What happened today in Forex?

Wednesday 16th September

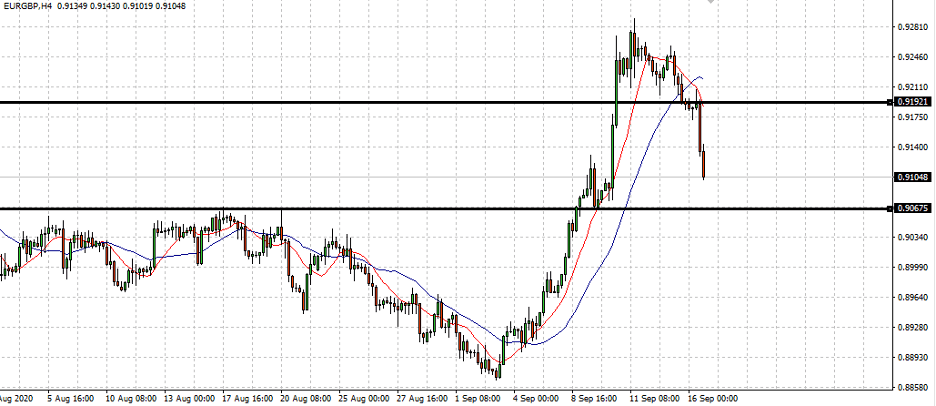

EUR/GBP

Ahead of tomorrow’s Bank of England rate decision, Sterling saw its biggest one day gain against the Euro since June 1st; this without doubt, made EUR/GBP one of the biggest movers on today’s FX dashboard.

The move was assisted by better than expected UK consumer inflation figures for August. Yesterday’s reports from Europe showed manufacturing was once again on the rise, although at a slower pace than two months prior. This pair has been plagued with uncertainty as tensions continue to rise between the EU and UK over Brexit negotiations.

As of writing, EUR/GBP was down close to 90 pips, and fast approaching the support level of 0.9067 after falling below its recent resistance level of 0.9192 earlier in today’s session. Many looking at the 10 and 25 EMAs will notice the downward cross which recently occurred - does this suggest further declines are imminent?

4H Chart via Tradeview Markets

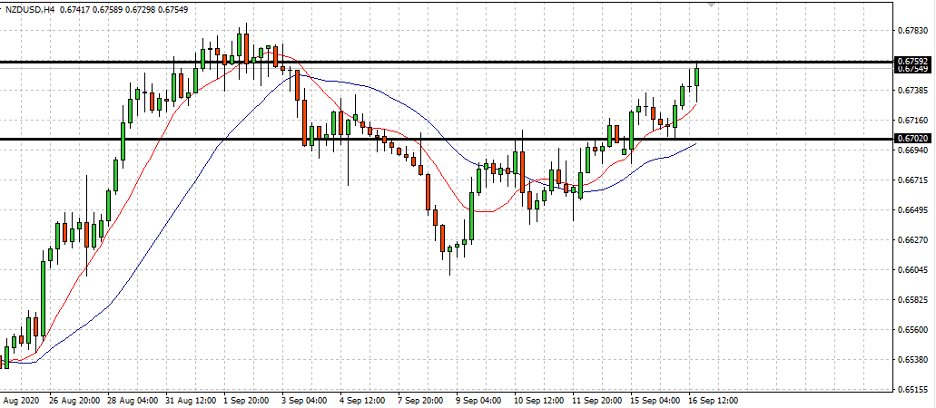

NZD/USD

It is Fed day, and traders of all levels have been looking towards this evening's FOMC meeting to find potential volatility from USD related FX pairs. Later this evening, after the Fed announcement, and close of the US trading session, New Zealand will release its GDP growth rate data which came in at -0.2% the previous month, could tonight’s decision potentially move the NZD.

Traders today looked at NZD/USD for current and upcoming opportunities in anticipation of these economic announcements. The pair today reached its long term resistance of 0.6759 which it has not broken over consecutive sessions since March 2019.

As of writing, NZD/USD was trading close to 0.6752, and although many believe there could be a breakout of this level, it may continue to consolidate depending on what the Fed announces in the next few hours.

4H Chart via Tradeview Markets

Author

Eliman Dambell

Sayvio AI

With over a decade in financial markets, Eliman brings an experienced and diversified point of view to market analysis. He covers current and historical macro trends to give insights on Metals, FX, Stocks, and Crypto.