When to stop?

S2N Spotlight

Today is a major public holiday and traditionally marks the end of the summer holidays. I am going to take the laid-back atmosphere and write on a subject close to my heart and one that I think is at the heart of everything happening at the geopolitical/economic level.

I am not sure if it is just my state of mind, especially since I have been working flat out launching a new business, but I am suffering from analysis overload. Actually I think more than overload, I am just finding most of the current analysis boring. It seems repetitive and very one-dimensional.

With that out of the way, come take a seat in my consulting room, where I am going to peel away a few layers and psychoanalyse the Commander in Chief. The President of the United States. The lifetime Chairman of the Board of Peace.

The question I have been pondering is a simple one; the answer is anything but.

Will Donald Trump take his deal-making, his foreign and trade policy, his meddling into the central banks' business, and his interfering in the DOJ too far?

I have no doubt my letter will ruffle a few feathers. My analysis has no political agenda; it is purely a look into the mind of the most powerful man on earth to decipher whether there is something that can be learned that will help a global market strategist position a portfolio to provide a better risk-adjusted return.

For those who are new to my writing, it is important to provide some background. I mostly write about macroeconomics with a quantitative or first-principles logical bent, or about markets seen through the prism of probability. But there is a softer side to my analysis that is steeped in psychology.

The brand of psychology that I believe best captures my world view is Jungian analysis, sometimes referred to as ‘depth psychology’. While I regard myself as a Jungian, having spent more than a decade in therapy with 2 registered Jungian analysts and studied the Collected Works of C.G. Jung, a 20-volume series of not-so-easy reading. I am not a Jungian analyst. Just so you know, it takes between 13 and 19 years to become a registered Jungian analyst from the C.G. Jung Institute Zurich. I am dedicated but not that much.

As the summer vibe comes to an end, I will get back to some more research analysis, but for now, enjoy something a little less Wall Street-ish.

Before I go further, I need to slow down and define a few Jungian ideas properly; otherwise, the rest of this will sound like poetic speculation. Don’t worry, I will leave Jung’s style of writing to diehards like me and hopefully make his theory seem accessible.

Jung’s core claim is simple but radical. Human beings are not only individuals. We are also carriers of inherited psychological patterns, thanks mom and dad, thanks gramps. Jung called these patterns archetypes. They are not ideas we learn. They are organising forces in the psyche that shape perception, emotion, and behaviour.

Think of an archetype as a pre-installed operating system. It tells you what matters, what threatens you, what you desire, what you fear, and what you are willing to do to protect your identity. It also tells you what kind of story you are living inside.

The archetypes that matter most in politics are easy to spot because they are ancient. The King. The Warrior. The Trickster. The Redeemer. The Tyrant. The Father. The Rebel. Each is a deep template. Each carries a gift and a shadow. I am not joking when I say that a big part of the Jungian syllabus is studying Fairy tales and Fables.

Now here is the crucial Jungian pivot.

Archetypes are not the problem. They are necessary. The problem is identification.

Jung used the term ‘ego inflation’ to describe what happens when the ego becomes fused with an archetypal image. Instead of experiencing an archetype as a role that visits the psyche, the person unconsciously believes they are the role. (this is so important; read the sentence again.)

This distinction is everything.

A healthy psyche can say, I am being called to lead. I must be careful with power. I will submit to limits. I will listen. I am representing the people who have chosen me.

An inflated psyche says, I am the leader. Limits are for lesser people. Process is an obstacle. Opposition is proof that I am right. Can you see where I am going with this?

Inflation often looks like confidence from the outside. It can even look like brilliance. I am sure you have heard the phrase, “Trump is playing chess while the world is playing checkers.” Psychologically, however, inflation is not intelligence. It is a loss of proportion. The ego has grown beyond its rightful size because it is borrowing energy from something larger than itself.

When Jung speaks of the collective unconscious, this is what he is pointing to. The individual psyche does not operate in isolation. It can tap into forces that are transpersonal, ancient, and immensely powerful. When that happens, the person feels expanded, certain, and unstoppable. The danger is that this energy does not belong to the ego, and it cannot be controlled indefinitely.

If I have lost you don’t worry about it my kids tell me all the time that I am very confusing, but I have a feeling what I am saying is actually registering in more ways than you may care to admit. Lets press on, stay with me, I promise you that you will never look at Trump the same way you looked at him before.

There is one more concept that matters here, and it is the one most people miss.

Inflation is usually contagious. When the collective is exhausted, distrustful, or humiliated, it develops a hunger for an archetypal solution. Not a policy solution. A symbolic one. Something that restores feeling, pride, momentum, and meaning. Jung’s term for this is psychological participation. The crowd does not simply watch the leader. It invests psychic energy into them.

This is why certain leaders feel larger than life. It is not only their personality. It is the collective projecting something onto them and then feeding it.

Once you see this, Trump becomes easier to read.

He is not merely a political actor making choices. He is an archetypal figure onto whom millions have projected the mandate to break the script. The rule book has lost legitimacy. The collective wants disruption with results. A kind of sanctioned transgression.

This is why he can meddle broadly and still be rewarded. Every boundary he violates signals to his base that he is not captured by the old order. The more outrage he generates, the more he confirms the role he has been assigned.

I will keep the behavioural examples short because you already know them. Don’t forget that old chestnut. You get the leader you deserve.

He inserts himself into arenas that were previously insulated. Diplomacy, trade, monetary signalling, prosecutorial independence. He treats institutions less like sacred constraints and more like negotiable counterparties. And remarkably often, he gets a result.

So all you Trump Diehards of which I am probably one are wondering, where is the danger?

The danger is not that this stops working tomorrow. The danger is that when it works, it accelerates inflation. Success becomes evidence of destiny. Destiny becomes evidence that restraint is unnecessary. And then restraint becomes evidence of weakness. Remember his pledge to keep winning so much that it will become boring. Inflation does not accept boring.

This is why I view the Davos moment as so revealing. I have been working on this peace (spelling intentional) for more than 2 weeks but each time I was reluctant to write as I felt that I didn’t want to take anything away from the man who I thought was about to step in and help the Iranian people to whom he has been pledging, “help is on its way.”

But when I read on Saturday about The Board of Peace, with Trump positioned as its permanent chairman, I felt this is my moment, as it is not merely policy theatre. It is symbolic theatre. It shows us the psychic direction of travel.

The King is no longer elected. The King is enthroned.

And once the psyche crosses that line, the archetype demands escalation. It needs ever larger gestures to remain convincing. It needs a bigger stage, bigger stakes, bigger enemies, bigger victories. Inflation does not tolerate moderation.

If you want a single Jungian sentence to hold onto, it is this.

When a leader becomes identified with the archetype, they stop negotiating with reality and begin negotiating with fate.

This brings me back to the question that matters for markets.

Will Trump take it too far.

From a Jungian lens, the question is not whether he will overreach, but when the compensation arrives, and what form it takes. The correction can come through politics, scandal, war, markets, institutional revolt, or a sudden reversal of narrative. The specifics are unknowable. The pattern is not.

Inflation feels good at first. It increases the apparent range of what is possible. It makes constraints look optional. It rewards the ones who act boldly and punishes the ones who insist on limits. But it is not a free lunch. It is a postponement of constraint.

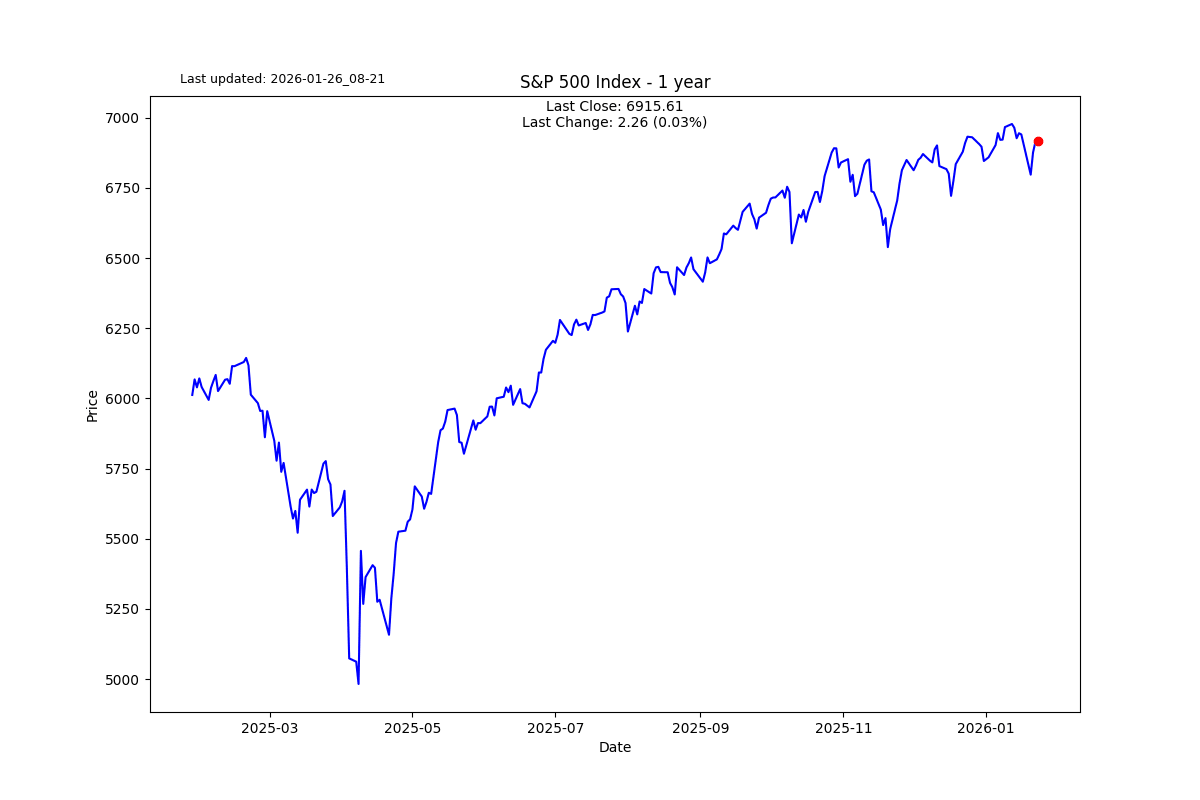

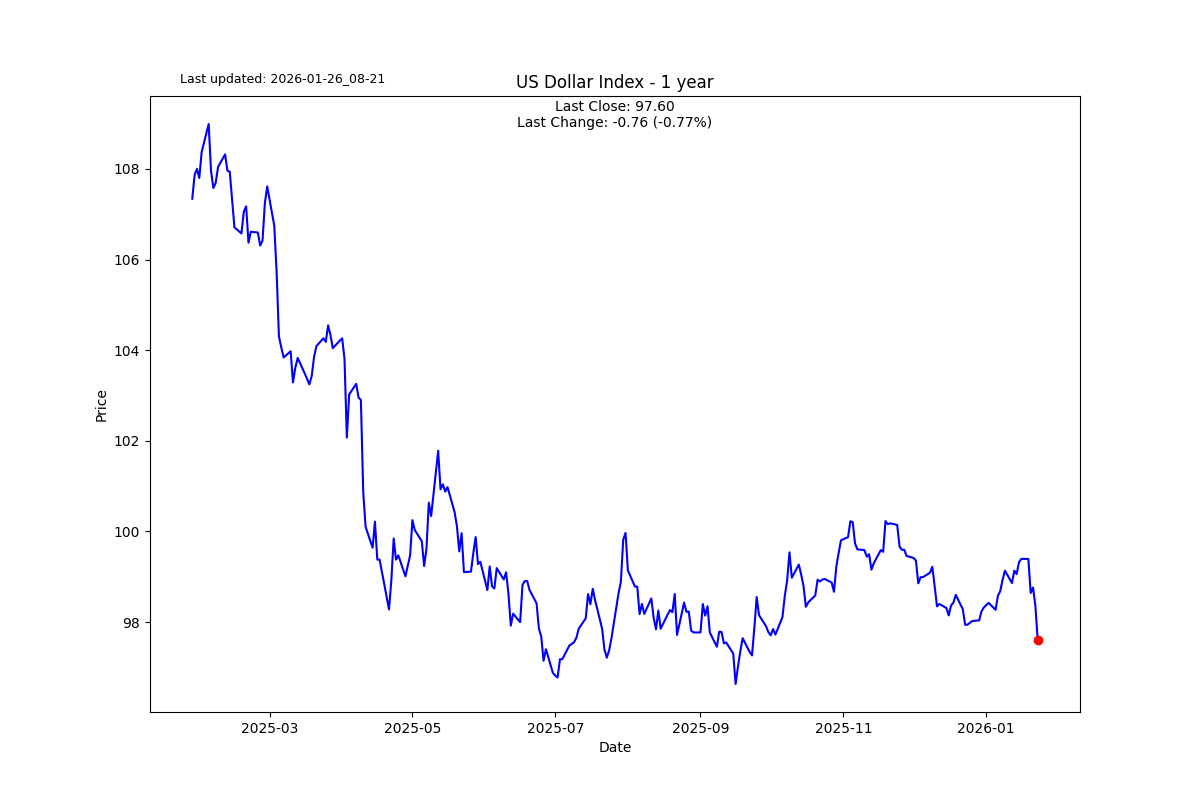

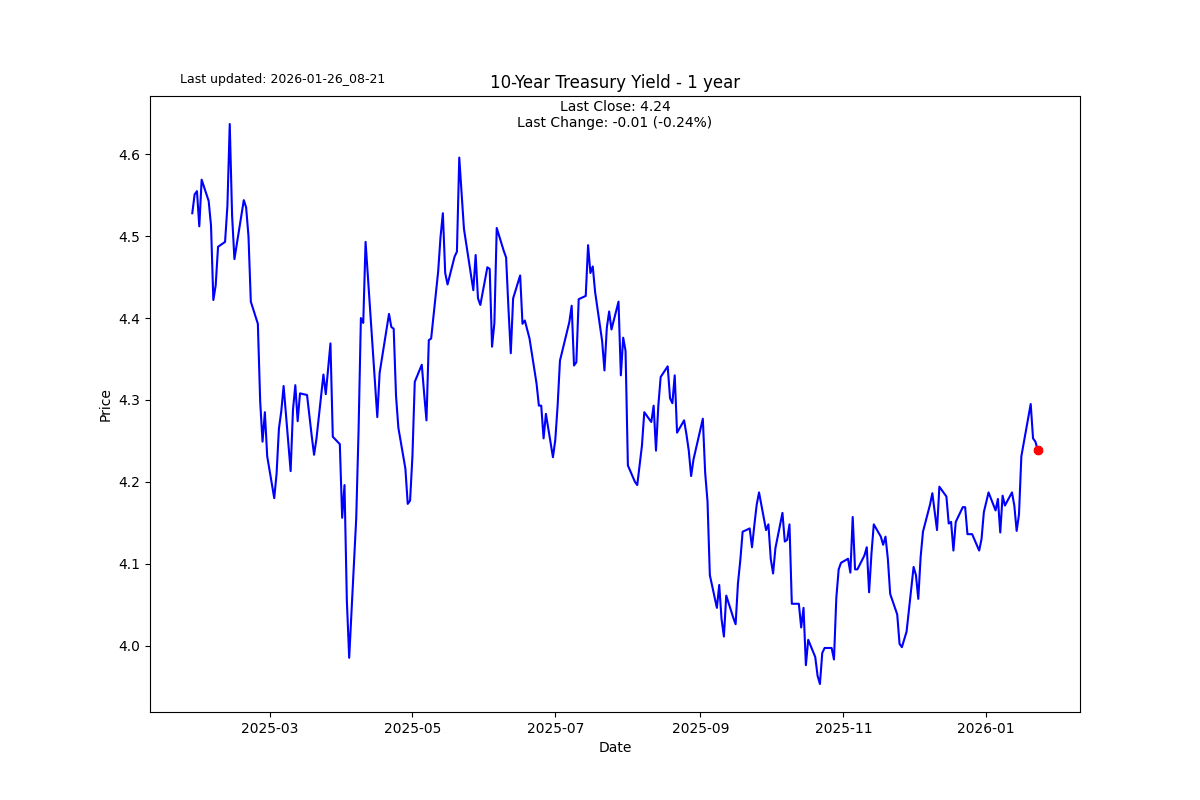

In psychology, the constraint returns as compensation. In economics, it returns as inflation, currency pressure, bond vigilantes, or social backlash. Sometimes it returns as all of them at once.

I am not claiming Trump will deliberately run the economy too hot. I am saying that the psychological profile that thrives on dominance and acceleration has a natural affinity for policies that create immediate wins and defer long term costs. Rate cuts. Tax cuts. Fiscal push. Pressure on central banks. Pressure on opponents. Pressure on allies. Pressure everywhere.

It works until it does not.

I will leave it there for now because the point of this letter is not to moralise. It is to recognise a regime. The global macro question is not whether you like Trump or dislike him. It is whether you can recognise the moment when momentum stops being power and starts being fragility.

Stay tuned, this year we are going to be looking for clear signs where that fragility is more exposed than the market believes. To end with a quote from someone I love to hate.

“Anything that is fragile eventually breaks.”

— Nassim Nicholas Taleb

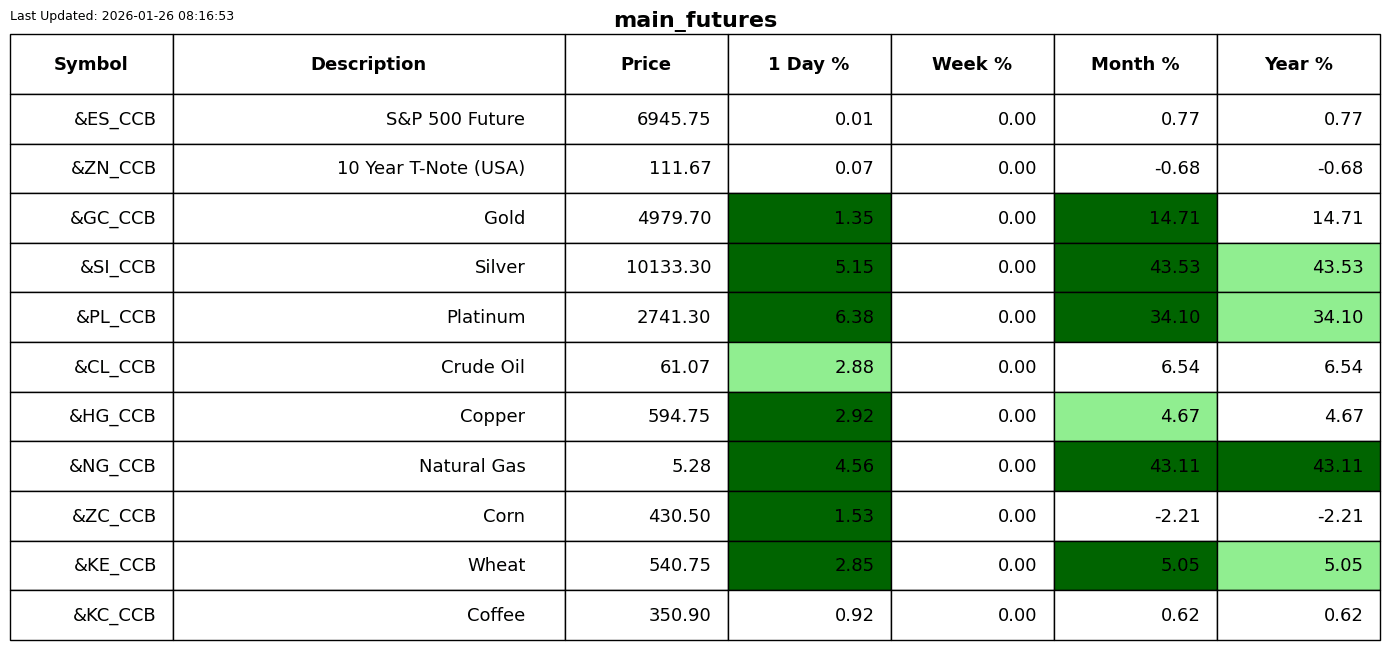

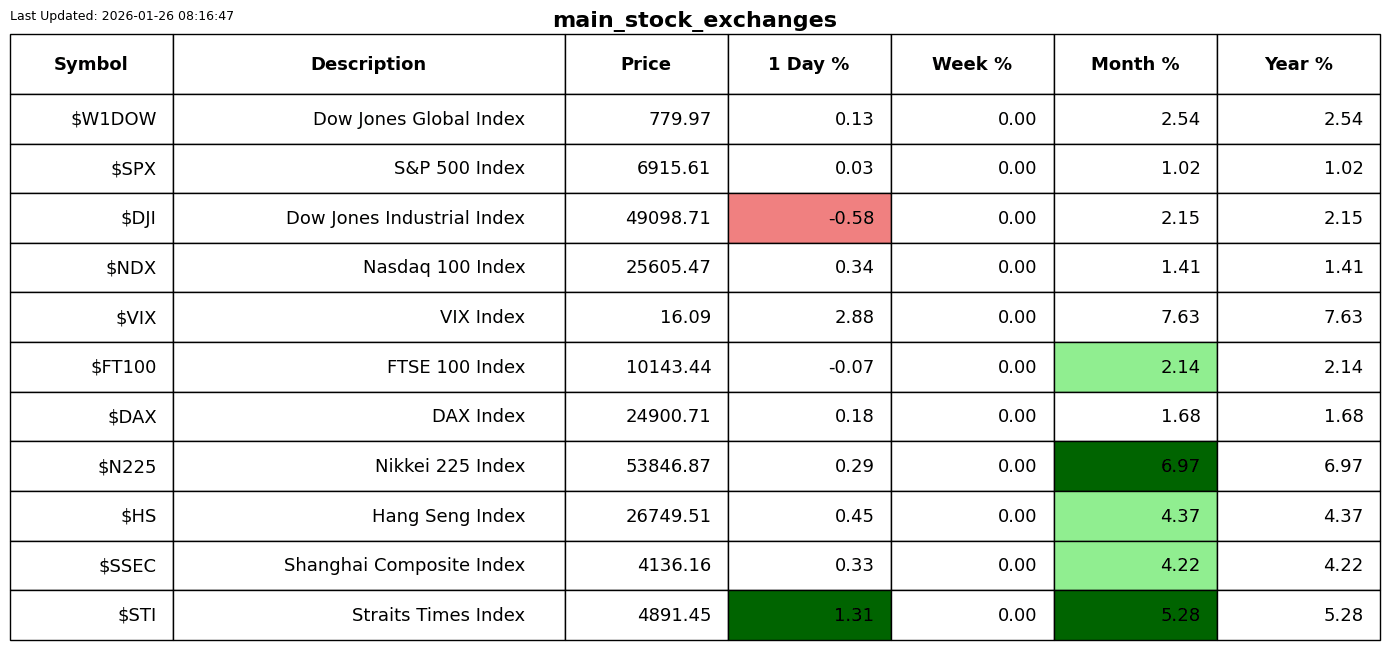

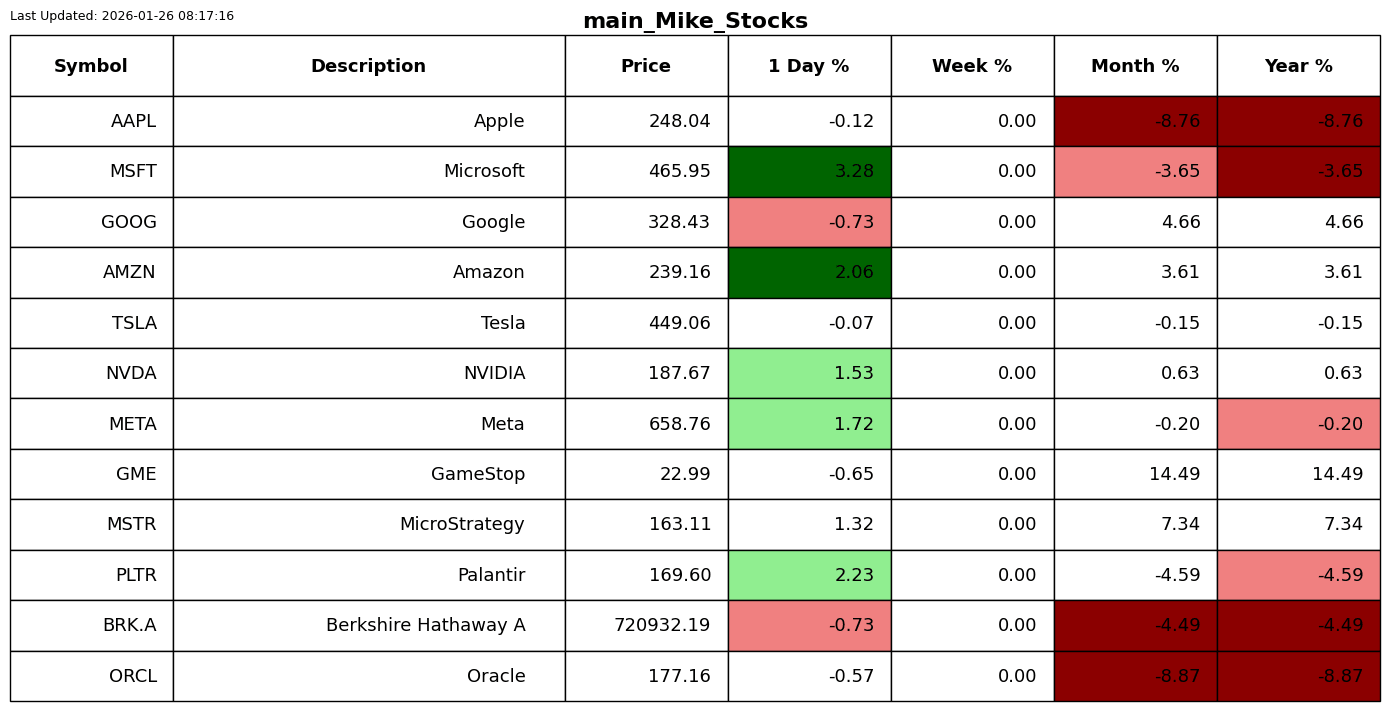

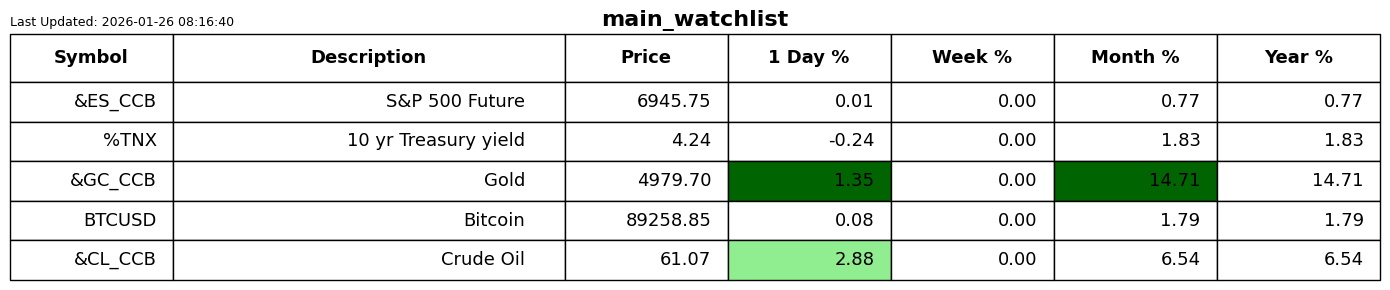

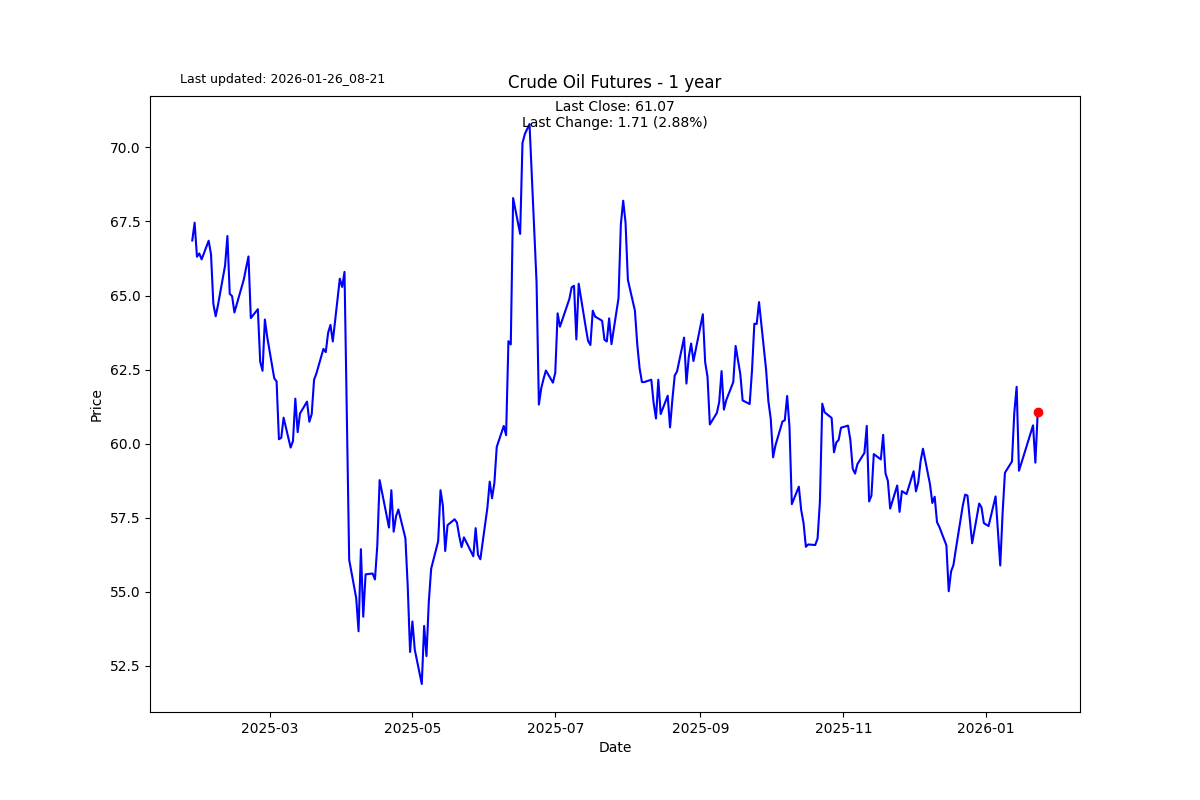

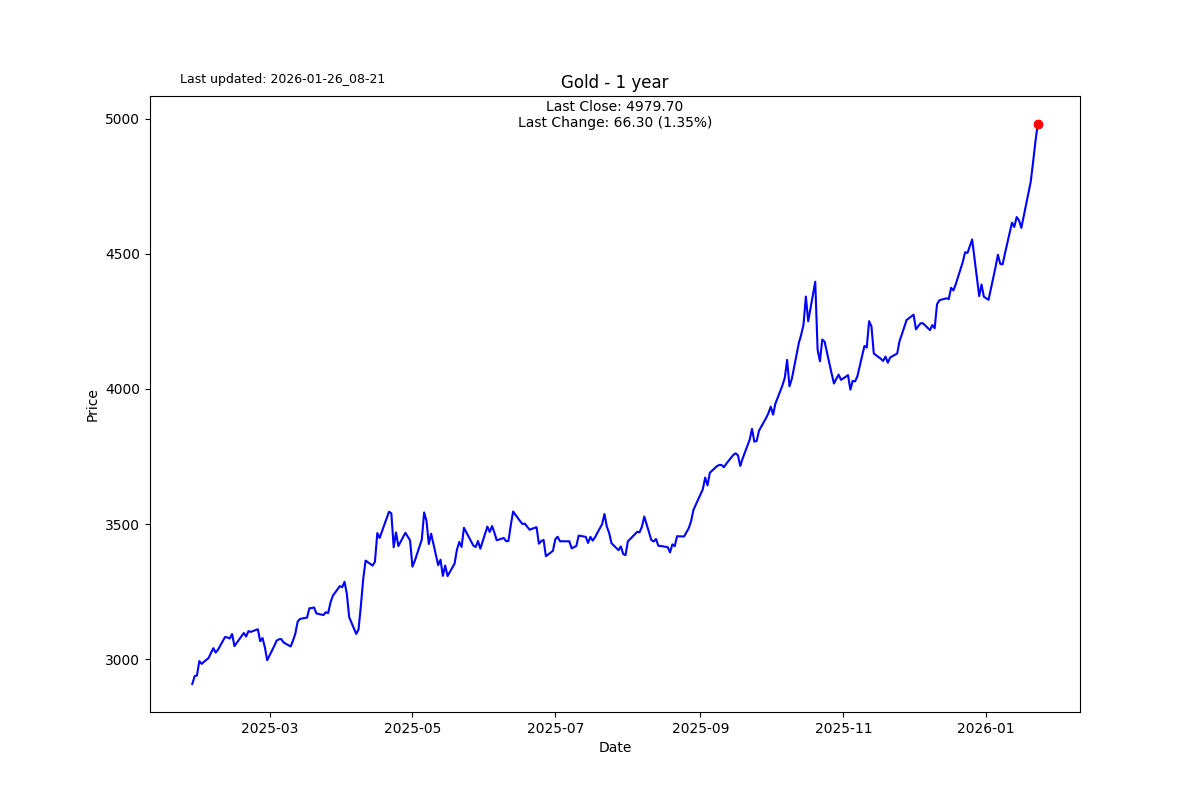

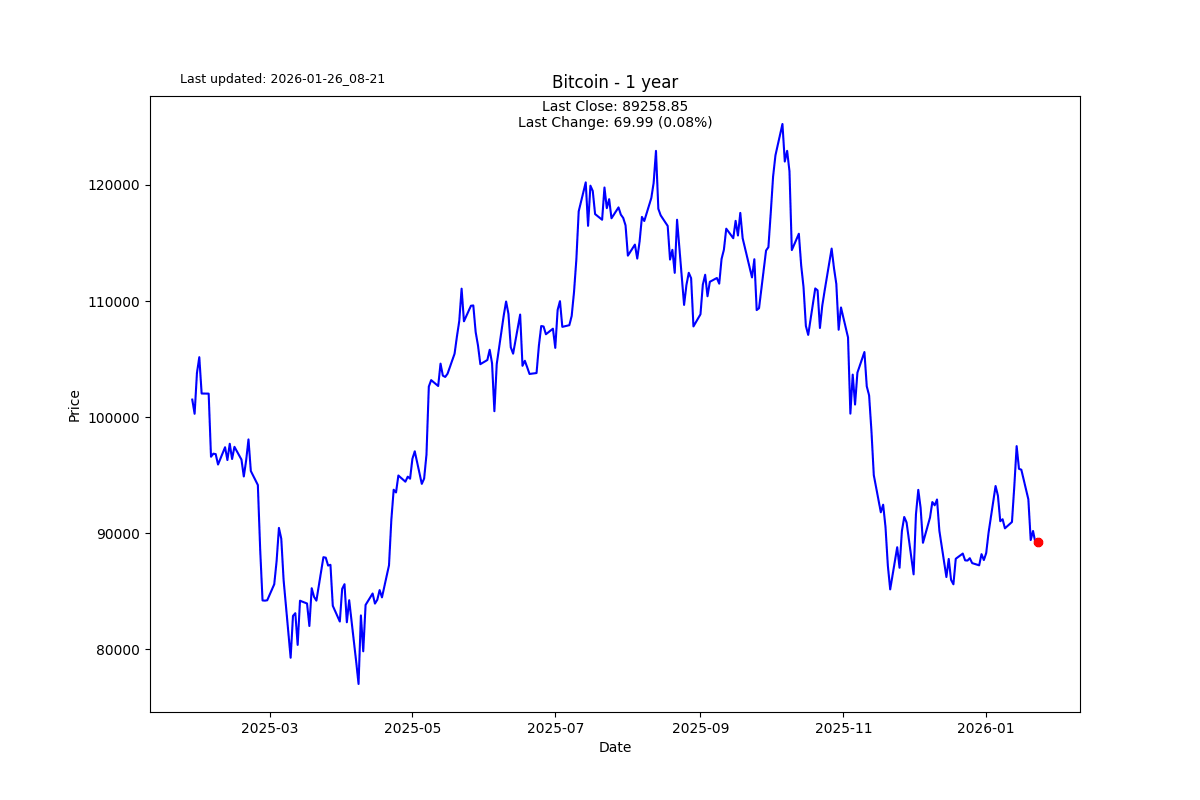

S2N performance review

S2N chart gallery

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.