Why platinum looks very strong

Platinum is approaching its best time of the year as a seasonal trend the metal tends to gain from mid-December over the first couple of months of the following year. This is a pattern that has stood over the last 25-30 years. Is this a great time to go long?

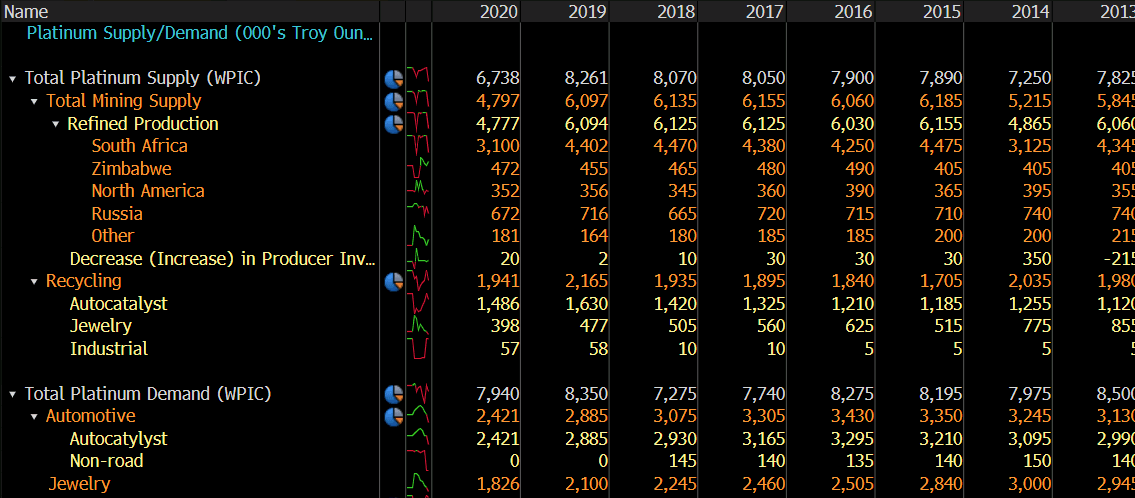

Platinum Demand is greater than Platinum supply

There is a basic fact to this metal market that demand for Platinum is out stripping its supply.

The bar chart below shows the annual supply changes from 2019 -2020 in the Platinum market. The left hand side is the 2019 supply print. The right hand side is the 2020 forecast supply.

And now for the demand side of the equation.

The right hand blue bar shows the demand for 2019 and the right blue bar shows the demand that is forecast for 2020. Now notice a deficit of -1,202 koz compared to an estimate of just -336 koz three months earlier.

However, then take a look into the future and you can see that demand is expected to rise in 2021 to 8089 koz – look at the chart below and the right hand side.

And the supply side for 2021? Well it is still below the demand level.

Conclusion?

So platinum is a market where demand is expected to outstrip supply for the end of this year and throughout 2021. Furthermore, there is a strategic role for platinum in the growth of the hydrogen economy too, so demand could expand even further. There is lots more to be said, but you can access some of the latest research from the World Platinum Investment Council here. Read pages 1-6 for a decent summary and page 4 for the investment case in a nutshell.

This could very well be a great time to go Platinum.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.

-637418102864917931.png&w=1536&q=95)