What’s going on with the Canadian Dollar

The Canadian Dollar has been finding steady bids over the last few weeks due to higher oil prices, an optimistic BoC, and recent reassurance from the Canadian consumer and house prices. On Tuesday of this week, Canadian retail sales for April rose by 0.9% vs 0.8% expected. Furthermore, this print was on the back of March’s data revised higher to 0.2% and projections for May’s data to come in around 1.6%. The House Price Index came in at 8.4% y/y, below the 8.7% expected and down from 9.4% prior, but it does not show panic in the House Price Index, so there is no reason for major panic from CAD buyers on that print.

So, does this mean the CAD has a buy bias?

Well, no, and here is why. Yes, the outlook remains supportive for the CAD, especially with yesterday’s high inflation print, but pricing is quite stretched now. The CAD has been gaining since February this year on the improving outlook for Canada’s terms of trade and strong growth outlook. You can see the strength in the CAD basket below.

However, the risks are tilted toward this change now. The US is Canada’s biggest export partner and there are concerns over a looming US recession. The latest falls in stock markets may also be starting to appear in commodity markets. If investors fear slowing global growth then oil prices will typically fall. If we see risk-off trading then the CAD tends to weaken alongside the NZD and the AUD as a commodity currency.

The best opportunity for trading CAD?

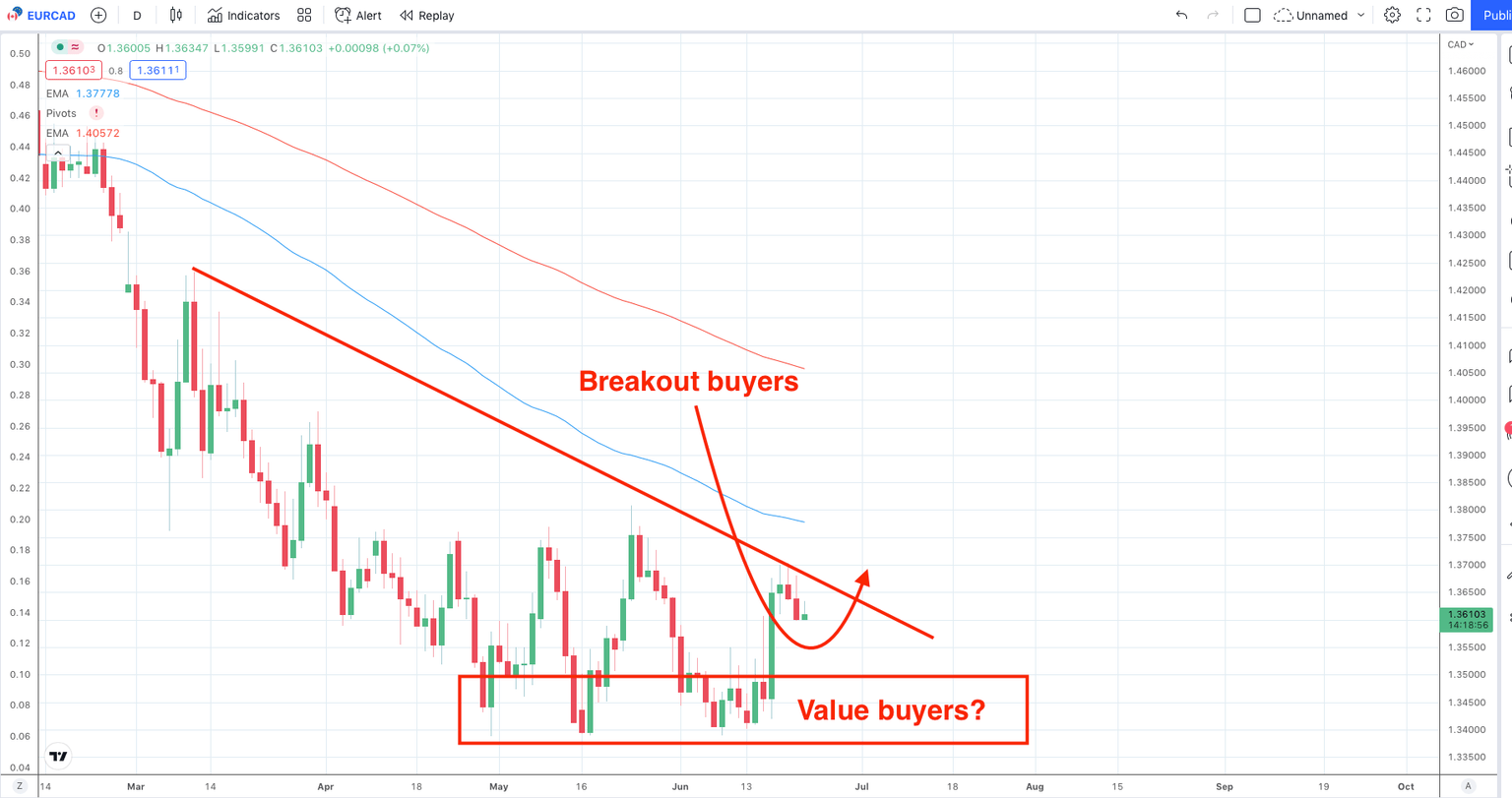

This would come from some disappointing data. Anything that allows the CAD positioning to fall lower would hold the best opportunity. If the ECB keeps ahead for its series of rate hikes then EURCAD gains could be attractive from value areas as outlined on the chart below.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.