Weekly economic & financial comentary

Summary

United States: Labor Market Continues to Tread Water

- The longest government shutdown on record continues to drag on. Private sector data show hiring remains weak, but layoffs remain contained. That said, the pressure to trim headcount appears to be broadening, as cost pressures continue to mount and tariff uncertainty persists.

- Next week: NFIB Small Business Optimism Index (Tue.)

International: Global Policy Pause: A Week of Holds with One Exception

- This week, several central banks across both G10 and emerging markets convened to assess monetary policy, with most opting to keep interest rates unchanged. The Bank of England, Riksbank, Norges Bank, Reserve Bank of Australia and Brazil’s Central Bank all held their respective policy rates steady. The only exception was Banxico, which delivered a rate cut, albeit with a hawkish tilt.

- Next week: U.K. GDP (Thu.), China Industrial Production and Retail Sales (Fri.)

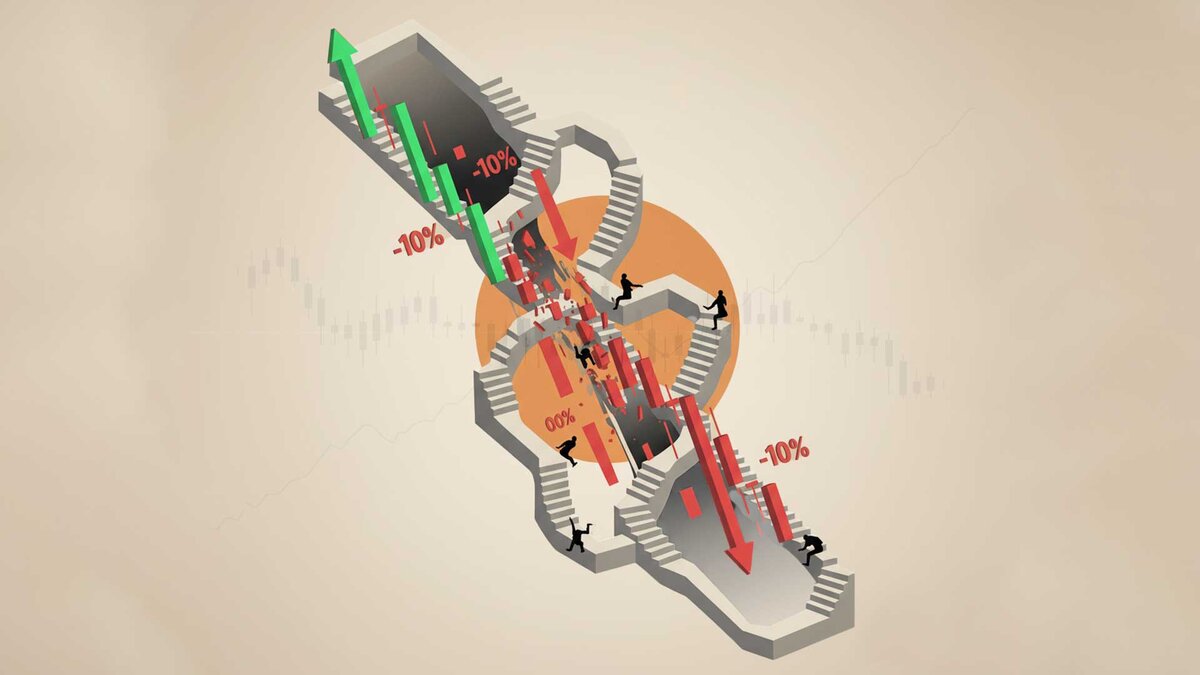

Topic of the Week: Supreme Court Hears Tariff Case

- Wednesday’s oral arguments provided the first indication of how the U.S. Supreme Court will strike down President Trump’s tariffs under the International Emergency Economic Powers Act (IEEPA). No matter what the Court decides, the high-tariff environment is set to remain.

Author

Wells Fargo Research Team

Wells Fargo