XAU/USD outlook: Extended range trading ahead of Fed policy decision

XAU/USD

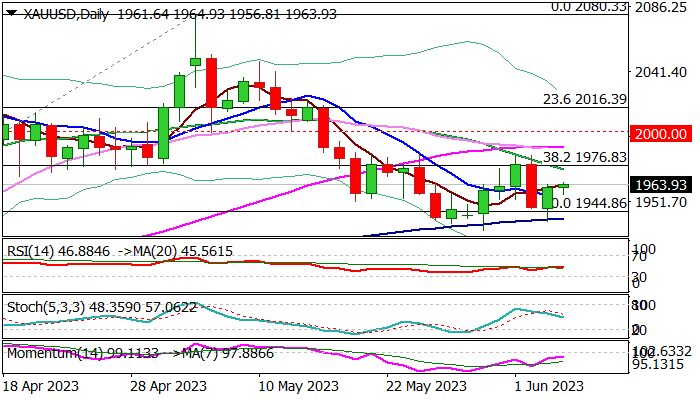

Gold is trading within a narrow range in European session on Tuesday but holding slight bid after Monday’s bounce which recovered around 50% of Friday’s post NFP 1.5% fall.

Technical studies are mixed on daily chart, as the metal’s price is holding in a larger range $1932/$1983) after sing 100DMA contained several attack and kept the downside well protected, while upside attempts were repeatedly rejected on failure at falling 20DMA.

Range trading is likely to extend as traders look for fresh direction signals, particularly focusing on Fed’s policy outlook, as policymakers meet next week.

Meanwhile, US economic data would continue to fuel gold movements, with focus on inflation report, which is expected to contribute the most to Fed’s decision and will be released just a day ahead of central bank’s verdict.

Pivotal resistances lay at $1976/83 (broken Fibo 38.2% / June 1,2 double-top /range ceiling,), followed by daily cloud top ($1993).

Lower triggers lay at $1932/26 (range floor / daily cloud base) with break at either side to generate strong direction signal.

Res: 1976; 1983; 1993; 2000.

Sup: 1957; 1938; 1932; 1926.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.