Why we expect the next Bank of England rate cut in March

From falling inflation to a weaker jobs market, the data suggests the Bank of England's work isn't finished. February looks too soon for another cut, given the caution within the committee. But fears of a longer-lasting inflation wave look overblown. We expect rate cuts in March and June.

The Bank of England outlook is uncertain

“Always predict what a central bank will do, not what you think it should do.”

It sounds obvious, but this well-worn mantra is severely testing UK economists right now as we try to forecast the Bank of England.

Here’s the problem: the economic data is screaming that the Bank’s work isn’t done, even if the endpoint of rate cuts is getting nearer. The Bank itself seems much less convinced, though the committee is also heavily divided.

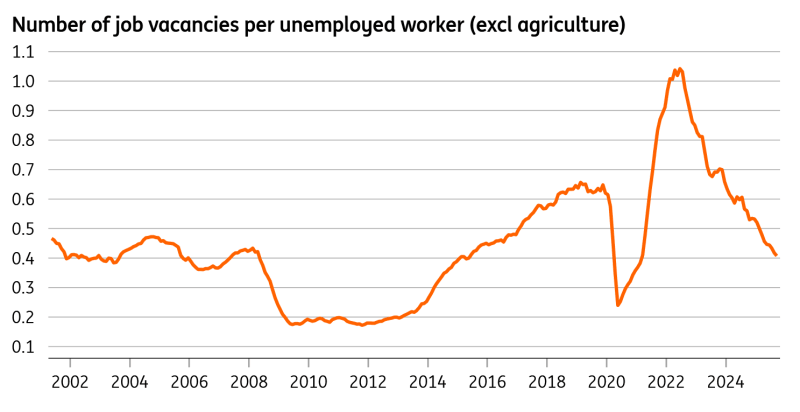

Take the jobs market. Back in 2022, there was one job vacancy for every unemployed worker; two-thirds of businesses said they couldn’t find staff.

Then came an unprecedented wave of economic migration. The number of non-EU nationals working in Britain virtually doubled from the end of 2019 to late 2024, a time when European Union worker numbers declined and only 24,000 extra UK nationals joined the payroll. The share of non-EU workers in low-paid sectors such as hospitality and health/social care grew from 10% to 20%.

The number of vacancies per unemployed worker has fallen dramatically

The result is that unfilled job openings are down sharply – and more so than in other developed economies. There are now only four vacancies for every 10 unemployed workers, below pre-Covid levels. Redundancies tentatively appear to be rising, and unusually, more companies are closing than opening. Unemployment is increasing, data quality issues notwithstanding.

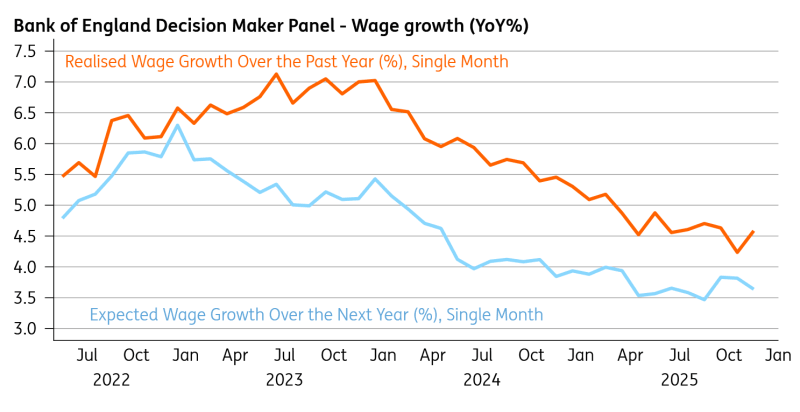

This matters for two reasons. First, wage growth is falling rapidly and has further to go. Private sector pay growth was 6% last January, 3.9% in October, and could conceivably fall to 3% within months. That would be below pre-Covid levels. Real disposable incomes are likely to flatline this year as a result.

Second, it says that fears of another inflation wave are overblown. The 2022 energy price spike fell on an economy with conditions ripe for inflation to take hold in a long-lasting way. That isn’t true today; workers – and companies – lack the power to secure higher wages/prices in response to rising costs. Inflation expectations may have risen in response to a spike in food prices, but we struggle to see inflation responding in the sort of long-lasting way it did three or four years ago.

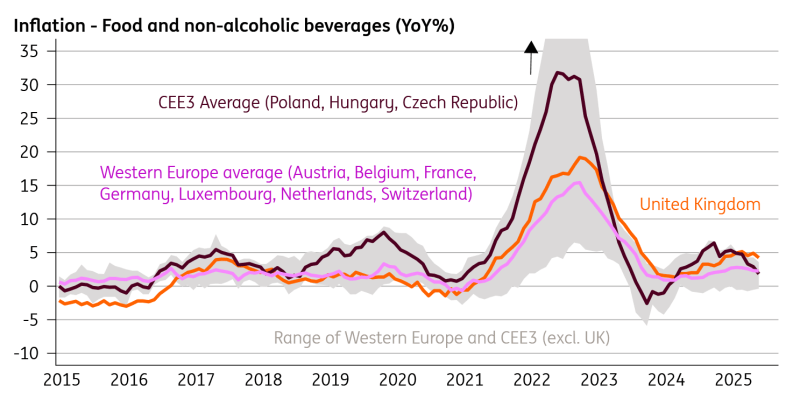

And anyway, food inflation has started to fall. All the evidence from elsewhere – Western Europe and CEE, which tends to lead the UK – suggests it should drop lower. The UN’s gauge of food input prices is falling.

Food inflation is higher than other parts of Europe, but for how long?

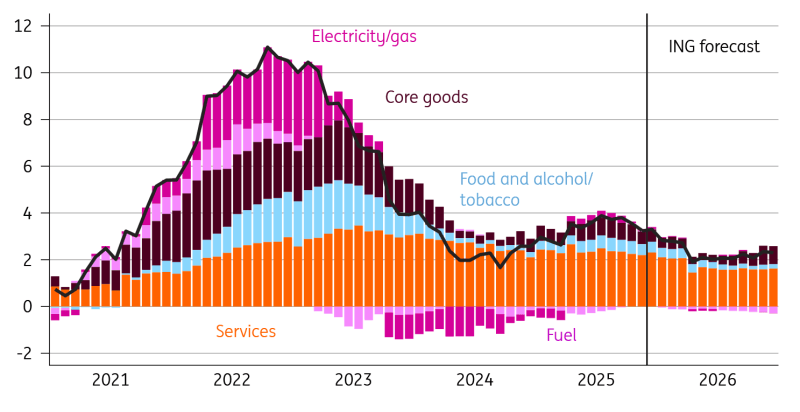

Then there’s services inflation, which we expect to fall from 4.4% in November to 3.2-3.3% by the summer. Rental inflation, which has already fallen dramatically, has a bit further to come down. Less pressure from food prices, together with a less aggressive increase in the Living Wage and no repeat payroll tax increase this April, also means restaurant/café inflation should ease too. We should also get a decent leg lower in April when the impact of last year’s bumper sewerage and vehicle tax increases drops out of the annual comparison.

Throw in falls in energy prices (helped by government efforts to lower household bills) and we think headline inflation will fall from 3.2% today to 2% from April, where we expect it to broadly remain for the rest of the year.

Contribution to UK headline CPI (YoY%)

Despite weaker data, the BoE is cautious

We could also throw in the recent weakness in the GDP figures. The economy grew by 0.1% in the third quarter and will probably be flat in the fourth quarter, though we suspect this may overstate the weakness. Ever since 2022, the GDP figures have shown a tendency to be stronger in the first half of the year than the second, hinting at an issue with the way the data is seasonally adjusted.

Listening to all of that, you might be tempted to conclude that the Bank will cut rates again at its next meeting in February. That was also our thinking after the data dropped in December. But after a surprisingly hawkish BoE decision last month, that now looks unlikely.

While the BoE cut rates last month – and signalled it will probably do so again – it came with a pretty clear message that further rate cuts could be some way off.

Governor Bailey said the Bank could “slow the cadence” of cuts, which, given it didn’t cut at all between August and December, wasn’t exactly fast in the first place. Markets have taken note: another cut is almost priced in for April. March is seen as 50:50.

Strikingly, both doves and hawks alike pointed to a monthly BoE survey of corporates, which has shown expected wage growth levelling out in the 3.5-3.8% area. The next batch of this survey will drop on Thursday and will clearly be critical.

BoE survey shows levelling off in wage growth expectations

We expect the next cut in March

Put simply, there isn’t enough new data between now and the early February meeting to shift the committee in favour of another cut next month. Services inflation – which, as mentioned above, is a key number for the Bank – will likely go temporarily higher in December, which is linked to when air fares are measured.

By March, however, we’ll have had three more releases of wage growth, which, assuming it continues to prove benign, should be a significant reassurance to the committee. We wouldn’t be surprised if the unemployment rate edges higher too.

For that reason, we think the Bank will be content with cutting rates again in March, and once more in June. At a time when there are near-unprecedented levels of division on the committee, it only takes one or two officials to change their stance to dramatically change the pace of rate cuts.

Read the original analysis: Why we expect the next Bank of England rate cut in March

Author

James Smith

ING Economic and Financial Analysis

James is a Developed Market economist, with primary responsibility for coverage of the UK economy and the Bank of England. As part of the wider team in London, he also spends time looking at the US economy, the Fed, Brexit and Trump's policies.