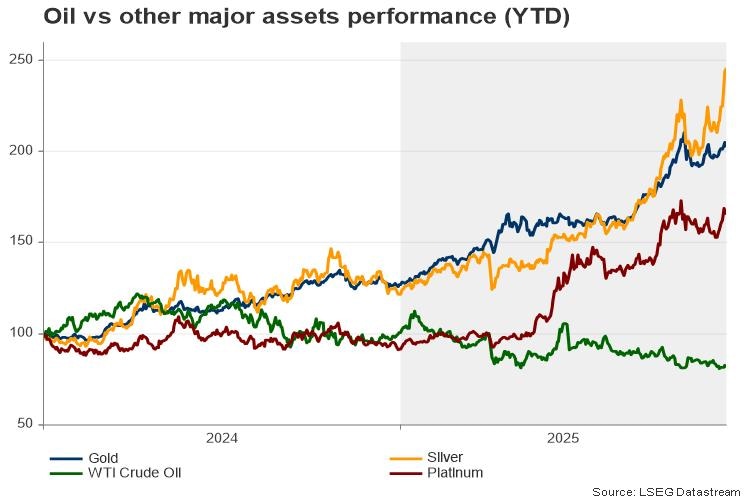

Year ahead 2026 – Oil’s bearish horizon and the white Metal boom

- Oil struggles in 2025 with oversupply and weak demand.

- OPEC+ to review capacity in 2026, aiming for credible quotas.

- 2026 oil outlook: surplus; WTI could drop to $50 unless cuts or geopolitics intervene.

- Silver soars over 112% in 2025; expected to hold near $60 with upside risk.

- Platinum jumps 84% above $1,700; could reach $1,900–$2,000 in 2026.

2025: A year of contrasts

2025 was a year of sharp contrasts across major commodities. Oil markets struggled under the weight of oversupply and weak demand, while silver and platinum surged to multi-year highs, outpacing gold thanks to structural deficits and industrial demand. As 2026 begins, oil faces bearish fundamentals with potential geopolitical upside, whereas silver and platinum remain supported by tight supply and strong industrial trends, albeit with heightened volatility.

2025 recap: Oversupply, OPEC+ output hikes and geopolitical shocks

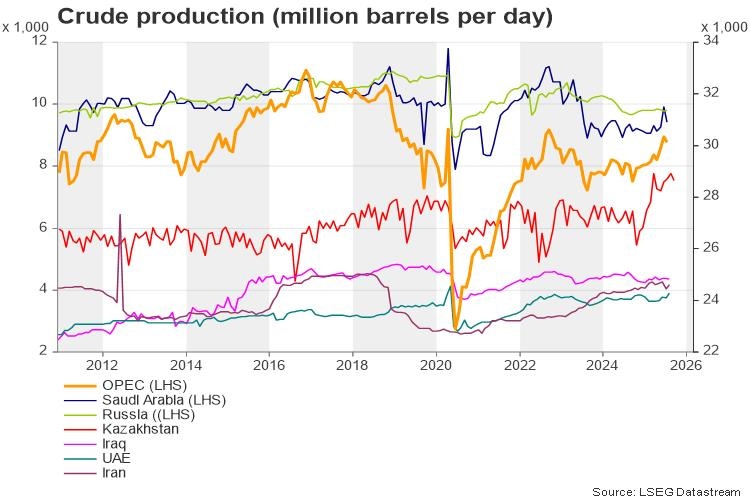

The year 2025 was marked by significant shifts in oil fundamentals. OPEC+ began unwinding approximately 2.9 million barrels per day of production cuts between April and November, aiming to regain market share and counter the rise of US shale output. This decision was influenced by political pressure from Washington and internal dynamics within the group. However, compliance issues by Iraq and Nigeria diluted the intended impact.

On the demand side, growth underperformed expectations. The International Energy Agency (IEA) projected an increase of only 0.7 million barrels per day, far below OPEC’s forecast of 1.3 million, as global economic activity slowed amid trade tensions and tariff disruptions. Prices fell to four-year lows in the second quarter before stabilizing mid-year, supported by geopolitical events such as limited Iran-Israel skirmishes, US sanctions on Russian energy firms, and China’s strategic stockpiling.

Recent developments: Late November to early December

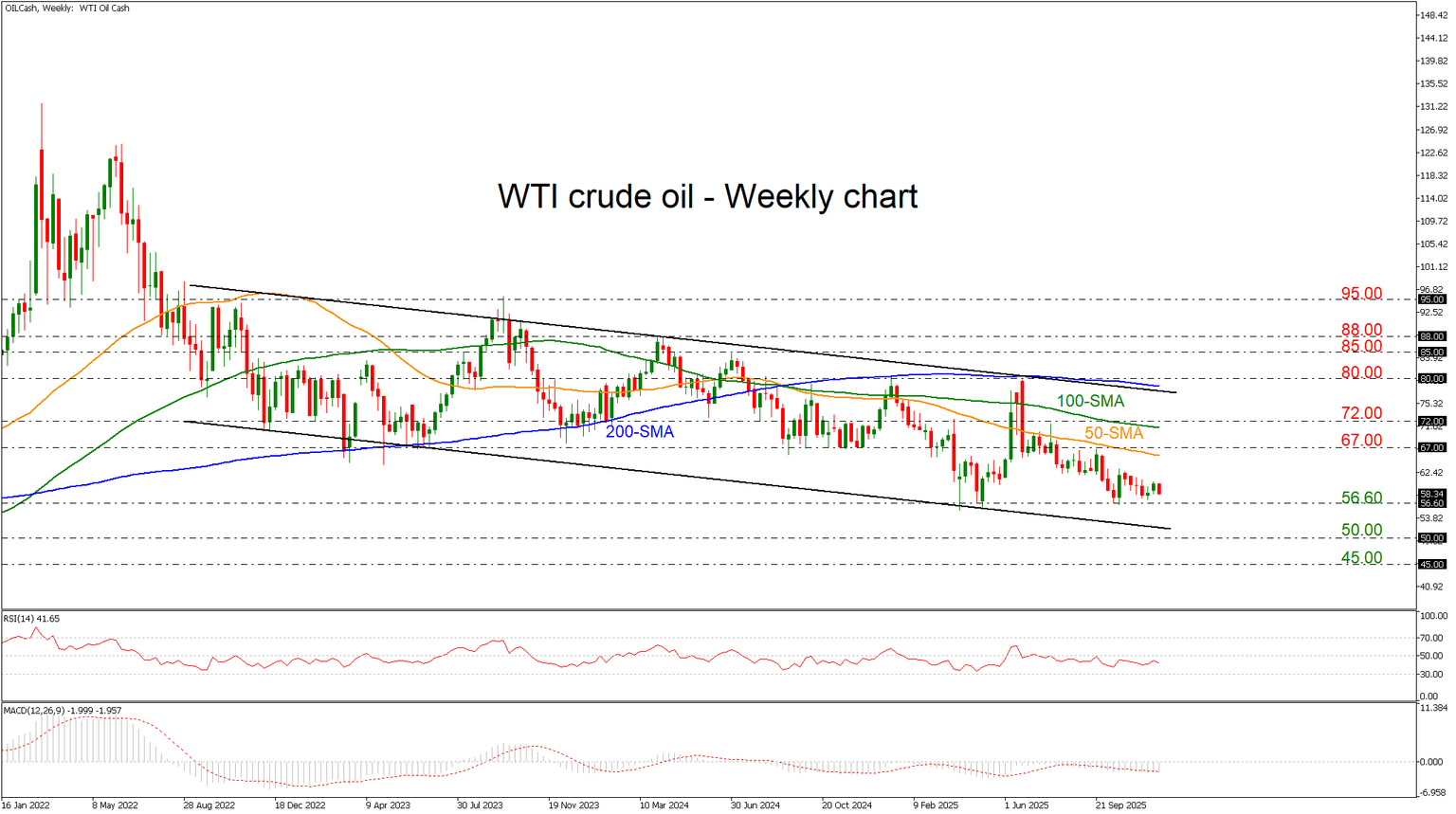

In the last weeks of November, prices remained under pressure, with WTI futures trading around $58.6 with key support levels at $56–57. A break below these levels could trigger a deeper decline. OPEC+ confirmed in late November that it would maintain current output targets for 2026, pausing further hikes but signaling readiness to cut. This stance reflects the group’s cautious approach amid fragile market conditions. At the same time, oil prices briefly rose on news that Russia-Ukraine peace talks were unlikely to result in the immediate removal of sanctions on Russian crude, although gains were capped by persistent concerns about oversupply.

OPEC+ capacity review and structural changes

Looking ahead, OPEC+ members will undergo an annual assessment of their production capacity starting in 2026, with results to be applied in 2027. This initiative, agreed upon in late November, aims to align output quotas more closely with each country’s actual capacity, addressing a long-standing issue that has undermined the credibility of OPEC+ quota agreements.

The move is expected to strengthen investor confidence in future production deals. The review comes amid diverging capacity trends, countries like the United Arab Emirates have expanded their production capabilities and seek higher targets, while several African members have experienced declines. For some nations, accepting lower quotas based on theoretical capacity remains politically and economically challenging. Angola’s exit from OPEC in 2024 over quota disputes underscores the sensitivity of this issue.

2026 Outlook: Risks and opportunities

The outlook for 2026 leans bearish. The IEA projects a surplus of more than 4 million barrels per day. Non-OPEC supply growth, particularly from the US, Brazil, Canada, and Guyana, will continue to weigh on prices, even if US shale output slows. Demand growth is expected to remain tepid, constrained by a sluggish global economy and a strong dollar, which makes dollar-priced commodities less attractive.

If technical support levels fail, WTI could slide toward $50 or even $45. However, upside risks remain. Geopolitical disruptions, such as renewed sanctions on Russia or instability in the Middle East, could tighten supply unexpectedly. OPEC+ may also reverse its production strategy and implement deep cuts if prices fall sharply. Unplanned supply outages or faster-than-expected declines in US shale output could provide a floor for prices. Additionally, a surprise rebound in demand from China, India, or Latin America could shift the balance toward stability.

Market reaction and technical signals

Throughout 2025, WTI crude oil traded mostly between $56 and $71 per barrel, briefly dipping towards $55 before recovering. The IEA warned of a bloated market heading into 2026, projecting a surplus of more than 3 million barrels per day, while the US Energy Information Administration (EIA) anticipated modest demand growth and slower non-OPEC supply expansion. If the commodity dives below the $55 key level and breaks the three-year downward sloping channel, the likelihood of further declines increases, potentially touching $50 during 2026. Conversely, a climb above the 200-week simple moving average (SMA) at $79 and the $80 handle may signal an upside retracement.

Silver’s exceptional rally and 2026 prospects

Silver was the standout performer in 2025, surging more than 110% to highs around $62 per ounce, its strongest rally in over a decade. This spike was fueled by structural supply deficits, booming industrial demand from solar and EV sectors, and thin inventories that pushed physical markets into backwardation. ETF inflows and expectations of Fed rate cuts amplified the move, making silver a high-beta alternative to gold, which rose more modestly.

For 2026, silver is expected to remain supported by persistent deficits and industrial consumption. More advances could drive silver toward the immediate $65 level and the $69 barrier, which is the 261.8% Fibonacci extension level of the latest down leg in October.

Platinum’s strong surge and future dynamics

Platinum also outperformed gold in 2025, rallying 84% to levels above $1,700 per ounce, driven by severe supply shortages and robust industrial demand. Automotive manufacturers increased platinum use in hybrid vehicles, Chinese jewelry demand rebounded in early 2025, and ETF inflows tightened physical availability. South African mining disruptions and limited recycling compounded the deficit, while speculative positioning added momentum.

In 2026, the World Platinum Investment Council anticipates only a marginal surplus as recycling ramps up, but backwardation and high lease rates suggest ongoing tightness. Forecasts point to potential highs near $1,900-$2,000 if trade frictions persist.

Conclusion

Commodities enter 2026 with divergent narratives. Oil faces structural oversupply and fragile demand, tempered by geopolitical uncertainty and OPEC+ intervention. Silver and platinum, by contrast, remain buoyed by industrial demand and supply deficits, though their sharp 2025 rallies introduce volatility risks. Investors should monitor macroeconomic signals, industry trends, dollar strength and cross-market dynamics to navigate this complex landscape.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.