What happened to the EUR/USD strength?

Macroeconomic snapshot

EUROPEAN CENTRAL BANK (ECB) GOVERNING COUNCIL: The July meeting matched expectations with a 0.25% hike of the Main Refinancing Operations rate setting it at 4.25% which is up from 4.00% and the 0.25% hike in May. The latest rate is just below the Trading Economics Q3 ‘23 forecast of 4.50% which they also identify as the peak. Over the previous three years, since the start of 2020, the interest rate has been trending up with a low of 0.00% and a high of 4.25%. Over the previous six months, the rate has continued to climb. The next meeting is due on Thursday, September 14th.

The EA interest rate is anticipated to be raised again although the peak is near which is likely to lead to stabilised bund yields which may dissuade investors and limit upward support on the value of the Euro.

GROSS DOMESTIC PRODUCT (GDP) GROWTH RATE: Flash Q2 ‘23 estimate slightly beat expectations coming in at 0.3% expansion and up from -0.1% contraction in Q1 ‘23. The latest report is below the Governing Council 2023 Real GDP forecast of 0.9% (revised down from 1.0%) and slightly below the Trading Economics Q3 ‘23 forecast of 0.4%. Over the previous three years, since the start of 2020, GDP has been trending up with a low of -4.3% and a high of 14.6%. Over the previous six months, GDP has been falling although recently reversed. The second estimate Q2 report is due on Wednesday, August 16th.

EA GDP is anticipated to improve this year which may increase investor confidence in EA stocks which may limit downward pressure on the value of the euro.

CONSUMER PRICE INDEX (CPI): June flash estimate slightly beat expectations coming in at 5.3% inflation and slightly down from 5.5% in Q1. The latest report now matches the Governing Council 2023 HICP forecast of 5.3% although Trading Economics are more optimistic with a Q3 ‘23 forecast of 4.7%. Over the previous three years, since the start of 2020, CPI has been trending up with a low of -0.3% and a high of 10.6%. Over the previous six months, CPI has been falling quickly. The final July report is published on Friday, August 18th.

EA CPI is anticipated to improve a little further this year but to remain high although with the peak now past, investor confidence in EA stocks is likely to improve which may limit downward pressure on the value of the euro.

LABOUR: May ‘23 report matches expectations coming in at 6.5% which is the same as April ‘23. The latest report is slightly below the Trading Economics Q3 ‘23 forecast of 6.6%. Over the previous three years, since the start of 2020, Unemployment has been trending down with a high of 8.3% and a low of 6.5%. Over the previous six months, unemployment has been steady. The June report is due on Tuesday, August 1st.

EA unemployment is anticipated to remain steady this year which may stabilise investor confidence in EA stocks which is likely to limit downward pressure on the value of the euro.

RUSSIAN EU GAS DISPUTE: The Russia-EU gas dispute has caused an increase in the cost of energy which has reduced the spending power of consumers and resulted in slower economic growth.

This is likely to lead to reduced foreign investment in the stock market and is expected to apply downward pressure on the Euro’s value.

RUSSIAN INVASION OF UKRAINE: The war is having a detrimental effect on the global and EA economy by causing higher energy prices, supply chain disruptions, financial market volatility, refugee crisis and geopolitical uncertainty

EUR/USD longer term (Previous three months)

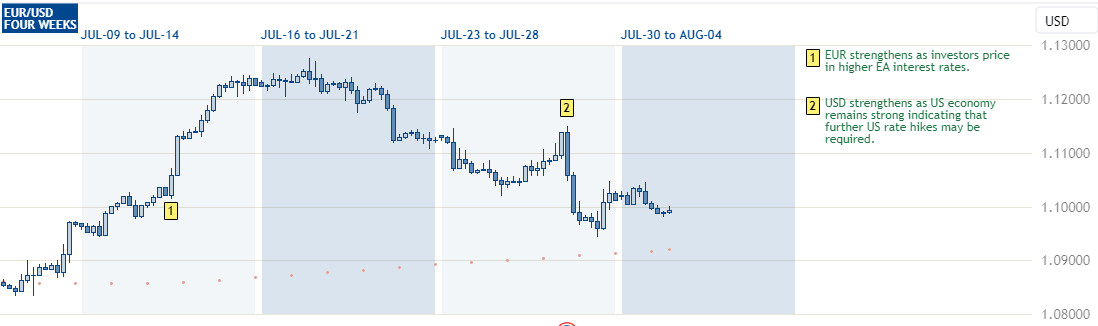

The EUR/USD has formed an uptrend since the start of July when the Euro strengthened on the back of elevated sentiment regarding EU rates. The pair is currently retracing the uptrend as the Dollar strengthened due to a strong economy possibly requiring further hikes from the Fed and looking to test the 78.60% fib. The uptrend will break on moves below the 100.00% level near 1.085.

EUR/USD (Previous three weeks)

The EUR/USD has been volatile in the previous three weeks as the Euro and US Dollar each take strength from hawkish sentiments regarding central bank policy. The pair remains above the 50 day moving average.

EUR/USD outlook

Upcoming and Recent Events:

Monday, July 31st

-

EA CPI Flash Estimate y/y fell to 5.3% as expected from 5.5% prev.

Tuesday, August 1st

-

US JOLTS Job Openings improvement to 9.6M exp. from 9.8M prev.

Wednesday, August 2nd

-

US ADP Non-Farm Employment Change Big fall to 195K exp. from 497K prev.

Friday, August 4th

-

US Average Hourly Earnings slight fall to 0.3% exp. from 0.4% prev.

-

US Non Farm Payrolls fall to 200K exp. from 209K prev.

-

US Unemployment Rate remain at 3.6% exp.

CME group 30-Day Fed fund futures

-

September: rising sentiment of a hold, 81% in favour (from 78%), 19% for a 0.25 hike (from 22%).

-

November: falling sentiment of a hold, 65% in favour (from 67%), 30% for a 0.25 hike (from 30%).

Six month bond yields

-

Treasuries: slightly rising at 5.55% from 5.50% last week.

-

Bund: steady at 3.5% from 3.50% last week.

Value of the EUR/USD to remain above 1.09 unless the US Labour report comes in higher than expected on Friday: The previous three week moves have been trending down from 1.12 to 1.09. Events this week are favoured towards a slightly weaker USD as the US labour market is anticipated to be slightly bearish.

Longer Term Value of the EUR/USD to remain above 1.08: The previous three month moves have created an uptrend climbing from 1.08 to 1.12 although has retraced to test 1.09. The macroeconomic situation suggests the uptrend is likely to extend.x

Author

Gavin Pearson

Independent Analyst

Gavin Pearson of Jeepson Trading is a currencies speculator from the UK focused on the G7 economies and is a recognized member of the eToro Popular Investor Program as well as being a funded prop trader with The 5%ers.