What’s going on with Gold?

-

Will the sell off in gold act as a drag on stocks?

-

Gold valuations look stretched.

-

Why a shakeout is necessary before the next leg higher for gold.

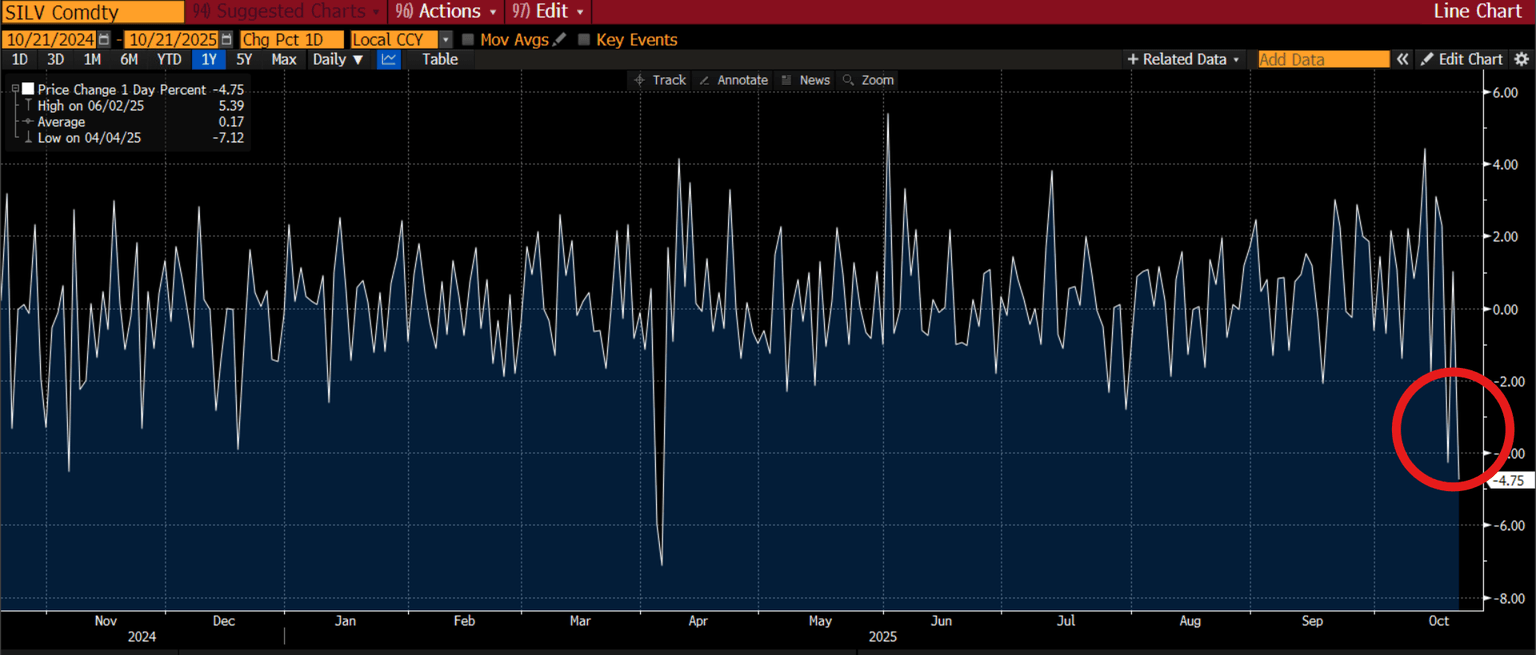

After a stunning rally, the gold price is unwinding on Tuesday. The yellow metal is down nearly $90 per ounce, and silver is also faltering, it was down more than 5% at some stage. The reversal has been abrupt, there was no single event that has caused today’s sell off, instead it is most likely caused by a confluence of factors including stretched valuations and signs that US CPI, which will be released at the end of this week, could come in softer than expected.

Will the sell off in Gold act as a drag on stocks?

The risk is that the sell off in gold infects other asset classes. Although gold has surged ahead of equities this year, gold and stocks have moved in tandem and hit record highs simultaneously in recent months.

Stocks in Europe are relatively flat and US equity futures are pointing to a lower open later today. There is a risk off tone to financial markets, although it is mild at this stage. Interestingly, the FTSE 100 is managing to eke out a 0.2% gain. However, the gold miners, who are the top performers on the FTSE 100 this year, are acting as a drag on the index, and Endeavour Mining and Fresnillo are both down more than 3% on Tuesday. If this sell off continues then we could see the FSTE 100 come under pressure later today.

If this is a prolonged sell off, then the FTSE 100 could be at risk, since Endeavour and Fresnillo have both risen by 270% and 130% respectively, so far this year. Thus, the focus will be on how far the gold price can fall.

Gold valuations look stretched

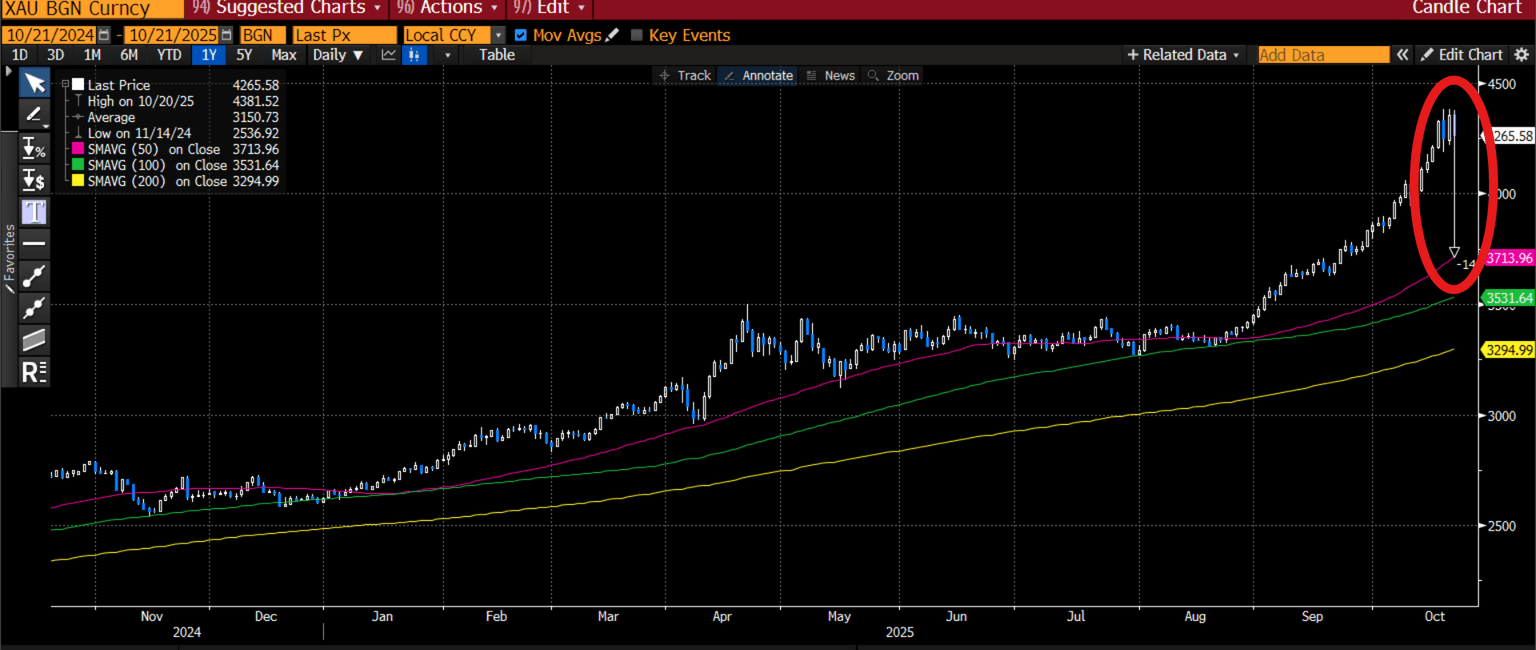

There is no doubt that the run-up in the price of precious metals has been fast and furious. The spot gold price for instance was 15% ahead of its 50-day moving average, as you can see below, which is unusual and suggests that the market was stretched to the upside. When this happens a correction can occur. This does not mean that the gold price has topped out, instead, the gold price could experience what stocks did last week: a volatile week, before recovering on the back of dip-buying.

It is worth putting this move into context: the gold price has still not surpassed Monday’s low, and it remains $900 above the 50-day sma. The move lower in silver is more severe, the 5% drop is the largest intra daily move since April, as you can see below, however, the silver price has only fallen to levels reached last week.

Why a shakeout is necessary before the next leg higher for Gold

A shake out in an asset market is the sign of healthy price action. It suggests that investors won’t get too far ahead of themselves, and there is a limit to upside exuberance. The reasons for holding gold and silver remain intact and include geopolitical fears, dollar debasement, the AI trade for silver, and concerns about inflation. Until several of these pillars start to crumble, we think that the downside for both gold and silver could be limited, even if this decline has been more severe than expected.

The gold price had become detached from its moving averages, which is one reason why a correction is one the cards

Source: XTB and Bloomberg

Silver price, the shake out on Tuesday has been severe

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.