Will JOLTS and Consumer Confidence numbers push Gold down?

-

Gold traders are awaiting JOLTs and CB Consumer Confidence data release.

-

Consensus indicates moderate decline in numbers.

-

Lower numbers may boost Gold prices while higher numbers will dampen Gold sentiments.

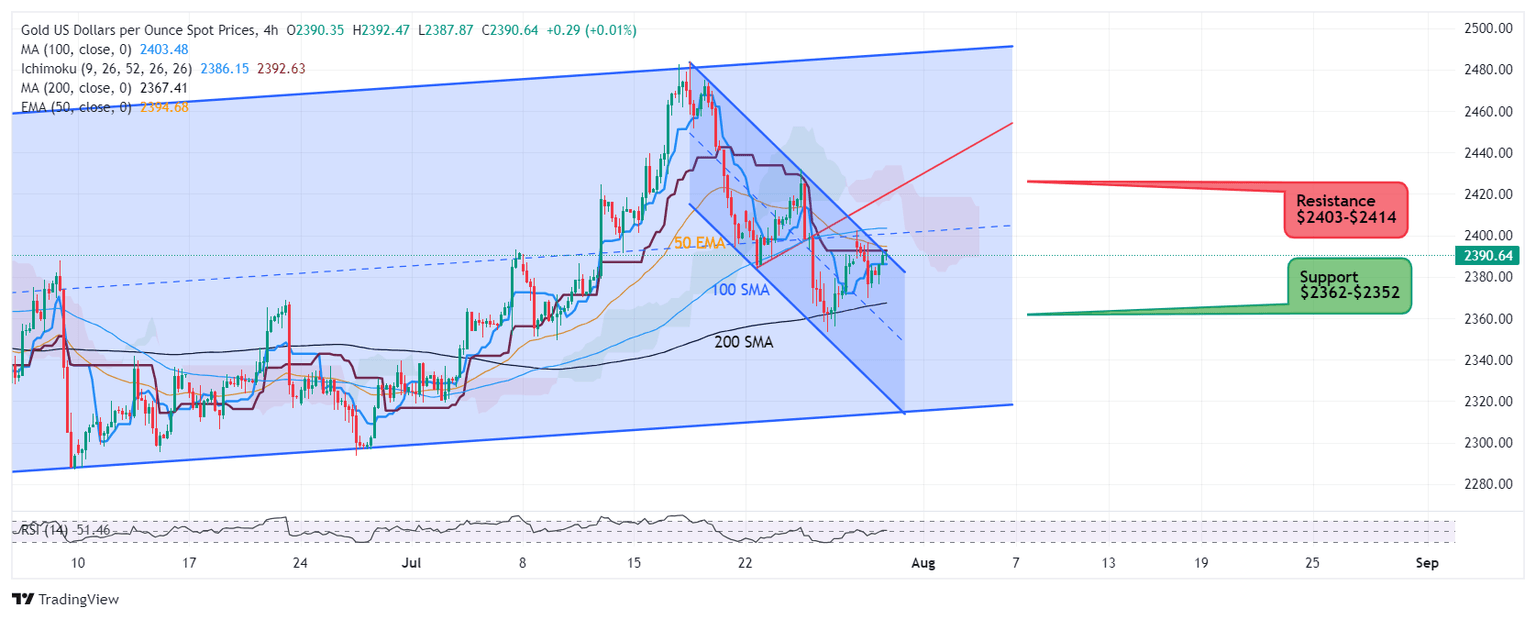

After yesterday's rally to $2403 faced initial rejection leading to steep drop reaching 50 Day EMA $2370, Gold traders rething about upcoming JOLTs job openings as well as CB Consumer Confidence numbers as consensus indicates that both the key data could somewhat miss the previous results which is likely to support the prices of yellow metal. The rise will begin with breaking immediate resistance 4 hourly 50 EMA $2395 and 100 SMA $2403 and after strong acceptance above this supply zone, some further gains towards next leg higher $2414 can hardly be ruled out.

However, if the two numbers come higher than previous/consensus, there may be an increasing pressure on Gold prices and a retest of 50 Day EMA $2370 may be very likely.

If selling gains momentum, this $2370 may come under threat, exposing horizontal and local demand zone $2353

Major downside support sits at $2328 which alins with 200 Day SMA

On the higher side, clearing through $2403-$2405 immediate resistnce zone will open the way to further rebound aiming $2414 followed by swing high $2433

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.