Yen steadies as inflation rises

The Japanese yen has stabilized on Tuesday and is trading at 141.58, down 0.37%. USD/JPY rocketed higher on Monday, gaining 1.2%.

BoJ core CPI jumps to 2.7%

With inflation continuing to gain traction in Japan, there shouldn’t have been much surprise that BoJ Core CPI accelerated in October for a ninth successive month. Still, the 2.7% gain was much stronger than the prior reading of 2.0% and the consensus of 2.2%. The reading comes on the heels of National Core CPI, which rose to 3.6%, up from 3.0%.

The Bank of Japan is unlikely to change its ultra-loose policy, even with inflation rising and a weak yen contributing to higher costs for households and businesses. The yen is well below the highs we saw in late October, when USD/JPY breached the 150 level and triggered a currency intervention. I am doubtful that such unilateral moves can have a lasting effect, but it is a tool that the government likes to resort to in order to dissuade speculators from pushing the yen lower.

What may lead to a change in BoJ policy is the changing of the guard at the central bank. Governor Kuroda is scheduled to step down in April, after a 10-year stint as head of the bank. There have been calls to re-examine the bank’s policy, which has been in place for years. Sayuri Shirai, a former BOJ board member and candidate for a deputy BOJ governor, does not favor sharp rate hikes but has urged the bank to review its stimulus policy, show some flexibility and simplify its communication with the markets. This kind of thinking will be a breath of fresh air at the BoJ, whose policy meetings are usually drab affairs that are ignored by the markets, as the BoJ simply reiterates its policy and expresses concern about the decline in the yen.

The most recent US inflation report was softer than expected, sending equity markets flying and the US dollar sliding lower. The Fed has responded with a steady stream of hawkish statements from Fed members, which has succeeded in dampening risk appetite and stabilizing the dollar. Fed member Mary Daly weighed in on Monday, stating that inflation remained unacceptably high and projecting that the fed funds rate will peak at 4.75%-5.00%

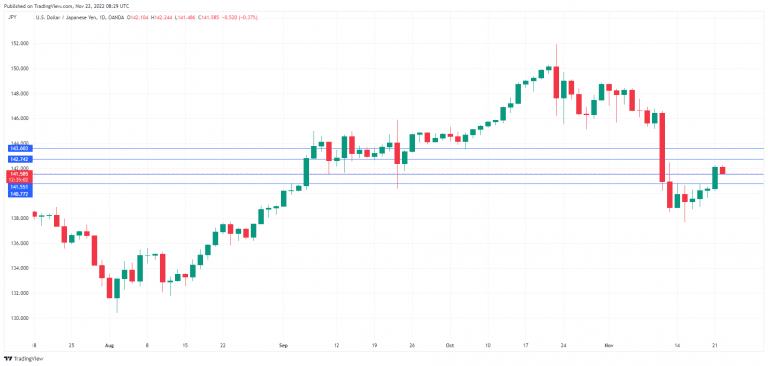

USD/JPY technical

-

USD/JPY is testing support at 141.55. Below, there is support at 140.77.

-

There is resistance at 142.74 and 143.60.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.