Yields yield yields

S2N spotlight

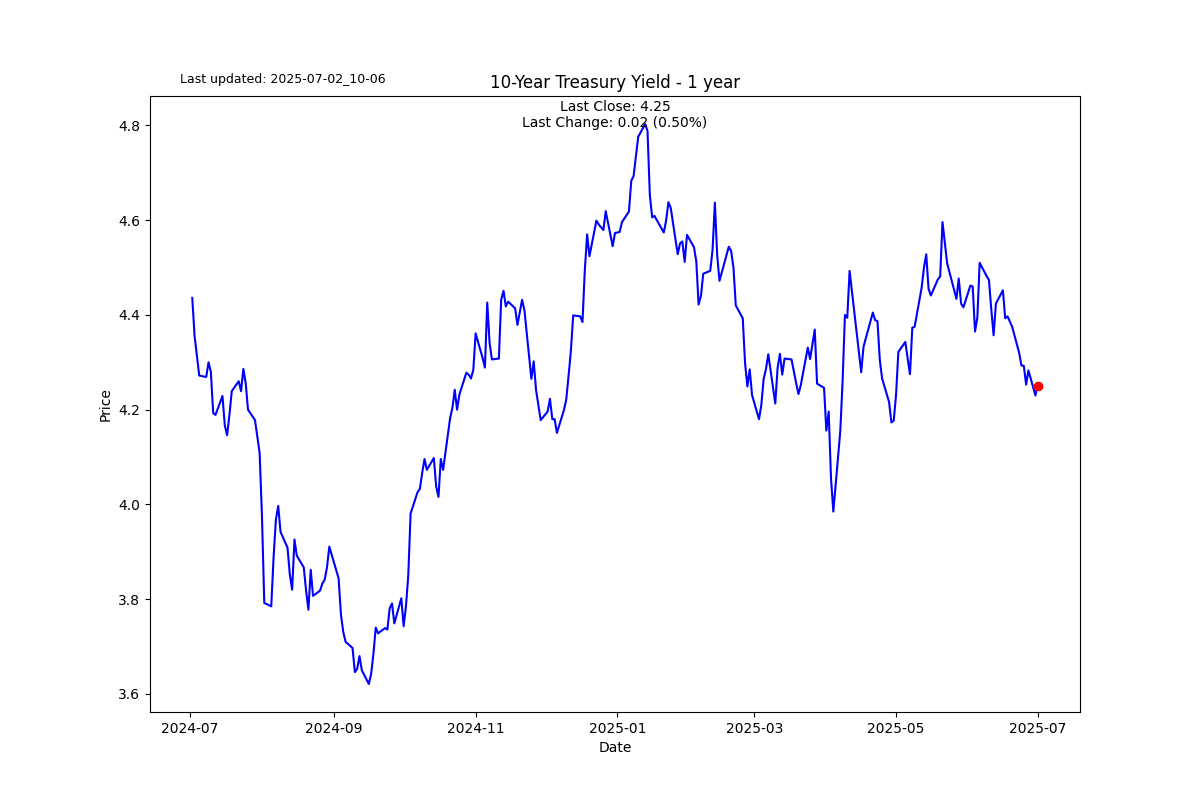

All the macro strategists I follow are commenting on the steepness of the yield curve.

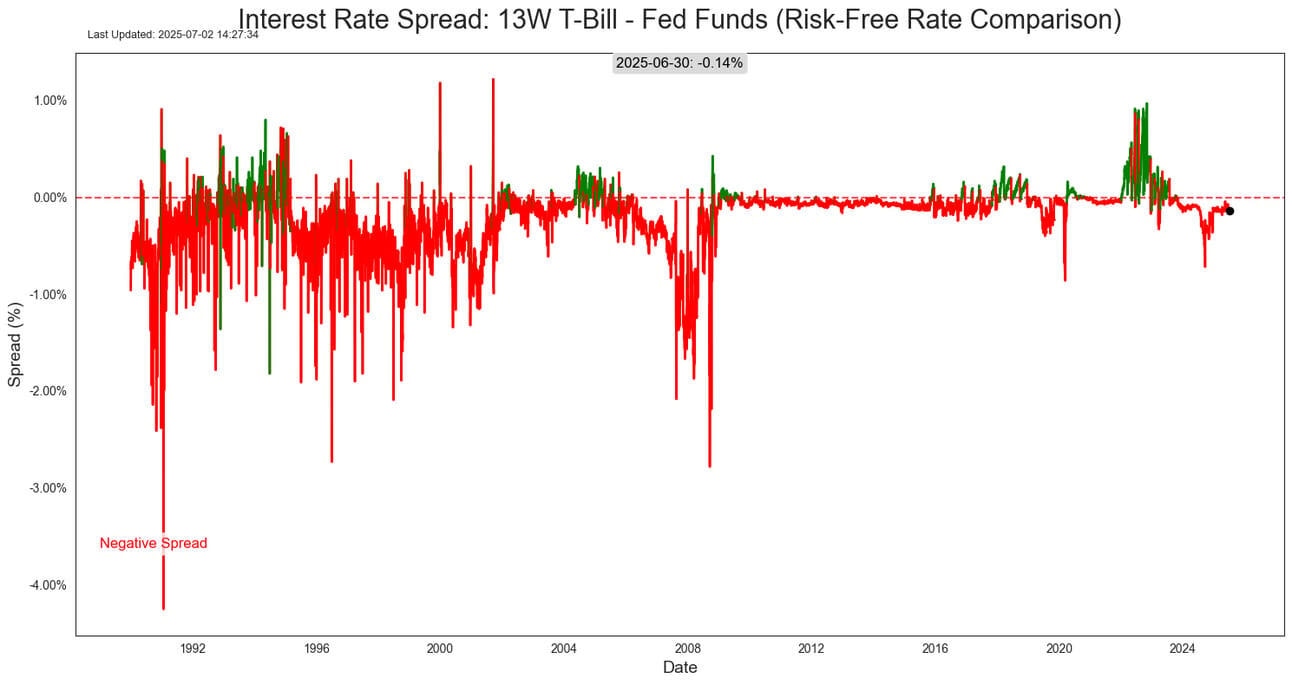

If you look at the very front end it has inverted.

The yield curve that is more reliable for calling recessions is this one with the 2-year on the front end, which is less “controlled” than the front end. I have been trading a yield steepener idea that has been fruitful.

I also felt the further out you go, the juicier the returns will be. I remain confident with this trade based on what I foresee as more reckless behaviour to follow. These charts are updated daily on the research portal.

The next chart looks a little messy; the Fed Fund Rate used to trade with wider margins back in the day. It is the first time I have ever seen this chart. I was inspired because the comments I have been reading are suggesting that the front end is being loaded downwards to force the Fed’s hand. I share this more to show that I don’t see anything untoward here despite the sensational commentary.

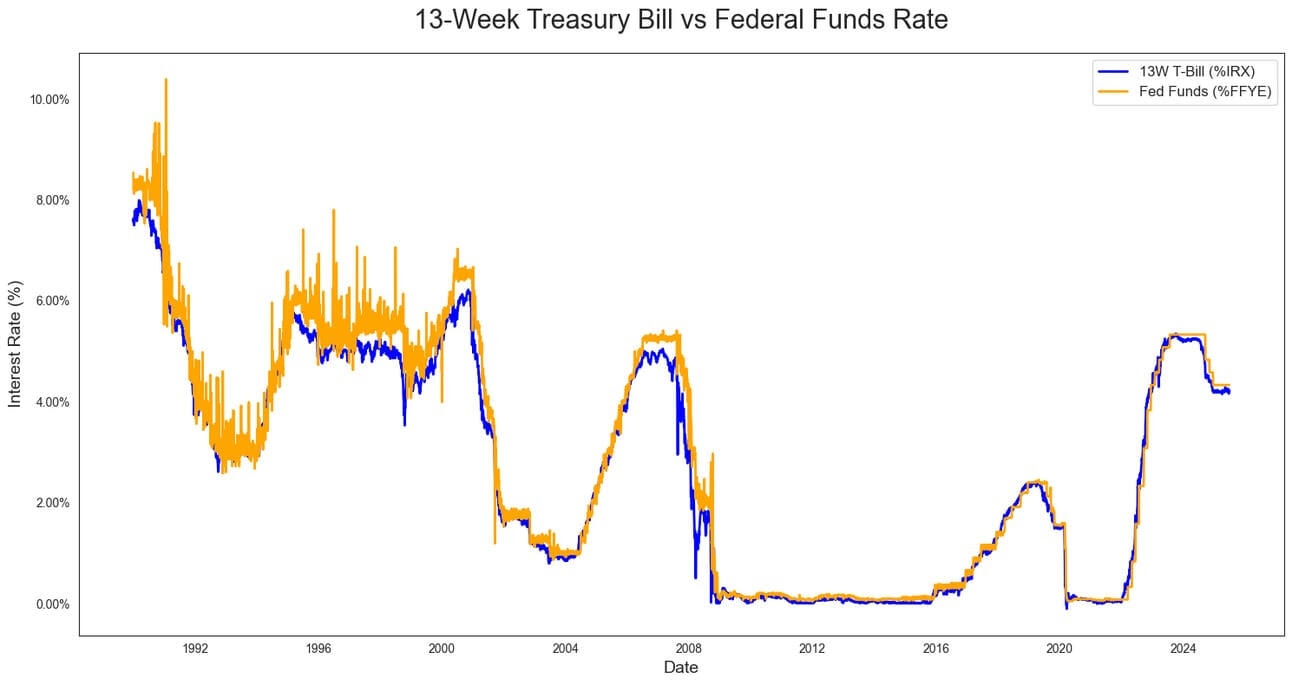

This might be an easier view to see what I am suggesting.

However, I think this Fed Fund futures curve says it all. The market is pricing in quite a few rate cuts. The 800-pound gorilla in the room is the growing debt the government needs to service. It needs interest rates lower and will do anything to achieve it. This will come with inflationary consequences. The yield steepener trade is alive and well, as is the junk bond spread.

S2N observations

Trump vs. Musk round 2 is getting quite exciting.

S2N screener alert

The EURUSD is on a 9-day up streak, the 2nd longest in its history.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.