A tip for when Bitcoin might recover

The recent falls in the crypto space has left many traders reeling. Alternative coins collapsed around a wider market sell off as high inflation has prompted central banks to enter steep hiking cycles. This in turn has led to worries over slowing growth that can potentially lead to a global recession. Industrial and base metals collapsed even as energy prices remain high. So, what are some tips for managing Bitcoin’s prices? Although wider questions remain about BTC’s viability, it does seem to be more part of the financial tapestry than it was 18 months ago. Well, it appears at this stage to be really quite straightforward to see where BTC prices might be headed next.

Bitcoin track stock prices

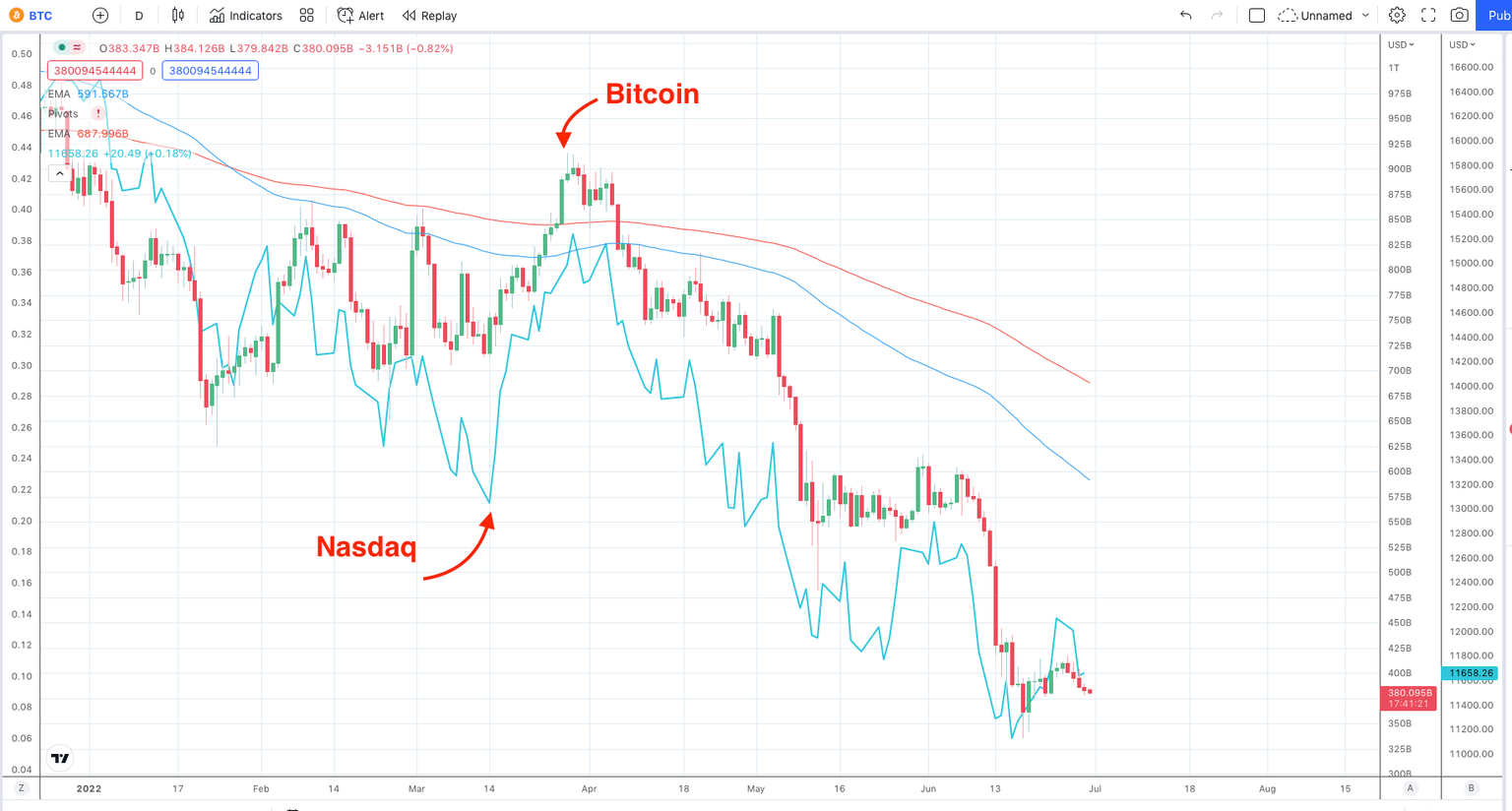

Take a look at the chart below which overlays Bitcoin prices and the Nasdaq. You will notice that BTC price and Nasdaq prices are moving in tandem.

Why is this correlation so tight? The best explanation is likely to be that BTC is now grouped with tech stock for risk management. So, when risk dictates sell tech, then BTC gets sold too. Remember that many BTC investors are large whales holding many, many coins.

So, what’s the trade?

Well, this means that BTC should recover alongside stocks. When will stocks recover? That will most likely be the moment that the Federal Reserve indicates that it will be pausing/stopping its rate hiking cycle. So, if you are wondering what the next path for BTC will be, then watching the Nasdaq may prove to be a reliable guide as long as this close correlation remains and there is no obvious reason why that relationship should break down. See here for another article I wrote back in December 2021 with the close correlation then between the VIX and BTC.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.