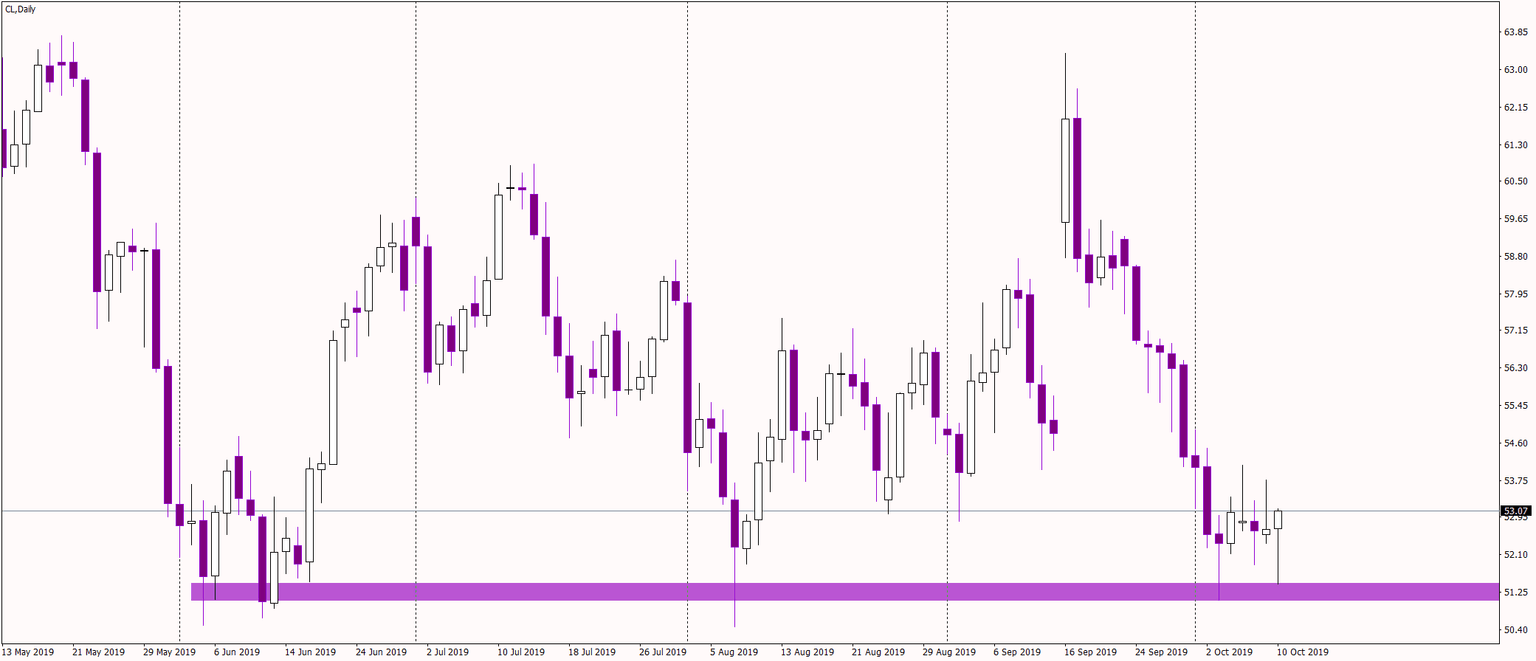

WTI Oil bounces from the key support!

Just a quick update for all the traders watching Oil. Today can be a crucial day for potential buyers. There is a chance that their prays were finally listened. As you can see on the daily chart, Crude is now drawing a hammer candlestick pattern. Hammer is a strong bullish reversal formation, in this case, promoting a start of a new up wave.

Current hammer on Oil has a very important meaning. The long tail, shows us another test of the 51.3 USD/bbl. support (pink). That was the second test in October. Price was trying to get lower since June without a success. This indicates, that this area is a real stronghold for the demand and that they will protect it at all costs. Long tail in today’s hammer is indicating a rejection of lower prices and willingness to go up. What is significant here is that this hammer is being build after two shooting stars. Apparently, sellers are very weak at the moment and their inability to use shooting stars in their favor shows that.

Do not get too optimistic though. The day has not ended yet. Signal from a daily candle is active only, when the day is over. Still a lot can happen till midnight but in case the hammer will hold, we will get a very promising bullish signal.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.