Why are some stock sectors surging?

Pot-boiler: London’s share trading is shifting to Amsterdam just as cannabis stocks surge: coincidence…? Stranger things have happened. Cannabis stocks are flying with the Reddit and RobinHood crowd piling on to the sector. Shares of Tilray, Canopy Growth, Aurora Cannabis and Aphria all surged as they have become the latest focus for the /wallstreetbets gang that drove GameStop, AMC Entertainment and others in recent weeks. There are several fundamental factors in play, such as Tilray and Aphria’s merger, which has sent shares in these stocks up 670% and 280% YTD respectively. Tilray this week struck a deal with Grow Pharma to import and distribute its medical cannabis products in the UK. Canopy Growth reported better-than-expected results this week.

Expected legalisation in the US is fuelling the speculation in these names, with Democrats planning to end prohibition at a Federal level, which would be a clear tailwind for the sector. Indeed, the rally in pot stocks really started back in November on Biden’s victory and accelerated after the Georgia run-off result. However, these stocks are running up way beyond what the current path to legalisation will mean with regards earnings. Whilst acknowledging certain positive fundamentals, the valuations are looking extremely stretched, albeit we are not anywhere near levels seen during the cannabis bubble of 2018. The rally looks predominantly driven by retail traders.

Some of the names are heavily shorted – short interest on Tilray stands at 23%. It may not be a GME situation, but it helps ease the path higher. Investors are getting high on pot stocks, but just like GME the comedown may be harsh. It’s another example of the excess, the frothiness and speculation that is running through corners of the market right now. We perhaps should be a little concerned about a ‘locust effect’, with stocks and sectors being pumped and dumped at will before the crowd moves on their next target.

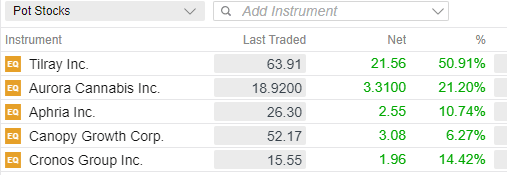

Pot stocks posted strong gains yesterday

Cannabis Blend – a basket of cannabis stocks has been performing well since November

This morning, stocks edged a little higher in Europe after a mixed day on Wall Street, with the S&P 500 down 0.03% and the Dow Jones +0.2% and notching a fresh record high. The WHO says the AstraZeneca vaccine works for all ages, whilst Germany has extended its national lockdown to March 7th. AstraZeneca also said it will focus on adapting its vaccine for new variants and gave a bullish outlook for the year ahead.

Royal Mail raised its profit guidance due to a surge in parcel deliveries, with volumes up 30% year on year. Management now see annual adjusted operating profit significantly above £500m. Shares rose another 5% - the company for long in the doldrums finally seems to be getting its house in order and is now a structural winner both from the pandemic and from a decade-long shift towards online shopping. E-commerce is key, but delivering PPE, home testing kits and vaccination letters has also helped.

Fed chair Jay Powell reaffirmed the central bank’s commitment to keep stoking the fires. Whilst the headline unemployment rate has fallen to 6.3%, Powell said the real level of joblessness was closer to 10% and that the employment picture is “a long way” from where it needs to be. He also downplayed the risk of inflation, saying he doesn’t expect “a large nor sustained” increase in inflation right now. Any price rises from a “burst of spending” as the economy reopens would be short-lived, he argued. Data yesterday showed US inflation rose more slowly than expected – CPI at 1.4% vs 1.5% expected. The pandemic continues to tame inflationary pressures, but this can only last so long. We should note that 1.4% was the fastest clip in five months.

Oil prices rallied to a fresh year-high after the EIA reported a larger-than-expected draw on crude inventories. Crude inventories fell by 6.6 million barrels last week amid signs of a pick-up in refining activity on higher fuel demand, whilst imports also declined. Refinery utilization rose 0.7% to 83%, whilst demand refined product supplied rising to 20.2 million bpd, highlighting improved demand. March WTI rose to $58.90 but has eased back to $58.30 this morning. Meanwhile the International Energy Agency (IEA) said this morning that global oil inventories fell more quickly than expected in the final quarter of last year. Stocks declined by 2.24m b/d in Q4 2020 as efforts by OPEC and allies to reduce output worked to draw on stockpiles. Early data also points to continued drawdown at the start of the year.

In FX, the dollar clawed back some small gains with GBPUSD hitting a session low under 1.3830 but remains supported above 1.380, yesterday’s low, whilst resistance seen at yesterday’s high at 1.3866. EURUSD was steady at 1.2130 with the bulls still in control.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.