XAU/USD outlook: Gold is consolidating after 2.2% fall; NFP in focus for fresh signals

GOLD

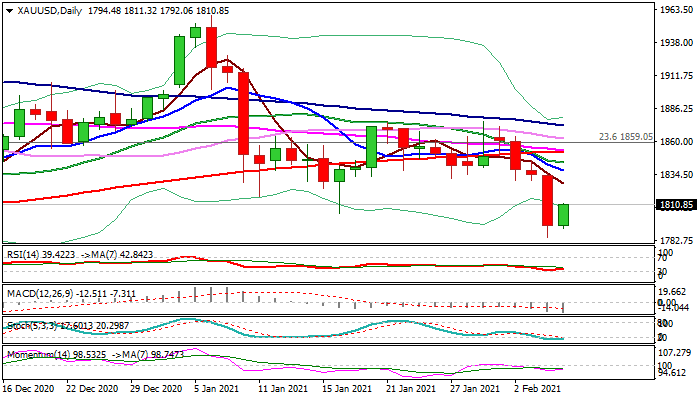

Spot gold is consolidating above new two-month low ($1785) posted on Thursday after 2.2% daily drop (the biggest one-day loss since Jan 8) which broke and closed below psychological $1800 level.

The yellow metal came under increased pressure from stronger dollar and brighter economic outlook on improving macroeconomic data and falling number of Covid-19 infections that undermined demand.

The metal is used as an inflation hedge and should remain under pressure until the economic recovery picks up and pushes inflation higher in late second and third quarter 2021, according to the expectations.

Gold is on track for strong weekly drop (the biggest since the week of 22/27 Nov) and pressures key short-term supports at $1764/60 (Nov 30 low/weekly cloud base), break of which would generate strong signal for continuation of the downtrend from all-time high at $2074.

Bearish daily studies are supportive but oversold conditions suggest that bears may consolidate before resuming, with extended upticks below daily Tenkan-sen ($1830), which guards upper pivots at $1843/52 (20/200DMA’s), to offer better opportunities to re-join bearish market.

US labor data are key event today, with strong numbers to further boost dollar and pressure gold’s price, but disappointing figures may deflate current optimism and increase safe-haven demand.

Res: 1817; 1830; 1837; 1843.

Sup: 1800; 1792; 1784; 1775.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.