Why I called for S&P 500 gap retest

S&P 500 indeed ran to the daily bearish gap, testing it twice, and I discuss it excessively in the client section – plenty of smashing opportunities for clients swing and intraday to profit, delivered. Earnings hadn‘t been smashing, after I had been calling PLTR bullish earlier, and AMD bearish, turned out well, and the day after DeepSeek I had been explaining the AI landscape shift implications for leading tech companies.

GOOGL missed on cloud, META is the (open source) winner, AMZN I‘m leaning a bit bearish (AWS not making its numbers all too greatly) – this is just anotherr example of what kind of guidance clients are getting (ARM is closer to being my cup of tea really!).

Bitcoin and crypto lanscape look to be slowly decaying – that‘s the near-term, and I am not lulled to sleep by BTC being still above $92K - $93K for now, you do remember my mid Dec call for $72K not being all that inconceivable (over the many months ahead I mean), right?

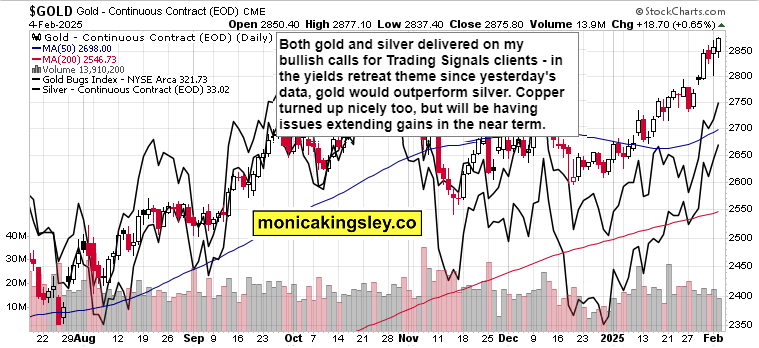

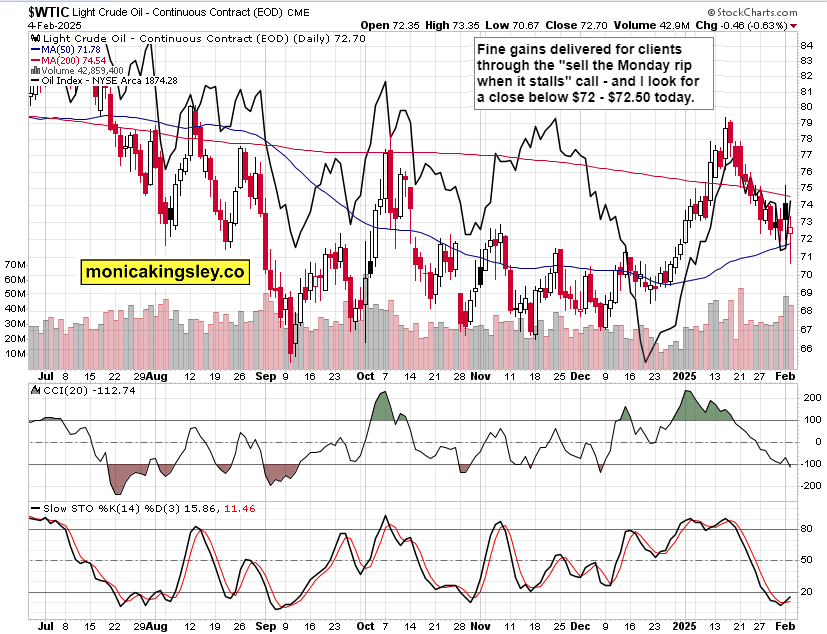

What implications does that have for risk taking and equities today, after Trading Signals clients benefited on bullish precious metals and selling the oil rip calls already? What‘s next in store following the underwhelming JOLTs job openings and factory orders yesterday? This ADP employment change beat is but one piece of the puzzle (services PMI roughly in line next I assume) – see the continued China trade war also spilling into regulatory as US tech behemoths can attest to? I was clear for clients about bearish AAPL implications, and here we go.

In today‘s punchy and quick video I dive into cryptos, real assets and equities, what conclusions would I draw from daily Nasdaq outperformance, how does it stack against industrials and financials? Two more trade setups reviewed with commentaries as to what drove client gains exactly yesterday, I covered too – what a fine setup going into today‘s session we have, check then the following charts (again a little, further uncommented preview of what Trading Signals clients are getting every day in precious metals and crude oil with copper).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.