Yen rebounds amid key global data and central bank moves

After a sharp decline on Wednesday, the Japanese Yen (JPY) staged an impressive rebound early Thursday. This reversal comes amid growing anticipation for key economic data releases and central bank commentary, which are set to shape market sentiment in the coming days. As the global economy continues to navigate inflation concerns and fluctuating growth, opportunities for traders are emerging on multiple fronts.

Yen recovers as markets brace for PMI data

The Yen’s recovery was largely driven by bargain hunters, following a steep sell-off that left the currency battered against its major counterparts. Traders will be watching the release of Tokyo inflation data closely later today, as it could significantly impact the timing of the Bank of Japan’s next move.

But USD/JPY traders have more to keep their eyes on than just the Yen’s price action. Later today, S&P Global will release the preliminary Purchasing Managers' Index (PMI) data for October, which will provide a snapshot of economic activity across several key regions, including Germany, the Eurozone, the UK, and the US.

These PMI readings will be closely scrutinized by traders, as they offer insight into the health of manufacturing and services sectors—two areas heavily impacted by inflation, supply chain disruptions, and changing demand patterns. Weak or strong results could significantly impact the Euro (EUR), British Pound (GBP), and US Dollar (USD), setting the stage for volatility in major currency pairs.

Eyes on US data: Jobless claims and new home sales

Beyond PMI data, the US economic calendar is also in focus, with weekly Initial Jobless Claims and September’s New Home Sales figures scheduled for release. These reports will give traders a clearer picture of the US labour market and housing sector, both of which play crucial roles in determining the Federal Reserve's next policy moves.

The labour market remains a key area of concern for the Fed, as strong employment could support higher inflation, while a cooling job market might ease inflationary pressures. Meanwhile, the housing market, which has been hit hard by rising mortgage rates, will be another critical factor to watch. Any surprise uptick in housing activity could shift expectations for future Fed rate cuts, which in turn would affect USD-based currency pairs and US equity markets.

BoJ and BoC: Central bank moves in the spotlight

Central bank policies continue to drive market sentiment, with the Bank of Japan (BoJ) and Bank of Canada (BoC) in the headlines. BoJ Governor Kazuo Ueda commented on Japan’s struggle to reach its 2% inflation target in a sustainable manner. He admitted that the timing and size of future rate hikes are still uncertain, adding an element of unpredictability to the JPY’s trajectory. At the same time, Finance Minister Katsunobu Kato emphasized the importance of stable currency movements, although he refrained from signaling any imminent intervention in the foreign exchange markets.

Meanwhile, the Bank of Canada made a decisive move by cutting its policy rate by 50 basis points to 3.75% following its October meeting. BoC Governor Tiff Macklem stated that shelter price inflation has started to ease, boosting confidence that overall inflation will continue to moderate. In response, the USD/CAD pair surged to its highest level since August, although it pulled back slightly in early Thursday trading.

Traders bracing for key data releases

For traders, these events provide a rich tapestry of potential opportunities. The Yen's rebound could be a precursor to further volatility if PMI data from major economies show unexpected strength or weakness. Any surprises in the US Jobless Claims or New Home Sales reports could cause significant movement in USD pairs, especially with the Fed’s policy still data-dependent. Meanwhile, Tokyo inflation data could play a key role in shaping the timing of the Bank of Japan's next move. And central bank comments, especially from the BoJ and BoC, are setting the stage for shifts in JPY and CAD positions, respectively.

With market sentiment delicately balanced between inflation concerns and growth prospects, traders should prepare for sudden shifts in momentum. Keeping an eye on key technical levels, particularly in currency pairs like USD/JPY and USD/CAD, will be critical as we move into the next trading sessions. Additionally, equity market stability and bond yields will play their part in influencing currency movements, creating further opportunities for traders to capitalize on.

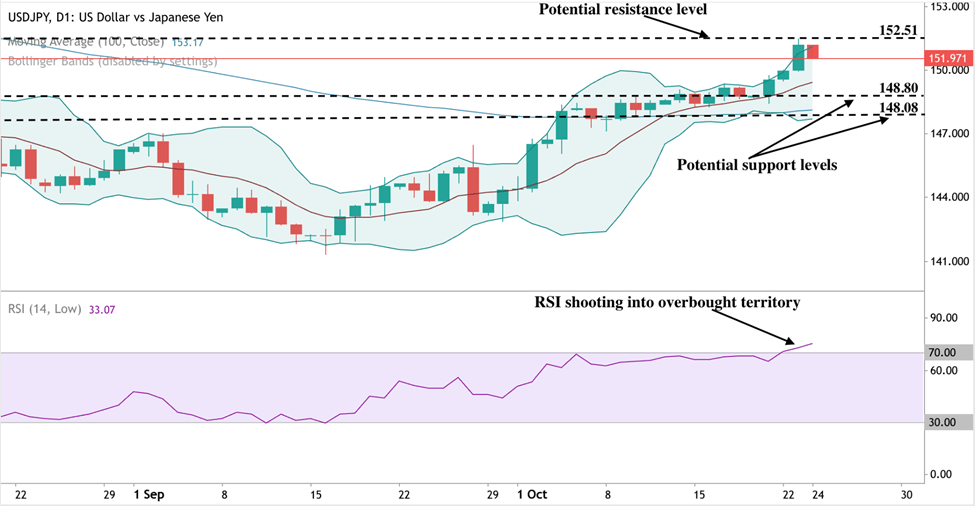

At the time of writing the USD/JPY pair is hovering around the $152 mark, with upward pressure still evident despite the latest push down. However, prices touching the upper Bollinger band as RSI shoots past 70, hints at overbought conditions. Buyers could struggle to breach the $152.51 mark while on the downside, sellers could be held at the $148.80 support level with a further move down likely to hold at the 100-day moving average.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.