What we learned from Christine Lagarde last week, Bitcoin's plunge and what's driving CAD

Bitcoin falls as China announces fresh warning on cryptocurrencies

Last month Bitcoin was strongly bid on the comments from China’s President Xi (Oct 24) that China should accelerate its development of block chain technology. Investors assumed that this would involve a mainstream welcome to existing cryptocurrencies. However, that initial enthusiasm in price has now slumped on the realisation that President XI’s positivity on blockchain may not include Bitcoin. The People’s Bank of China have recently warned that it will tackle growing cases of illegality involving virtual currencies. The PBOC also warned investors not to confuse blockchain technology with cryptocurrencies.

What’s driving the CAD?

The CAD strength that came into the market last week on the back of comments from BoC Governor Poloz when he said that he thought monetary conditions are ‘about right’ was further supported by the Canadian Retail sales data. In this coming week we will have a look at Q3 growth and there has to be some upside risks to this data release now. The chances of a December rate cut are now unlikely and, barring a breakdown in US-China trade negotiations you would expect to see CAD strength going forward. I would expect EURCAD sellers on pullbacks going forward as the eurozone’s outlook is still pretty bleak.

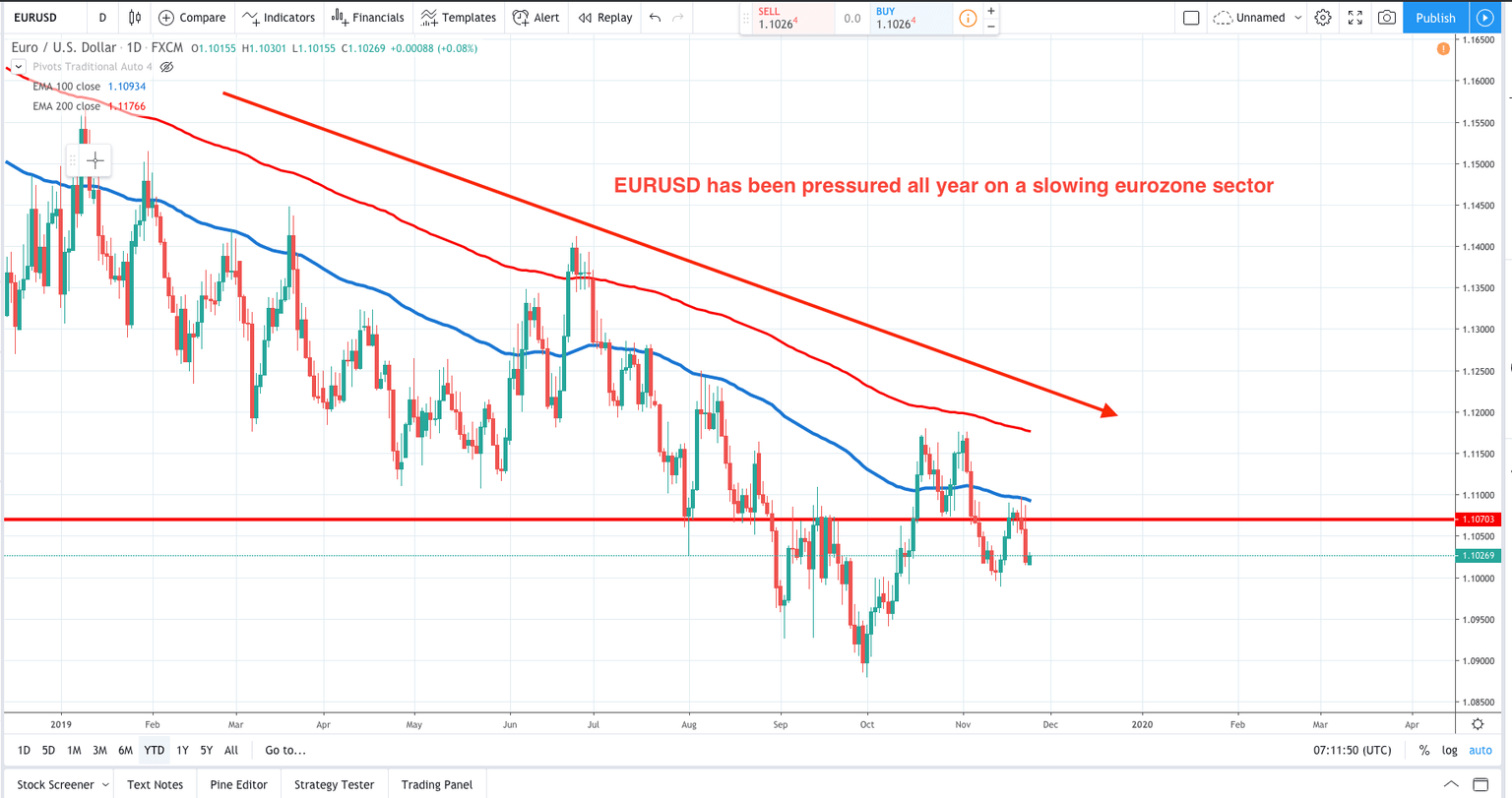

EUR: What did we learn from EUR PMI’s and Christine Lagarde last week?

As we got the news that eurozone PMI’s decreased in November from 50.6 to 50.3 the spillover impact from the manufacturing sector to the service sector is at the heart of the decline. With still no confirmation of a phase 1 US-China trade deal risks to the eurozone remain tilted to the downside. Christine Lagarde’s first policy speech passed without any major impact. Christine Lagarde stated that:

-

The ECB will start strategic review of its monetary policy in the ‘near future’,

-

The ECB will ‘continuously monitor the side effects of its policies,

-

Reiterated a call for fiscal policies.

This speech from Lagarde gave very little away and the next monetary policy speech from Lagarde now will be December 12 with the ECB interest rate decision.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.