Why has GBP/USD underperformed EUR/USD?

Not all is well with GBP/USD. That was the message from the currency market on Thursday. While 25 bps hike by the Bank of England (BoE) was widely expected, the narrow vote of 5 to 4 against raising rates by 50 bps was not. By any measure, this was as hawkish a signal imaginable from the BoE short of raising by more than 25 bps. Still, after GBP/USD spiked to a high of 1.36281 on the decision, it quickly retraced its gains to close 0.19% higher on the day at 1.35993.

GBP/USD 1-minute chart

GBP/USD political risk premium

By mid-Friday trading, GBP/USD had slipped below Wednesday’s closing price as Boris Johnson’s government faced further challenges, raising more questions about the future of his premiership. Nor did the pound find much support from what has been a volatile week for global risk appetite more generally. Few, if any, would have anticipated GBP/USD to perform as it has given the circumstances.

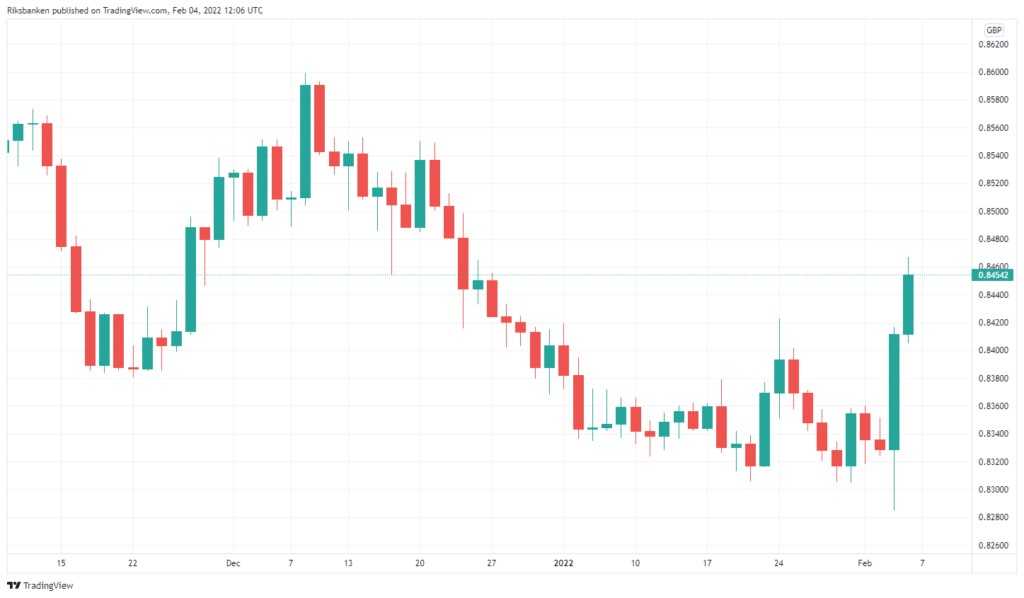

Meanwhile, EUR/USD has outperformed even though the ECB stood pat on policy Thursday. Investors reacted to ECB President Christine Lagarde’s sounding more vigilant about inflation and omitting her previous comments that a rate hike in 2022 was “very unlikely”. As a result, EUR/GBP has risen to a high of 0.84670 - its highest level since the 23 December last year.

EUR/GBP daily chart

Three factors to consider

The pounds underperformance comes down to three factors. First, the challenge of the BoE talking up near-term yields marginally higher, especially relative to the ECB and euro area going forward. Second, the political uncertainty related not just to Boris Johnson’s government but Brexit issues around Northern Ireland, which looks to a slower burn issue. Thirdly, the susceptibility to Federal Reserve policy, especially in terms of how it affects global risk appetite.

Ukraine hasn't gone away

Then there is the big wild card: what happens with geopolitical tensions related to the Ukraine? The Ukraine story is far from done. It could take Russia up until 10 February for troops to reach the full compliment to assault Kyiv, according to the Economist. But Putin, if he were to attack, is likely to wait after the Winter Olympics, which end on 20 February not to spoil thing for China and wait for the spring thaw. Any aggression could talk even longer if Putin waits for more solid ground.

Author

Carl Paraskevas

VARIANSE

Carl Paraskevas has over twenty years’ experience in finance and banking, primarily in research related roles at several institutions.