We will know who won the election within a day

Late Counting

I created my "Late Counting" map based on the New York Times article How Long Will Vote Counting Take? Estimates and Deadlines in All 50 States

Even though California allows counting until November 20, let's be honest. We know who won California already.

The same applies to Illinois, New York, and Utah. The latter will go to Trump.

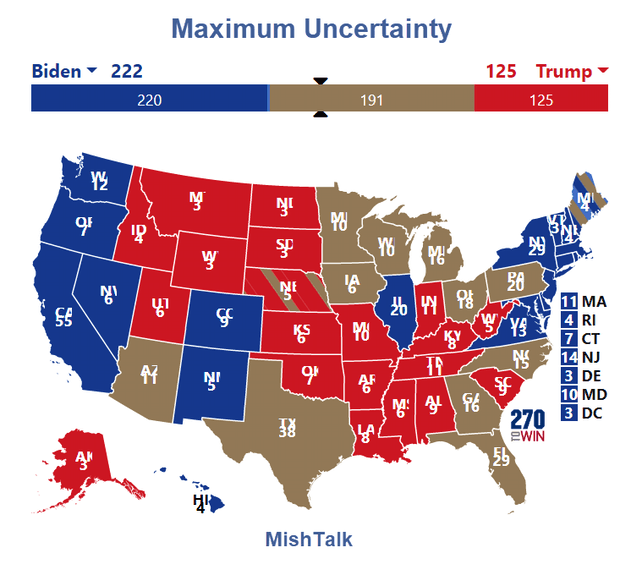

Maximum Uncertainty

For the benefit of Trump, let's assume some states are tossups that really aren't.

Let's also factor in states where late counting could matter.

Maximum Uncertainty Map

Biden is a 222 and Trump is at 125.

Likely to Quickly Know

- AZ: 11

- TX: 38

- WI: 10

- GA: 16

- FL: 29

- ME: 1

- NE: 1

- Total of Above: 106

Biden needs 270-222 = 48 of 106.

But we cannot stop there.

- NC expects 98% counting. Given the preponderance of mail-in voting will be Democratic, if Biden is ahead with 98% counting we will know Biden won that state.

- Ohio, Iowa, Michigan, and Minnesota are similar. If Biden is ahead with just mail-in votes to count, we will know who won.

What Does "Know" Mean?

The results will not be official until states officially post results and that will be after all the counting.

But let's be honest, we will realistically know who won if Biden is ahead with only mail-in votes to count in such setups.

In addition, we will reach a mathematical certainty far before the official period based on outstanding ballots.

Trump's hope of the Supreme Court deciding the election hinges on Trump winning nearly all of the "Maximum Uncertainty" states plus Pennsylvania (outright or on a Supreme Court decision).

There will be delays in official counts, but count on knowing who won much sooner.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc