When does the FX market start girding its loins for central bank actions in the upcoming weeks?

The ADP job losses get bolstered today by the Challenger job openings/cuts today and the weekly jobless claims. Challenger reported layoffs of 135,000 last month. Tomorrow it’s the outdated PCE and the University of Michigan's preliminary consumer confidence and inflation expectations for December.

As noted before, “the dollar” is not a single thing unless you like the dollar index, which is mostly the euro, anyway. This is one of those times when the mishmash of components can be misleading. Yes, the euro is on the rise but the bigger gains were in the pound and yen, relatively smaller in the index but making bigger moves yesterday than the euro—for their own reasons and not necessarily anything to do with the US economy or politics.

- Euro, 57.6%.

- Japanese yen, 13.6%.

- Pound sterling, 11.9%.

- Canadian dollar, 9.1%.

- Swedish krona, 4.2%.

- Swiss franc, 3.6%.

Still, it’s not wrong to focus on the US economy. For example, expectations of stagnation/recession arising from tariffs was dead wrong. One key reason is the unrelenting materialism of the American consumer, who is, after all, two thirds of GDP. Adobe Analytics reported that over the Thanksgiving weekend including Cyber Monday, a record 203 million consumers went shopping. This is up 8% y/y. The National Retail Federation points out that spending will exceed $1 trillion in Nov and Dec for the first time. But as the NYT reports, “that total masks a growing divide in how Americans buy: High-income shoppers are increasing spending at more expensive stores, while middle-income households are turning to value brands. Gee, economic rationality.

Will we ever get tariff-induced inflation? Yeah, probably, when bought-ahead inventories get used up and companies stop eating the extra cost. Many forecasters had said Q3 or Q4, and now it’s pushed out into Q1. Inflation comes, if it does, at the same time the White House will be attacking the Fed’s independence and demanding more cuts. The CME Fed funds bettors are not buying it. The outlook for the March 18 policy meeting is 44.7% at the same after next week’s cut, with only 40.9% seeing another cut by then. This is vaguely dollar-positive.

More dollar positive is the rise in yields expected from the Battle for the Fed, which may not be offset by revulsion at the power grab.

Finally, when does the FX market start girding its loins for central bank actions in the upcoming weeks? We get the Fed next week (Dec 10). The following week it’s the Bank of England (Dec 18) and a day later, the Bank of Japan. As noted above, the FinMin and others are not objecting to the expected BoJ rate hike (with maybe another in Q1), which pushed up yields and the yen. When the dust settles, Japan will still have a low yield compared to others…

Forecast

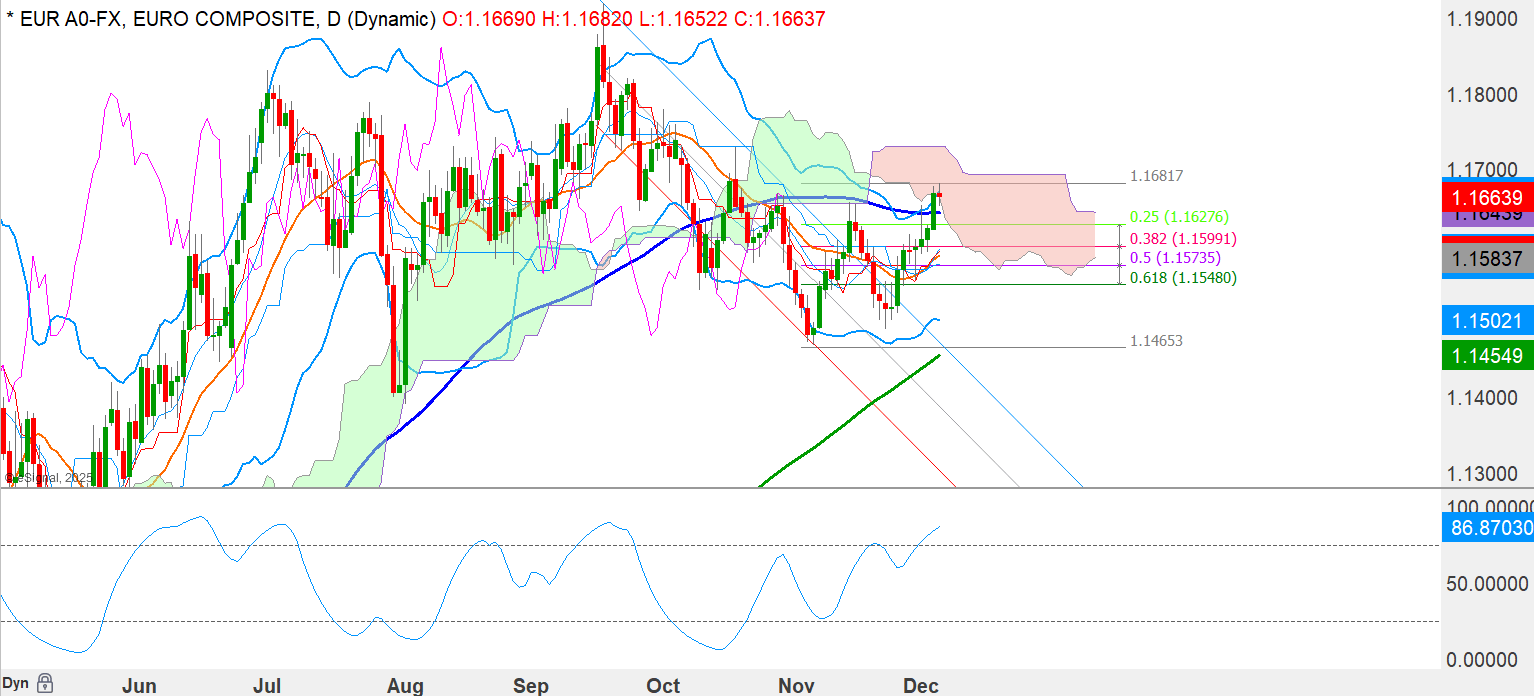

We worry when a counter-trend moves like the euro’s lasts as long as ten days. A counter-counter move is due. We expect the euro to resume the upmove, but not until it corrects by some amount. Prices don’t move in a straight line and the euro is overbought by some measures. A 50% retracement would take it to 1.1574. Eeek, too much. More realistic is 38% at 1.1599.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat