XAG/USD outlook: Sharp pullback may extend as near-term sentiment is negative

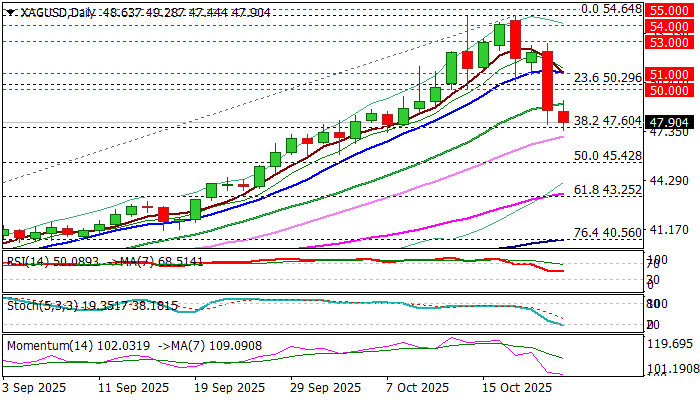

Silver stabilized after finding temporary footsteps at important Fibo support at $47.60 (38.2% retracement of $36.20/$54.64 rally).

Fresh bears take a breather after massive loss on Tuesday, when the metal’s price fell 7%, in the biggest daily drop since 11 Aug 2020.

Pullback from new record high ($54.64) started on Friday and accelerated on Tuesday, as traders opted for more aggressive profit-taking, dragged by strong pullback of gold price and stronger dollar.

Change in key fundamental factors, such as lower demand from India and restored supply, that would help renewing stocks, recently used due to supply shortage, eased upside pressure and shifted near term sentiment into opposite direction for now.

Strong acceleration on Tuesday broke the most significant support at $50 zone (psychological / former record highs of 1980 and 2011) signaled deeper correction.

Although the latest pullback was significant and weakened near term structure, larger picture still shows strong uptrend in play, with current action to be described as a healthy correction which would provide better levels to re-enter broader bullish market.

The Fibo support at $47.60 is reinforced by daily Kijun-sen and should ideally contain dips, but consolidation attempts were so far fragile and signal that the downside remains vulnerable.

Violation of $47.60 to unmask $45.42 (50% retracement of $36.20/$54.64) and rising 55DMA ($43.44) above which extended dips should find firm ground.

Broken 20DMA marks initial resistance ($49.14), with near-term action expected to remain biased lower while broken $50 pivot (now acting as solid resistance) caps upticks.

Res: 49.14; 50.00; 50.30; 51.00

Sup: 47.01; 45.90; 45.42; 43.65

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.