European Central Bank delivers large hike, but refrains from future guidance

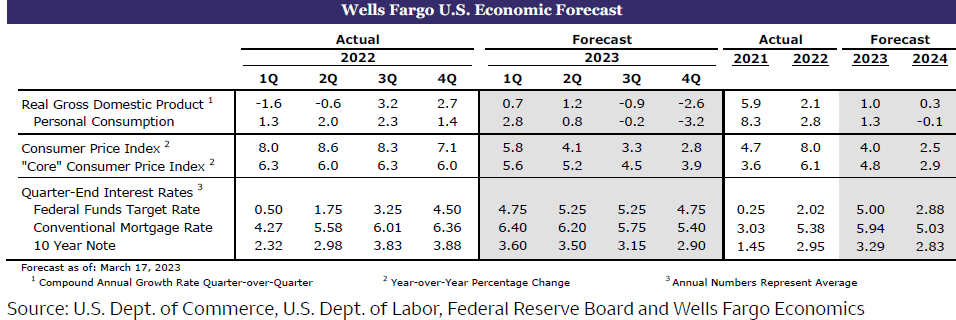

United States: Top O' the cycle?

-

In February, the headline and core CPI rose 0.4% and 0.5%, respectively. The headline PPI fell 0.1%. Retail sales declined 0.4% during February, while industrial production was flat (0.0%). Housing starts and permits jumped 9.8% and 13.8%, respectively. The Leading Economic Index dipped 0.3%. The preliminary University of Michigan Sentiment Index fell to 63.4 in March.

-

Next week: Existing Home Sales (Tue), New Home Sales (Thu), Durable Goods (Fri)

International: European Central Bank delivers large hike, but refrains from future guidance

-

In a widely anticipated monetary policy announcement, the European Central Bank (ECB) raised its Deposit Rate 50 bps to 3.00%, saying that inflation is projected to remain far too high. However, in a nod to recent financial market strains, the ECB highlighted elevated uncertainty, emphasized a data-dependent approach to policy rate decisions and refrained from signaling any future rate moves. That said, with inflation elevated we still expect further tightening and forecast a peak policy rate of 3.50% by June this year.

-

Next week: Swiss National Bank (Thu), Bank of England (Thu), Eurozone PMIs (Fri)

Interest rate watch: FOMC: To hike or not to hike on March 22?

-

It's a close call, but we expect the recent banking crisis to lead the FOMC to temporarily pause its tightening cycle at its policy meeting on March 22. Assuming the current crisis remains contained, we look for the FOMC to hike rates again starting on May 3.

Topic of the week: The state of the US banking sector

-

Recent tightening of financial conditions triggered by the collapse of a few U.S. regional banks has led to fears that other institutions may be in a similar position of not being able to meet obligations to depositors due to losses on securities holdings. We believe that authorities will take the necessary steps to prevent another global financial crisis, but there will likely be lasting consequences in the form of tighter financial conditions.

Author

Wells Fargo Research Team

Wells Fargo