Will the trend of wage acceleration continue?

Summary

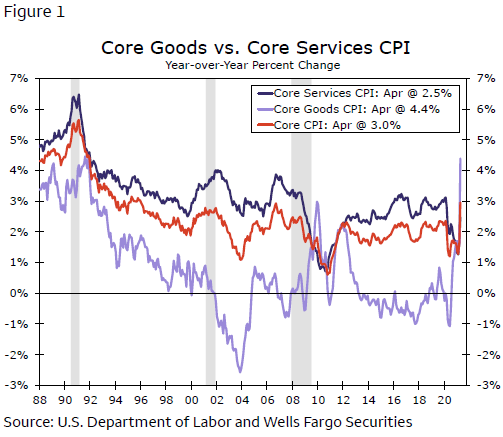

Inflation has picked up materially in recent months, with the core CPI rising 3.0% in April, the highest year-over-year rate in 25 years.

As measured by the Employment Cost Index (ECI), growth in wages and salaries among private-sector workers has also picked up. Further acceleration in wages and salaries, should it occur, could push rates of consumer price inflation even higher and keep the current burst of inflation from subsiding as the FOMC presently expects.

To gauge the extent of wage pressure in coming quarters, we follow other researchers in devising a Labor Market Conditions Index (LMCI) to measure the underlying strength of the labor market. We then use this LMCI to model the growth rate in average hourly earnings (AHE) over the next four quarters.

Our model suggests that there is a 40% probability that growth in AHE exceeds2.9%, which is one standard deviation above the average increase of 2.4% during the the2009-2019 cycle. In a historical context, this estimated probability of "high" wage growth is elevated.

But wage acceleration, should it indeed occur, does not necessarily need to lead to higher rates of consumer price inflation. Upward pressure on consumer price inflation from higher wage growth could be muted by stronger growth in labor productivity.

Financial markets likely will remain on edge in the coming months regarding the potential for stronger wage growth, given its implications for inflation and prots.

But the Federal Reserve, which is trying to engineer an inflation rate that "moderately" exceeds its long-run target of 2% "for some time," likely will take a more relaxed approach to any signs of wage acceleration and its potential to lead to higher inflation, at least for the foreseeable future.

Inflation has risen markedly recently

The rapid rebound of the U.S. economy from its COVID-induced nosedive, in conjunction with substantial financial support and the prospect of two more major packages that have been proposed to congress, has an increasing number of observers worried about the potential of significantly higher inflation in the coming years. In that regard, the "core" rate of CPI inflation shot up to 3.0% in April, the highest year-over-year rate in 25 years (Figure 1). Although some of this jump in the year-over-year rate of inflation reflects low base effects–many prices fell sharply a year ago when the pandemic shut down the economy–there were broad-based price increases on a monthly basis in April that also contributed to the sharp rise in the rate of inflation. Price increases have been especially pronounced for goods over the past year, as consumers have rapidly shifted spending away from services. At 4.4%, the rate of core goods inflation stood at a near 30-year high in April. Prices of core services have not accelerated as much as core goods prices, but they are expected to jump as consumers unleash pent-up demand for services at the epicenter of social distancing, such as travel and live entertainment.

Federal Reserve policymakers have characterized current price pressures as transitory, noting that these pressures reflect strong spending as the economy more fully reopens and bottlenecks across supply chains from meeting this torrent of demand. According to this view, price pressures should eventually cool as supply chains adjust and the initial urry of pent-up demand subsides.

Prices could, however, continue to move markedly higher, especially in the service sector, if wages and salaries also ratchet up. Weakness in the labor market is frequently touted as a reason why the reopening fueled pop in prices is unlikely to last at its current pace. But as shown in Figure 2, wages and salaries among private-sector workers shot up at an annualized rate of 4.6% in Q1-2021. This rate of sequential growth in wages and salaries in Q1, the fastest rate since the series began in 2001, occurred when the unemployment rate generally exceeded 6.0%. What will happen to wage and salaries if, as we expect, the labor market strengthens further in the coming months? With wages and salaries representing the largest cost for most firms, especially service providers, significant acceleration in labor costs, should it occur, could impart more upward pressure on the prices of many services, which account for three-quarters of the core CPI.

Author

Wells Fargo Research Team

Wells Fargo