XAU/USD outlook: Bulls may pause before final push towards new record high, US jobs data in focus

XAU/USD

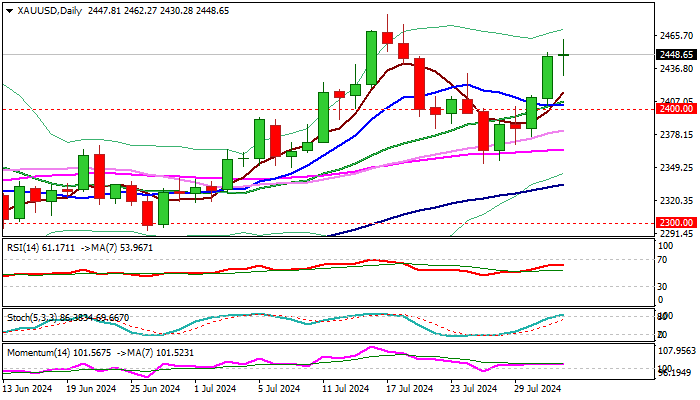

Gold price edged higher on Thursday and hit two-week high ($2462), but with warning that the latest upleg from $2353 may stall, as daily action was so far shaped in long-legged Doji.

Overbought conditions on daily chart suggest that bulls may take a breather on approach to new record high ($2483), with consolidation / limited correction to stay above $2410/00 zone to keep near term bias with bulls.

The metal appreciated from dovish Fed, on fresh signals about rate cut in September, with key geopolitical factor being supportive for safe haven bullion, particularly on wider political instability and growing threats of escalation of the conflict in the Middle East.

Markets focus now shifts to Friday’s US labor report for July, which may obstruct Fed’s latest signals for rate cut in September, if job growth significantly exceeds expectations.

Res: 2462; 2474; 2483; 2500.

Sup: 2430; 2410; 2400; 2376.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.