What happens when the Chinese jump back into this Gold bull market?

Do you know who has been missing from the most recent gold bull run?

The Chinese.

And yet, we’re still seeing gold push to record highs.

What happens when the Chinese jump back into the market with both feet?

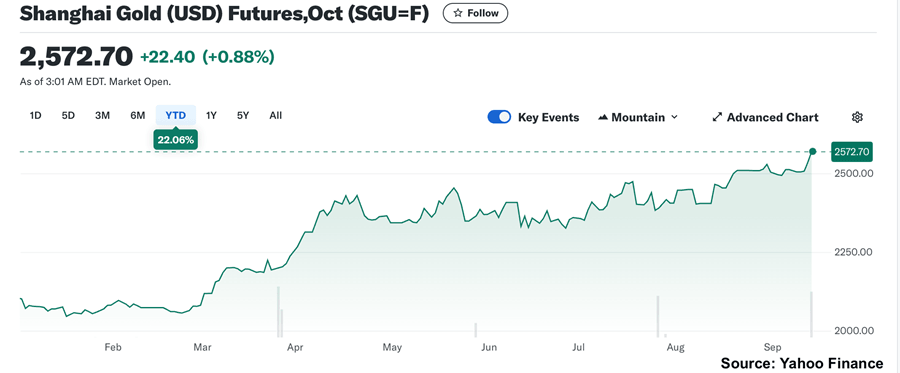

Another record

Gold set another new record on Thursday as investors drool over the prospect of an interest rate cut next week.

The gold price climbed by about 1.8 percent, peaking at around $2,559 per ounce. By early Friday morning, the yellow metal was up nearly $8 at $2,577.

Investors shrugged off a small uptick in core CPI last month and a larger-than-expected increase in producer prices, anticipating that the Federal Reserve is going to cut interest rates anyway.

As one analyst told CNBC, “We are headed towards a lower interest rate environment, so gold is becoming a lot more attractive.” And even if the first cut is only 25 basis points, many analysts think we could see deeper cuts at future Fed meetings.

Another analyst pointed out increasing weakness in the labor market, telling CNBC, “The journey that they’ll embark on in cutting rates is going to go for an extended period of time.”

Gold started this bull run in mid-February, driving from just under $2,000 to nearly $2,400 in mid-April. After trading sideways for several months, the rally found new legs late last month as it became increasingly clear the Fed was prepared to surrender to inflation and begin cutting interest rates.

Where are the Chinese?

A big factor in the gold rally last spring was buying in the East. In fact, Western investors were largely absent from the first run-up. We could see the shift of gold from the West to the East in gold imports flowing into China.

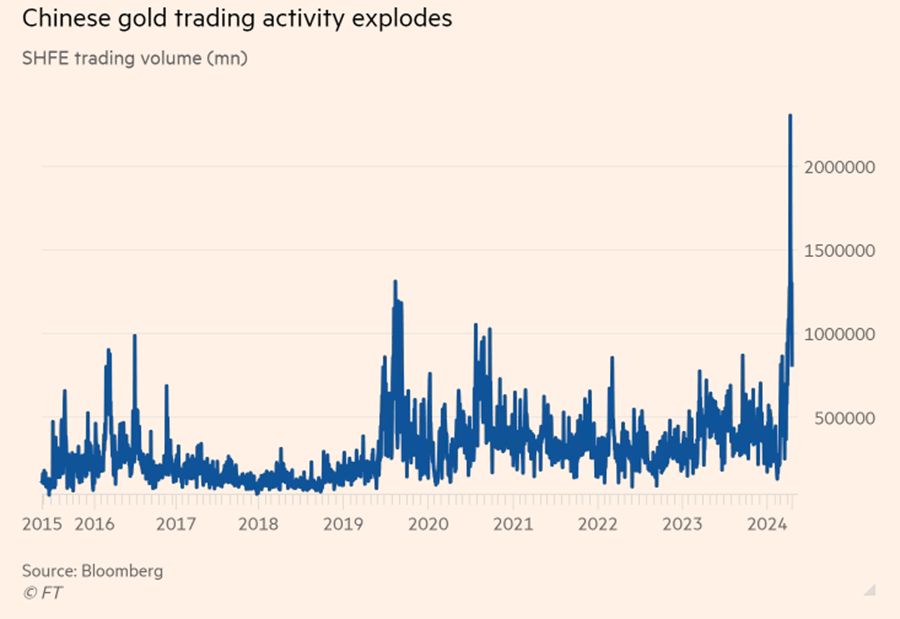

We can also see China’s appetite for gold in activity on the Shanghai Futures Exchange.

An article in the Financial Times last spring said Chinese gold speculation “helped supercharge” the gold rally. World Gold Council chief market strategist John Reade told the Times, “Chinese speculators have really grabbed gold by the throat.”

A sagging Chinese stock market, along with real estate prices, pushed many investors into the safety and stability of gold.

But as prices hit record highs and regulators put some shackles on futures trading, Chinese gold demand cooled over the summer, putting the global gold rally on hold.

In May, the People’s Bank of China stopped reporting increases in its gold reserves, and physical demand slumped.

One of the factors that kept Western investors out of the gold market was high interest rates, as the Fed and other Western central banks fought price inflation. Since gold is a non-yielding asset, higher interest rates tend to create headwinds for gold.

But the situation in China was much different. In response to the economic malaise, the Chinese central bank drove interest rates to all-time lows, making gold even more attractive.

In the spring, the Shanghai Futures Exchange tightened trading conditions, raising gold margin requirements from 10 to 12 percent and increasing the daily price limit from 9 to 11 percent. Gold globally traded sideways for several months this summer as Chinese gold demand cooled, but it began to rally again in August despite an empty Chinese chair at the table.

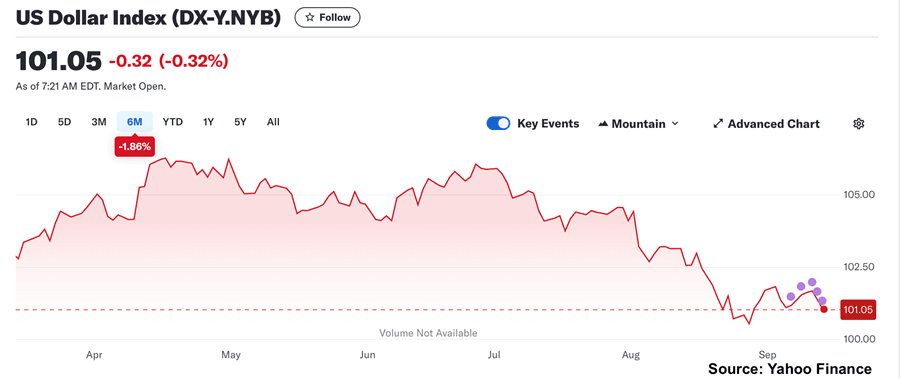

Gold's recent price gains have largely been driven by factors in the West. Dollar weakness has helped gold. In fact, the latest increase in gold prices is more a function of dollar weakness than gold strength.

We’ve seen an uptick in gold demand in North American and European markets with the promise of rate cuts. (The European Central Bank has already jumped on the cutting train.) We see evidence of this renewed interest in gold with positive flows of gold into Western ETFs.

Meanwhile, trading on the Shanghai Futures Exchange has run sideways in a relatively narrow range since the spring rally.

When Chinese gold futures break through the current resistance level, we could see another rapid run-up in the price of gold, once again supercharging the gold bull run.

Meanwhile, as it becomes clear that gold prices aren’t going to fall any time soon, physical demand in China, as well as other Asian markets, will likely pick up steam again.

These dynamics indicate that this gold bull likely still has plenty of legs.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.