Week ahead – Could US data revive risk appetite amidst a low liquidity week?

- Risk assets sell off on AI valuation concerns and hawkish Fedspeak.

- US data in focus amidst a holiday-shortened week with low liquidity available.

- Dollar weakness hinges on improved risk appetite and weak data releases.

- Fresh Ukraine-Russia peace deal pushes both oil and gold lower.

- Intervention risk heightens for yen; pound traders await Wednesday’s Budget.

Risk appetite falters this week, Nvidia fails to reverse sentiment

It has been a very difficult period for risk assets, with equities feeling the pressure throughout the week. At some stage, the three major US indices were 5.5-8.5% below their recent peaks, with technical analysis generating very bearish short-term signals. This market nervousness is clearly depicted in one-month implied volatility rising to new monthly highs.

Interestingly, Wednesday’s strong Nvidia earnings report and the upbeat commentary from its CEO failed to sustainably reverse the negative momentum. Investors continue to question the rallies posted by firms seen as AI leaders, and their investment announcements, which go beyond their current financial and manufacturing capabilities. Should AI-related concerns linger, it would be difficult to risk assets to meaningfully rally.

The situation is even worse in cryptocurrencies. Bitcoin is trading around $83k at the time of writing, 35% below its all-time high of $126k, almost fully erasing its post-April gains. The king of cryptos is down 18% this week – the strongest weekly drop since mid-November 2022 – with November primed to post the worst monthly performance since the June 2022 correction.

Hawkish Fedspeak also dampens risk sentiment

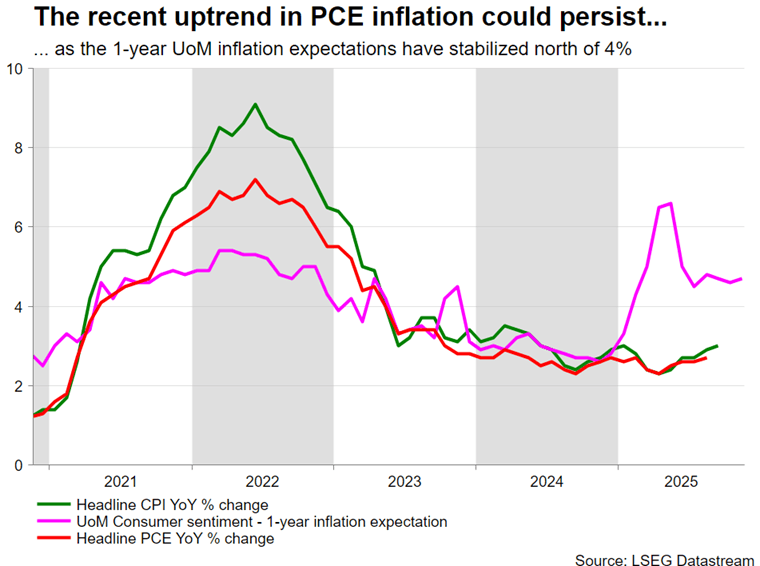

Beyond AI, hawkish Fedspeak has been branded as the main culprit for the negative risk appetite. Chances of the December rate cut have crashed to 27% from 90% before the October meeting, as the hawks have been extremely vocal lately, highlighting the lack of clean data posing the greatest obstacle for further rate cuts. The minutes from the latest FOMC meeting confirmed this hawkish stance, with the Fed doves scrambling to gather enough evidence to convince the board of the need for further easing.

Data in focus but shortened week implies minimal moves

Next week’s focus will probably be on the amended US data calendar. With the October CPI report missing, next week’s PCE print is critical for Fedspeak; a soft report may revive the current low December expectations, supporting risk appetite.

That said, consumer confidence could play an even greater role going forward. Persistent weakening in spending appetite could result in significantly weak Q4 GDP growth, highlighting the damage done by the shutdown. As a reminder, the recently approved bill funds the federal government until January 30, so the risk of another shutdown cannot be understated.

Notably, next week will be shortened due to Thursday’s US Thanksgiving holiday and Black Friday, when US markets will observe an early close, with noticeably lower liquidity available.

Trade tensions and geopolitics are wildcards for next week

Amidst this mixed environment, there are a couple of wildcards that could materially change market sentiment.

While trade tensions have abated, there are issues in the background that could result in flare-ups. Specifically, there is uncertainty about the US administration’s stance regarding foreign made chips – will Trump impose hefty tariffs? – and the currently debated ‘Gain AI’ bill in Congress. This bill requires US chip companies such as Nvidia to limit their exports, giving priority to domestic clients, potentially drawing China’s ire.

The second wildcard is the fresh US-brokered peace deal between Ukraine and Russia. Despite the plan appearing to favour Russia, and the initial negative reaction from Ukrainian officials, the current deal might be the only way to restart the negotiations between the two sides.

Concrete progress toward a resolution would support risk appetite, but dent gold’s current appeal. The precious metal has been dropping toward $4,000, unable to capitalize on the stock market weakness, potentially revealing its own weaknesses such as the overstretched 2025 rally. A move towards the late October low of $3,886 may challenge the prevailing long-term bullish trend.

Persistent risk-off sentiment could boost the Dollar

While both the US government reopening and the hawkish Fedspeak failed to boost the US dollar, the current stock market weakness is a different story. The greenback is posting gains this week, with euro/dollar testing the 1.1500 area once again. A boost in December Fed cut expectations, an improvement in risk appetite and positive news on the geopolitical stage could dent the dollar’s current appeal next week.

In the meantime, the newsflow from the euro area remains subdued, as most of the ECB members are content with the current monetary policy stance. Thursday’s minutes from the last ECB meeting are expected to confirm the current rates pause, with the focus quickly shifting to Friday’s preliminary Germany inflation report. The absence of a major downside surprise in this data print should make the final ECB meeting for 2025 more a formality than something that could capture the market’s attention.

UK budget in focus, pound in agony

Following months of speculation, Chancellor Reeves will present the 2026 Budget in Parliament on Wednesday, November 26. The market’s attention will be on the magnitude of tax increases, as Reeves attempts to close the current £20bn fiscal gap to remain on course to meet her own fiscal rules, and increase the fiscal headroom. Plans for higher personal taxes have been abandoned, but other revenue sources will be explored, with higher property taxes potentially in the frame.

With gilt yields climbing lately and the pound weakening aggressively, the budget could prove a make-or-break moment. Aggressive tax increases might initially please the market but could open the door to a severe government crisis, challenging PM Starmer’s ability to govern. The result will probably be higher gilt yields and a weaker pound.

A tax-light budget might also result in a negative market reaction as the Labour government would be then seen as lacking the resolve to take difficult decisions. Higher yields will not benefit the pound, with pound bears eyeing a decline towards the April 7, 2005 low of 1.2707 in pound/dollar.

The BoE will be left to pick up the pieces of the Budget, with an 82% probability currently assigned to a December rate cut following the softer October CPI report. An acute market reaction following the budget could further support current cut expectations and bring forward the next 25bps rate cut – after December’s meeting – currently fully priced in for July.

Yen weakness persists as BoJ fails to provide a lifeline

With Governor Ueda still sending mixed messages about the timing of the next rate hike, and PM Takaichi announcing a new stimulus plan of ¥21.3tr ($135bn) – the largest since 2022 – the yen remains under pressure. Next Friday’s critical Tokyo CPI might surprise on the upside, somewhat boosting the yen, but this might not prove enough to turn the tide.

Meanwhile, verbal interventions have intensified as dollar/yen reached 157.88 on Thursday. Should this move persist, with dollar/yen surpassing the 2025 high of 158.66 and getting close to the key 160 level, chances of an actual intervention would heighten. Notably, given the low liquidity market conditions expected for the latter part of next week, it might be the best opportunity for the BoJ to intervene and produce a meaningful drop in dollar/yen, should the need arise.

Likely peace deal pushes Oil lower

The latest developments regarding the Ukraine-Russia conflict have come into the spotlight, with a possible ceasefire agreement heavily influencing the outlook for the oil market, adding to the current bearish setup of unspectacular growth and oversupply. The bears crave a retest of the October lows, not far from the five-year low of $55.60 posted in early May.

On the other hand, failed Ukraine-Russia negotiations and renewed escalation on the battlefield – with Ukraine potentially targeting Russian oil and gas infrastructure – could result in a jump in oil prices, reversing the current bearish oil trend.

Could peripheral currencies react to this week’s underperformance against the Dollar?

With the aussie, the kiwi and the loonie posting sizeable losses against the dollar, next week’s calendar might offer them a chance for redemption. The Australian CPI report, the RBNZ meeting and the Canadian Q3 GDP could set the tone for the remainder of the year. Notably, the aussie appears to be best suited to take advantage of the greenback’s renewed weakness, while the kiwi remains the weakest of the bunch, as the RBNZ remains on an aggressive easing path.

Author

Achilleas joined XM as an Investment Analyst in November 2022. He holds a BSc in Business Economics from Middlesex University and a MSc in Mathematical Trading and Finance from Bayes Business School, City University.