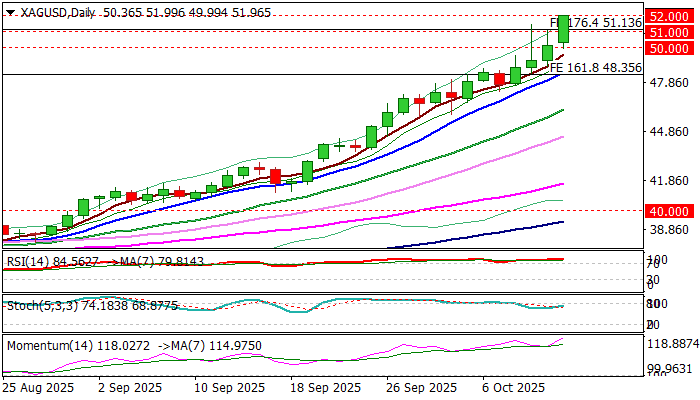

XAG/USD outlook: Silver at new record high

Silver price hit new record high on Monday, after the price action accelerated in past couple of days and larger uptrend steepened in past couple of sessions.

Violation of psychological $50 barrier, for the first time in decades, generated bullish signal, with price action receiving fresh boost from President Trump’s latest threats of imposing 100% tariffs on all goods imported from China.

Silver continues to track gold in strong demand for safe-haven assets and is additionally boosted by growing worries about supply shortage as demand rises much faster than expected and inventories continue to fall (London silver stock declined by 33% since 2021), pointing to tightening conditions in the market.

Bulls cracked $52 barrier in less than 24 hours after break of $51 barrier, marking the shortest rally from one to another round-figure level ($51.00 to $52.00) in history.

Stretched daily studies warn of corrective action ahead, although, all indicators continue to head north and none shows any signal of fatigue so far.

In the situation of extremely favorable fundamentals, corrective moves are likely to be very limited and mark positioning for fresh push higher.

The notion is supported by the latest completion of multi-decade cup and holder pattern, following final break of $50 barrier, where silver price peaked in 1980 and 2011 (cup) and attacked again after correction in 2025 (holder).

This adds to signals of further advance, as silver price is riding on extended third wave (monthly chart) of the five-wave cycle from $11.23 (March 2020 low) and eyes its Fibonacci 200% expansion level at $55.62).

Broken FE 176.4% ($51.13) marks initial support ahead of broken $51.00 and $50.00 (also today’s low) which should contain potential dips and keep larger bulls intact.

Res: 52.25; 52.94; 53.50; 54.00

Sup: 51.52; 51.13; 51.00; 50.00

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.