Year ahead 2026 – Euro poised to outperform the Pound but surprises loom

- After an impressive year, a 2026 euro rally hinges on fresh bullish catalysts.

- Stronger growth, a balanced ECB and de-dollarization support euro upside.

- Fiscal drag and political uncertainty cloud the pound’s outlook.

- Euro strength versus the pound is priced in, yet unexpected twists could become the norm.

Euro's tremendous 2025 rally – Can it repeat in 2026?

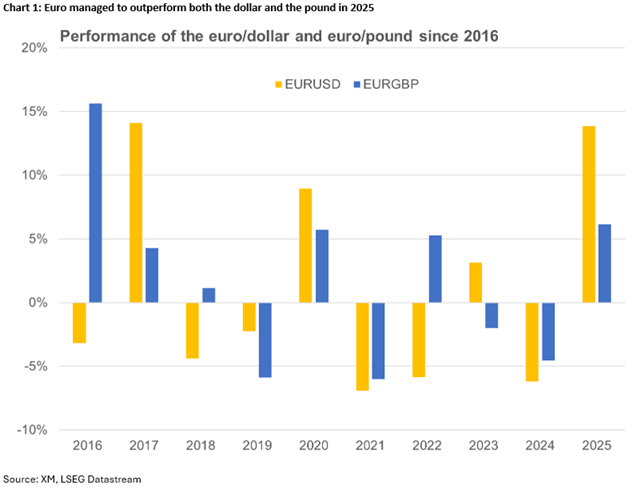

After a disastrous 2024, this year proved to be a memorable year for the euro. It managed to record its strongest rally against the US dollar and the pound since 2017 and 2016, respectively. Despite the ECB delivering a plethora of rate cuts during 2025, its determination to sufficiently boost the local economy without delay, along with external factors – particularly US President Trump’s tariff strategy – proved extremely beneficial for the euro.

Next year might prove more challenging for the euro area currency, though, as further sustained gains hinge on fresh bullish catalysts. A material eurozone growth pickup – Germany is seen growing by 0.8%-1.3% in 2026 – persistent de-dollarization, a solution to the Ukraine-Russia conflict that satisfies European leaders – with the former also preparing for European Union membership soon – and a quieter trade environment could keep the euro in demand, maintaining its 2025 trend.

ECB to remain on hold but ready to ease if needed

Notably, the ECB is expected to mostly remain on the sidelines in 2026, as President Lagarde et al. are increasingly content with both the inflation and growth outlooks. That said, despite the market pricing in a decent chance of a 25bps rate hike during 2026, the bar for such a move is much higher than currently foreseen, particularly when the Fed would be still easing policy. The opposite is not true, as, under Lagarde’s leadership, the ECB has proven its readiness to act in response to slowing inflation. Interestingly, headline inflation is projected in the 1.9-2.2% region for 2026, keeping the door partially open to further easing, if needed.

Such a policy shift could become necessary if there is a turn for the worst in the eurozone. Renewed political crises (a new parliamentary election might take place in France to solve the current deadlock, while the German government’s cohesion could be tested in various state elections starting in March 2026), worsening Eurozone-Russia relations, and a potentially disappointing impact from the much-discussed fiscal spending – particularly if Germany’s growth projections are not met – could materially alter the ECB’s stance during 2026.

Additionally, the Fed’s latest announcement about reserve management purchases – adding liquidity to the Fed system via purchases of Treasury bills – could also address the increased funding costs for Europeans. Historically, an aggressive drop in three-month cross currency swaps leads to euro/dollar decline, a tendency that continued in 2025 as well.

Markets favour further Euro gains in 2026

All in all, the market appears to favour euro upside against both the dollar and the pound in 2026, with futures pointing to a potential retest of the recent highs of 1.1919 and 0.8900 respectively, mostly due to the expected continued divergence in their respective monetary policy stances. However, a plethora of unknowns could turn the tide against the euro, particularly in the second half of 2026.

Can the Pound bounce back amidst a challenging outlook?

Contrary to the euro, it has been a year to forget for the pound after a strong 2024. Despite the UK reaching a trade deal with the US administration relatively quickly – thus mostly avoiding tariff-related shenanigans – and the BoE not being the most dovish member of the G10 bloc, weak economic momentum contributed to a poor performance by the pound, particularly against both the euro and the Swiss franc. It managed to outperform only the US dollar and the yen, but that is not surprising as both currencies have had an abysmal year.

Fiscal issues and politics could further weigh on the Pound

Current indications for 2026 are not optimistic. The recently announced tax-heavy budget, on top of the record amount of tax increases announced in 2024, and the heightened possibility of further measures in the Spring 2026 budget, may continue to choke growth, potentially resulting in further gilt borrowing, which investors absolutely disapprove. At the same time though, inflation is projected by the Bank of England and most independent institutions to decelerate below 3% in the second half of 2026.

Any likely fiscal issues could put the current Labour government under renewed stress, but the decisive blow could come at the May 2026 local elections. A weak result would confirm the dramatic drop seen in rating polls for Labour, angering left-wing MPs. While PM Starmer managed to quickly fend off the alleged munity ahead of the Autumn Budget in November, he is clearly more vulnerable than perceived, opening the door to serious political crises ahead.

Externally, despite the relative calm in UK-US trade relations – occasionally interrupted by the US administration, as seen in the case of the “Tech Prosperity Deal” – the UK’s economy could be significantly tested if there are renewed trade tensions, and if both Germany and France continue to struggle with low growth. In this scenario, current inflation forecasts could quickly become obsolete.

Such a turn of events might force the BoE to come to the rescue once again. The market is currently pricing in just 35bps of additional easing in 2026, but there is a solid chance of this increasing significantly, potentially making the BoE the last major central bank to complete its easing cycle.

Markets see continued Pound weakness in 2026

The expected monetary policy divergence between the ECB and the BoE could further damage the pound’s battered profile, maintaining the current long-term uptrend in euro/pound, particularly in the first half of 2026, and even surpassing the current six-month forward rate of 0.8846.

But not everything is bleak for 2026. A stronger US economy, a calmer trade environment, and a potential peace deal between Ukraine and Russia could result in a stronger UK economy without considerably pushing inflation higher, especially if followed by a drop in energy prices. This could allow the BoE to be less aggressive, potentially taking advantage of any eurozone troubles down the line and defying current market pricing for a gradual but persistent pound weakness through 2026.

Author

Achilleas joined XM as an Investment Analyst in November 2022. He holds a BSc in Business Economics from Middlesex University and a MSc in Mathematical Trading and Finance from Bayes Business School, City University.