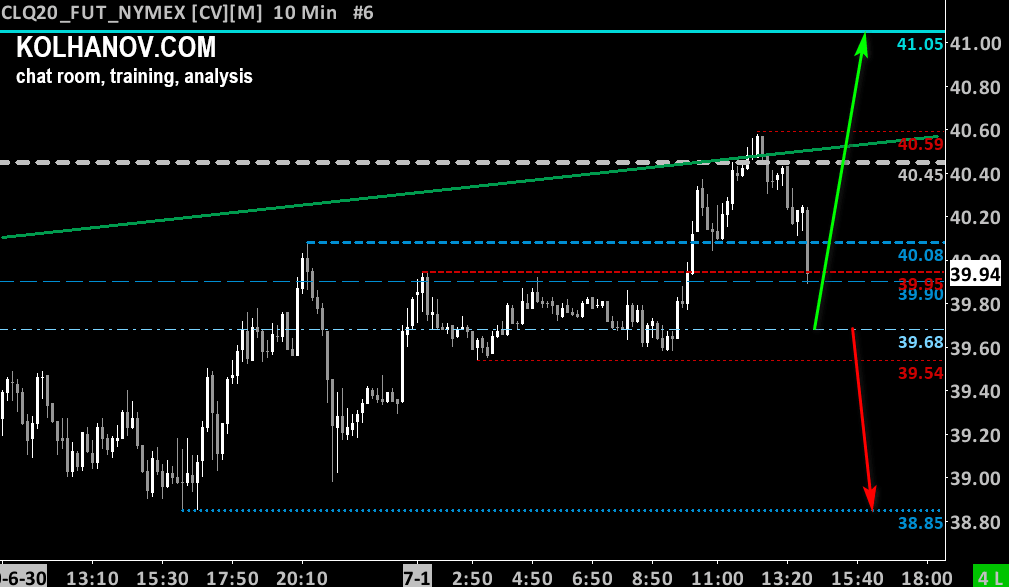

WTI crude oil: Uptrend will continue if it trades above 39.68

WTI Crude oil (CL), Futures market

Wednesday forecast, July 1

Uptrend

The uptrend may be expected to continue, while pair is trading above support level 39.68, which will be followed by reaching resistance level 40.60 - 41.05.

Downtrend

An downtrend will start as soon, as the pair drops below support level 39.68, which will be followed by moving down to support level 38.85.

Weekly forecast, June 29 - July 3

Uptrend

An uptrend will start as soon, as the pair rises above resistance level 39.35, which will be followed by moving up to resistance level 31.05 - 42.30.

Downtrend

The downtrend may be expected to continue, while pair is trading below resistance level 39.35, which will be followed by reaching support level 37.09 and if it keeps on moving down below that level, we may expect the pair to reach support level 34.35.

Monthly forecast, July 2020

Uptrend

An uptrend will start as soon, as the pair rises above resistance level 41.05, which will be followed by moving up to resistance level 50.50.

Downtrend

The downtrend may be expected to continue, while pair is trading below resistance level 41.05, which will be followed by reaching support level 34.35 and if it keeps on moving down below that level, we may expect the pair to reach support level 26.00 - 21.42.

DISCLAIMER: All information provided by Anton Kolhanov is for informational purposes only. Information provided is not meant as investment advice nor is it a recommendation to Buy or Sell securities. Anton Kolhanov is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained. You should do your own thorough research before making any investment decisions and seek advice from an independent financial advisor.

Author

Anton Kolhanov

Anton Kolhanov

Anton Kolhanov is a trader and an analyst. He started to study the Forex market in 2003.