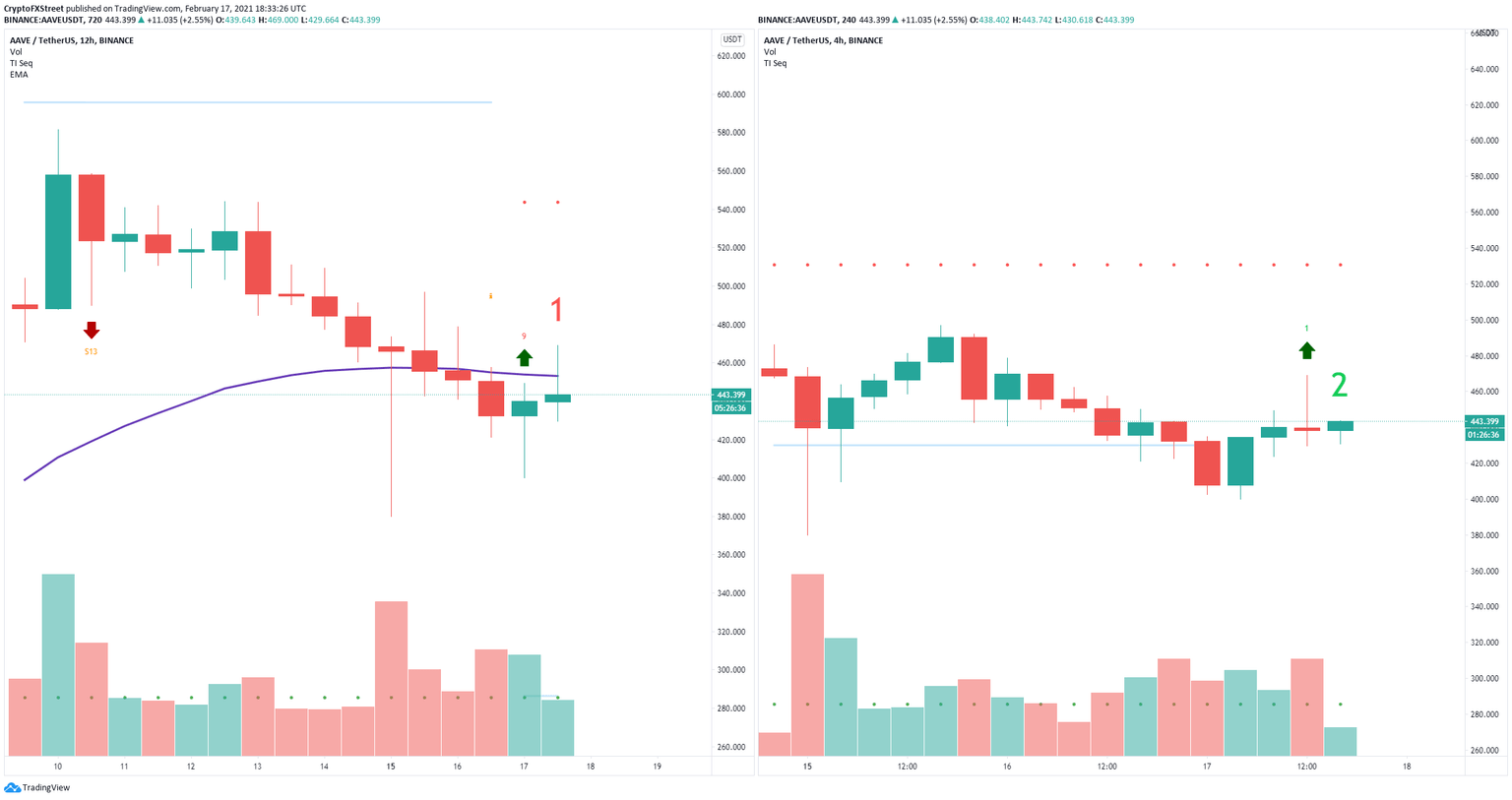

On the 12-hour and 4-hour charts, the TD Sequential indicator has presented two strong buy signals. There is one key resistance level at $450, which is the 26-EMA on the 12-hour chart.

AAVE/USD buy signals

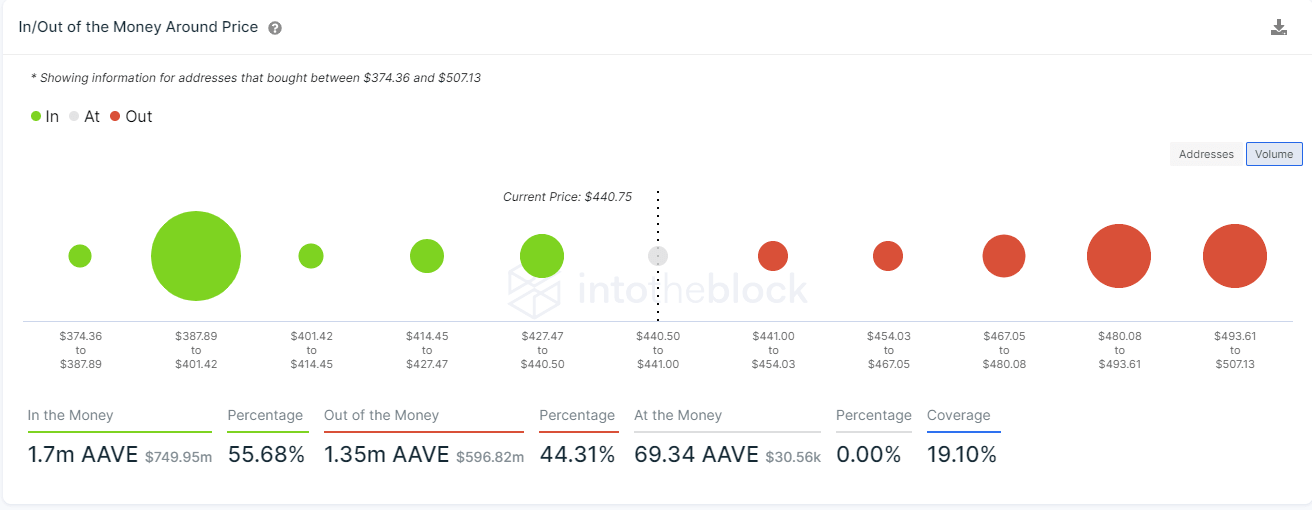

However, the In/Out of the Money Around Price (IOMAP) chart shows practically no intense resistance levels ahead. The strongest seems to be located between $493 and $507, where 5,430 addresses purchased over 560,000 AAVE coins. A breakout above $500 can quickly drive Aave price towards $600.

AAVE IOMAP chart

However, a rejection from the 26-EMA resistance level at $450 on the 12-hour chat and a close below $400 would invalidate the bullish outlook and drive Aave towards $300. The IOMAP model shows only one key support area between $387 and $401, which coincides with the levels above.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.