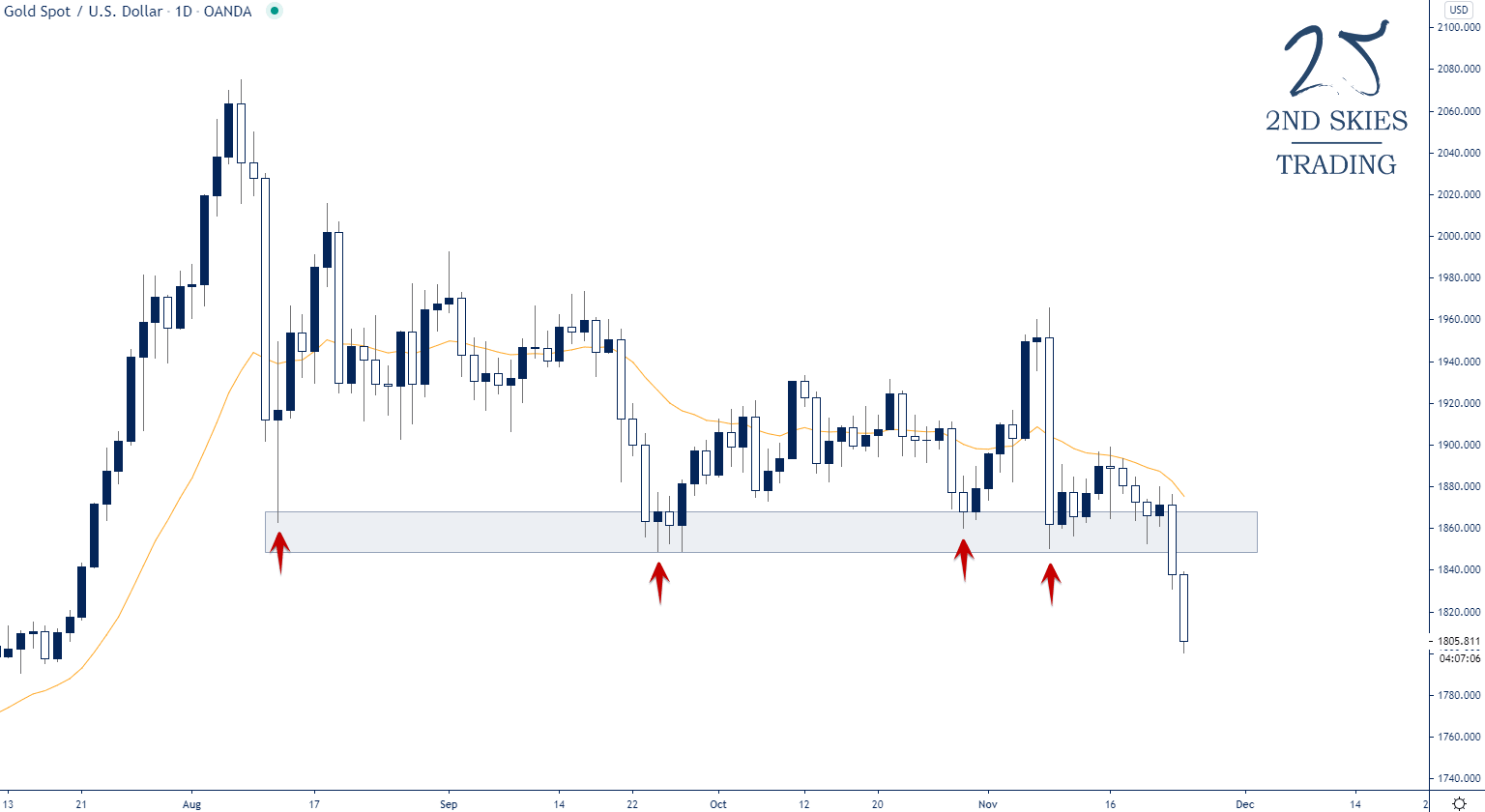

XAU/USD: Broken below key support

Price Action Context

Following the all-time high in August, the price of the precious metal has been consolidating, pulling back $270 in the process. Inside of this pullback/range price has been printing both lower highs and false breaks to the upside suggesting continued bearish pressure. On the 23rd a strong bearish impulsive move cleared the key support around $1850.

Trending Analysis

Short-term bias is bearish and weak pullbacks into the broken support, which now should act as resistance can offer potential short-term selling opportunities whilst long-term bulls can look for potential trading opportunities around the next area of support.

Closest Support & Resistance Zones

Resistance: 1850 - 1870

Support: 1730 - 1765

Visit our website at 2ndSkies for more price action content, free trading lessons, strategies and videos. Find out how we can help you to change the way you think, trade and perform.

Visit our website at 2ndSkies for more price action content, free trading lessons, strategies and videos. Find out how we can help you to change the way you think, trade and perform.

Author

Chris Capre

2ndskiesforex

Chris Capre is a professional forex trader and mentor specialized in Price Action trading, and the Ichimoku Cloud.